Yearn Partners with Akropolis in Move for Institutional DeFi

Yearn Finance announced a merger with Akropolis, trailing a series of Yearn partnerships and recent ecosystem hacks. Earlier this month, Akropolis lost $2M in an exploitation attack. This technical partnership highlights the permissionless nature of DeFi, where Akropolis could make the unilateral decision to integrate itself in the Yearn ecosystem. Akropolis enables under-collateralized lending protocol…

By: Sydney Lai • Loading...

DeFiYearn Finance announced a merger with Akropolis, trailing a series of Yearn partnerships and recent ecosystem hacks.

Earlier this month, Akropolis lost $2M in an exploitation attack. This technical partnership highlights the permissionless nature of DeFi, where Akropolis could make the unilateral decision to integrate itself in the Yearn ecosystem. Akropolis enables under-collateralized lending protocol aiming to optimize a user’s DeFi yield and interest rate.

The two projects are coming together with the goal of helping move retail and institutional traders into DeFi by improving user interface

Main Changes

Product-Focused

Akropolis and Yearn plan to create non-custodial, open-source alternatives to savings and high-yield accounts. Operating systems AkropolisOS and Sparta would be moved into the Open Source development resources section of Yearn for a more streamlined product offering.

New vaults

Akropolis adopts the code of Yearn v2 vaults and gets access to Pickle, and Cream products, and can integrate its Dollar Cost Averaging solutions with these.

New strategies

Yearn will be able to leverage new investment strategies written by Akropolis developers. Developers will be able to earn performance fees.

New institutional app

Yearn accesses Akropolis business development expertise and exposure to its institutional client network. Akropolis in turn becomes the exclusive institutional front-end to the combined Yearn & Akropolis yield-generating product suite. The development will then be concentrated on a trading front end that would allow traders to access the combined ecosystem.

Small Jump, Big Moves

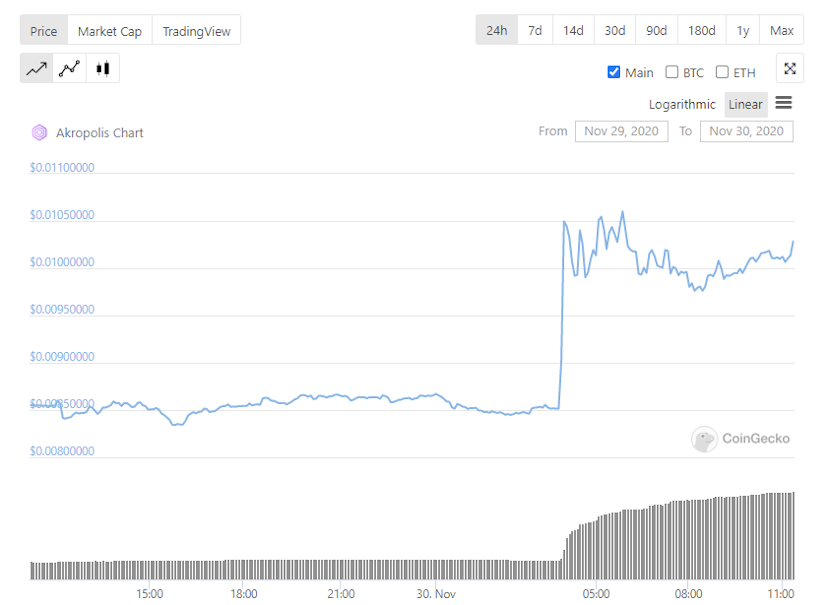

On the day of the merger announcement, the Akropolis token jumped by 25% to $0.01, compared with its all-time high of $0.06.

But the gains in this partnership are larger than the market reactions. This collaboration brings in the next wave of retail and institutional traders into the Yearn Finance ecosystem, which further reinforces the staying power of yield farming products.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.