DeFi - Page 39

Loading...

Defiant Degens: How to Earn Yield with Automated Options Selling on Ribbon Finance

This is a weekly tutorial on the most compelling opportunities to consider yield farming, written by our friend DeFi Dad, an advisor to the Defiant and the Chief DeFi Officer of Zapper. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs. Background on Protocol: Ribbon Finance…

Loading...

Index Coop’s Leveraged ETH Token 2x-ed Only on the Way Up –– Here’s Why

In a week where the entire market was gapping down, a curious case was how Index Coop’s indexed token ETH 2x – FLI did not reflect this price action proportionally in relation to its methodology, i.e. if ETH is up X, this index token should be up 2x, while if it’s down X, the FLI…

Loading...

An Ape-Friendly Guide to DeFi Yield Derivatives

Generating passive income using DeFi is one of the most attractive things for a newcomer. The interest rates of these protocols are often promoted to be in the range of hundred to thousands % APY, putting the bank interest rates to shame –– but that’s somewhat misleading as returns are calculated on an annual basis,…

Loading...

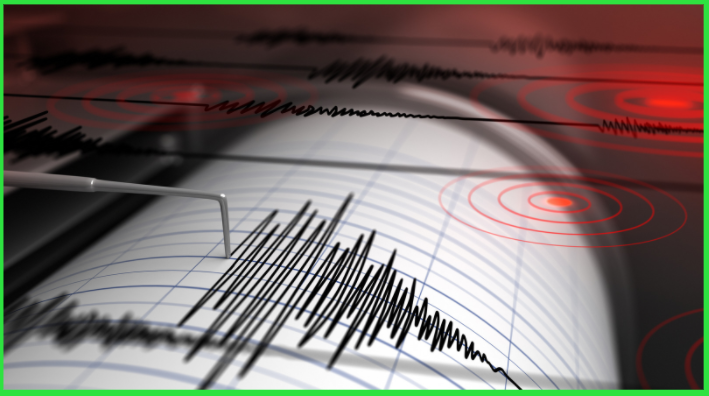

Bear Market Blues

The crypto market faced one of its significant drops this week. In this video we conduct a narrative analysis across different sources to try to understand why the drop happened and where we go from here.

Loading...

Yearn Finance Ecosystem Breakdown –– Pushing the Boundaries of Human Coordination

Yearn Finance surprised the DeFi world late last year when the project announced a flurry of mergers with Cream, Pickle, SushiSwap, Akropolis, and Cover in the span of a week. While the Cover merger ended, the remaining teams continue to collaborate at top speeds enabled by the shared goal of capital efficiency, belief in Yearn’s…

Loading...

DeFi Protocols Show Resilience in Stress Test

In a selloff which saw Ethereum’s ETH and the DeFi Pulse Index basket of DeFi tokens dropping over 20% in an hour and more than 40% overall yesterday, DeFi protocols never stopped running and generally behaved as designed. As DeFi grows to hold $100B in assets with millions of users, yesterday was a test on…

Loading...

Defiant Degens: How to Yield Farm with Curve LPs in Convex Finance

This is a weekly tutorial on the most compelling opportunities to consider yield farming, written by our friend DeFi Dad, an advisor to the Defiant and the Chief DeFi Officer of Zapper. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs. Background on Protocol: Convex Finance…

Loading...

Aave Hints at New Institutional Product

Aave is hinting at a new product for allowing institutions to practice DeFi. On Monday, Aave founder Stani Kulechov tweeted the words “Aave Pro for institutions” alongside a cryptic screenshot. According to Aave full-stack blockchain developer Emilio Frangella, the screenshot depicts the “technical implementation of an experimental version of the Aave protocol for institutions.” He…

Loading...

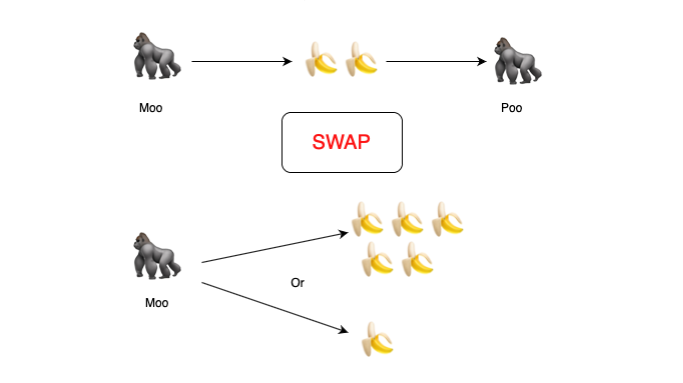

No Risk Liquidity Providing with LP Royale

Learn how liquidity providing works without the risks. LP Royale is a liquidity provider simulator teaching you liquidity providing in a practical way.

Loading...

Uniswap V3

Uniswap v3 introduces concentrated liquidity, giving individual LPs granular control over what price ranges their capital is allocated to, and multiple fee tiers, allowing LPs to be appropriately compensated for taking on varying degrees of risk.