DeFi - Page 37

Loading...

DeFi ‘Revenue’ Has Stabilized in June Despite Token Sell-offs

It’s grim times for DeFi tokens but as prices plunge, protocol revenue remains stable. The DeFi Pulse Index, which tracks the performance of 14 key tokens including Uniswap and Maker, has skidded 31% in the last seven days and 6.5% in just the last 24 hours, compared with a 2.1% decline for ETH from yesterday. …

Loading...

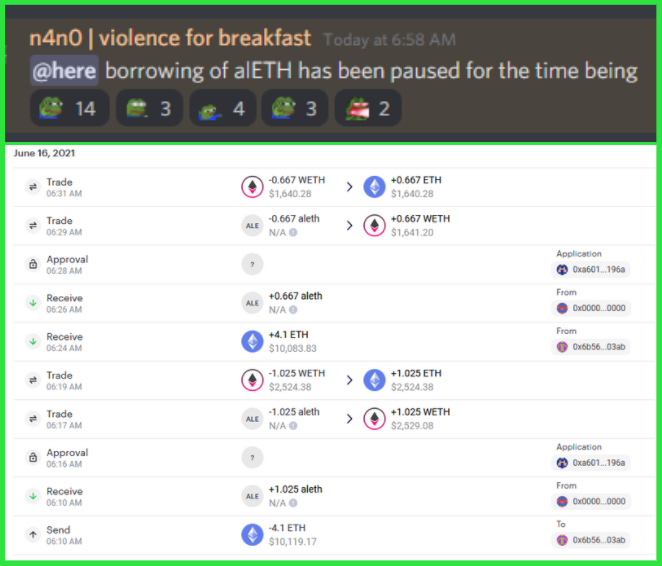

Alchemix Asks Users to Return Funds After alETH Bug

It isn’t often that a market player appeals to the morality of its customers to correct a mistake. But that’s what’s unfolding this week as Alchemix Finance made traders an offer to iron out the alETH debacle that unfolded on June 16. Alchemix Finance recently launched alETH, a synthetic yield derivative that lets DeFi users…

Loading...

Liquid + Boosted. Staking Superpowers on Curve with Convex

Convex allows Curve.fi liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort.

Loading...

Kusama, Karura and the Crazy World of Crowdloans

Today we’re covering Karura but in order to understand it we have to define its relationship to Kusama as well as Kusama’s relationship to Polkadot, not to mention Karura’s relationship to Acala. But I’ll do my best to make it as clear as possible because what’s being built here, particularly in DeFi could be really…

Loading...

Iron Finance Implodes After ‘Bank Run’

In a month, Iron Finance has gone from being the darling of yield farmers to one of the biggest crashes in DeFi history. The partially collateralized stablecoin project expanded to the Polygon network on May 18 and quickly became the go-to protocol for earning insane yields –– it even received praise from Mark Cuban. The…

Loading...

No Collateral, No Problem: Goldfinch Raises $11M to Bring Unsecured Loans to DeFi

Unsecured loans, long a missing piece in the DeFi puzzle, may finally be coming to open finance. Goldfinch, a DeFi platform that specializes in making no-collateral loans, announced an $11M raise from the likes of Andreessen Horowitz, DeFi Alliance, and other investors. Goldfinch enables borrowers to garner access to unsecured loans without having to go…

Loading...

InstaDapp Releases Governance Token with 55% for Community Members

DeFi infrastructure protocol InstaDapp has launched their governance token, INST, on Ethereum Mainnet. INST holders will be able to discuss and vote on all future InstaDapp protocol upgrades. InstaDapp has minted 100M INST, allocating 55% for community members and the other 45% for team members, investors, and advisors. Initially, 10M INST will be available to…

Loading...

Bug in Alchemix’s New ETH Vault Has Left a $6.4M Shortfall

A bug was discovered in the Alchemix Finance alETH contract on Wednesday morning, leaving the project undercollateralized by 2,688 ETH, or roughly $6.4M, as users were able to withdraw these funds without repaying their loans first. Alchemix Finance recently launched alETH, a synthetic yield derivative that lets DeFi users borrow 1 alETH for every 4…

Loading...

Alchemix Allows Users to Stay Long ETH With Auto-Loan Repayment

Last weekend, Alchemix, which offers automatic repaying loans, shipped a vault that accepts ETH. Alchemix users will now be able to borrow alETH, Alchemix’s token that’s soft-pegged to ETH, using ETH as collateral. The collateralization ratio: 400%. The launch came with a debt cap of 2,000 alETH and it was reached within a day of launch,…

Loading...

Zapper Zaps Its Own Vulnerability Before Hackers Do

Twenty days after upgrading its “Polygon Bridge” smart contract, Zapper found a vulnerability in its own deprecated version. According to a tweet, the Zapper project “exploited the vulnerability ourselves and all of the funds have been rescued.” The problem would have affected those with an infinite approval for the bridge contract. Infinite approval is part…