DeFi - Page 36

Loading...

Iron Finance at it Again: V2 has Drawn in Over $1B With Eye-Popping Yield Farms

Less than a month after the spectacular implosion of Iron Finance’s algorithmic stablecoin, the DeFi project has relaunched a new yield farm on Polygon. Iron Finance’s IronSwap is an automated market maker (AMM) for stablecoin swaps. It aims to facilitate high-volume, low-slippage trades with low fees. For now, there’s no algorithmic insanity to deal with,…

Loading...

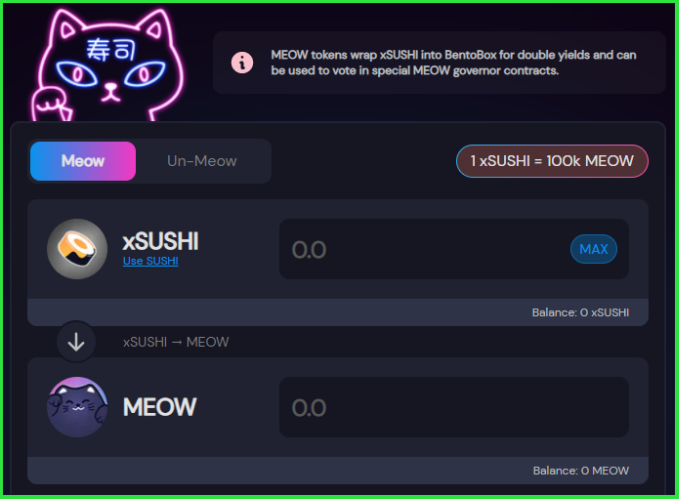

Meowshi Boosts Yields for SUSHI Stakers In Run-up to V3

It’s shaping up to be a big month for Sushiswap. The decentralized automated market maker (AMM) is slated to release its much-anticipated V3 upgrade, codenamed MIRIN, on July 20. A host of new features are expected including limit orders, improved support for multi-token yield farming, MEV protection, and an upgraded user interface. xSUSHI Boost A…

Loading...

Railgun: The New Weapon in Privacy

RAILGUN secures privacy for DEX trading and lending. Built without any bridge or layer-2, RAILGUN is a smart contract system that gives zk-SNARK privacy to any transaction or smart contract interaction on Ethereum.

Loading...

Live: DeFi 101

Join us for our first ever livestream – Defiant Weekly is our friday deep dive show and where the video department first began. In this special episode we’re going back to basics and doing a live version of Robin’s now infamous Consensus presentation. We’ll cover the basics of DeFi from LP’s to Collateralized debt positions…

Loading...

Get Your Future Yield Now with $PENDLE

Pendle is a futuristic DeFi protocol that allows you to realise the future interest of a yield-bearing token like aUSDC or cDAI by breaking it into two derivative tokens, a Yield Token and an Owner Token. This opens up fresh possibilities for owners to create liquidity, for traders to leverage yield opportunities without locking up…

Loading...

Synthetix Founder Announces Return to “Save the Project”

Kain Warwick, founder of derivatives liquidity protocol Synthetix, is back. The founder had previously stepped away from the protocol to take on a “more passive role,” but has now declared his intention to run for the Spartan Council, an eight-member governance DAO that votes on and manages changes to the protocol. Warwick previously stewarded the…

Loading...

SafeDollar Stablecoin Plummets to Zero After Exploit

The value of SafeDollar (SDO), an algorithmic stablecoin intended to be pegged to $1, has dropped to zero after a $248K exploit on Polygon. In a post-mortem analysis published on June 28, SafeDollar reported it had lost $202K of USDC and $46K of USDT as a result of an attack on one of its pools…

Loading...

DeversiFi Unveils Governance Token

The decentralized Ethereum exchange DeversiFi plans to launch a governance token called DVF. DVF will be distributed via an open and fair launch mechanism called DeversiFi Launch Market (DLM). The proceeds will be placed in a community-governed treasury. Tokenomics and further details on the DLM mechanism will be made available closer to launch. While DeversiFi’s…

Loading...

The Latest Scam in DeFi: 'Soft Rugs'

Anyone in DeFi is probably familiar with the rug pull — the scam in which crypto developers abandon a project and vanish with investors’ tokens and funds. Now say hello to the “soft rug.” In this new breed of grift a project’s founders simply dump their tokens and exit a project instead of taking control…

Loading...

Fixed Rate Savings on Element Finance

Element Finance is a decentralized protocol that allows users to buy assets (BTC, ETH, USDC, DAI) at a discounted price. The protocol allows users to create liquidity and trade these discounted assets to allow buyers to earn fixed rates. The Element protocol does not require trusted intermediaries and allows for fast and efficient trading of…