Bitcoin’s New Runes Protocol Fuels Sky High Transaction Fees

Runestones have dropped 70% after an airdrop snapshot was taken on April 21.

By: Pedro Solimano • Loading...

NFTs & Web3

Bitcoin’s fourth halving has brought a new Ordinals-based protocol that is taking the collectibles world by storm.

The halving event, which took place on April 20 and saw the block subsidy drop from 6.25 BTC per block to 3.125 BTC, saw the launch of Runes, the newest creation of Ordinals inventor Casey Rodarmor.

Rodarmor is the developer behind the Ordinals standard, which went live in early 2023 as a way to inscribe arbitrary data onto the once-only-monetary Bitcoin network by tacking these inscriptions onto individual satoshis (the smallest denomination of a Bitcoin).

Ordinals have taken the Bitcoin ecosystem by storm, spearheading funding for wallets and data layer protocols, driving renewed interest in the NFT sector, as well as spawning an entirely new ecosystem of memecoins and degens.

What Are Runes?

Runes are a more efficient way to inscribe data on Bitcoin that aims to reduce the footprint of BRC-20s, the previous iteration of fungible tokens that were responsible for clogging up the network and driving up fees.

However, in terms of fees, Runes have done the exact opposite.

As users rush to “etch” (or create, in Runespeak) the first Runes, such as SATOSHI•NAKAMOTO, MEME•ECONOMICS, or WANKO•MANKO•RUNES, transaction fees have gone vertical.

Geniidata, an Ordinals data platform, reported that there are 106,793 unique Runes holders, with thousands of different Runes tickers created since the halving.

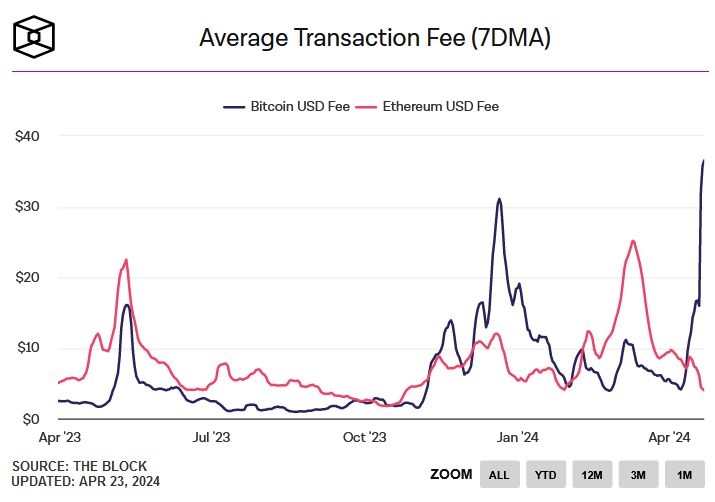

According to IntoTheBlock, average fees on Bitcoin soared past $36, after starting the month at roughly $5, with no signs of stopping.

The Halving Frenzy

As block 840,000 neared, dozens of projects began preparing to etch their Runes into the halving block.

That’s because getting into the first block would garner added provenance, and lend the project more credibility with investors interested in Runes. It’s no surprise since some of the earliest Ordinals inscriptions – such as Bitcoin Rocks – showcase a 4.2 BTC floor, or nearly $280,000, on Magic Eden.

Miners were the biggest winners of the day, with the halving block paying out a whopping 37 BTC, or roughly $2.4 million. The following blocks dropped slightly, but miners still received an overwhelming amount of revenue – despite the halving that was meant to make them less profitable.

In fact, most blocks are still paying out north of 6.25 BTC, the former block subsidy.

A number of Runes are available for trading on Magic Eden. The aforementioned SATOSHI•NAKAMOTO trades at $3.06 with a market capitalization of $64 million. Z•Z•Z•Z•Z•FEHU•Z•Z•Z•Z•Z is the first ever Rune inscribed and sells for $17.62, with a market cap of $1.9 billion.

Runestones Drop

One of the less fortunate communities in the Bitcoin halving aftermath is Runestones.

Just today, Runestones have lost 20% of their value. According to Coingecko, they traded last week for 0.089 BC, or roughly $6,000, but have since plummeted 70% in seven days to 0.025 BTC.

Runestones had rallied in anticipation of three airdrops for holders, which will take place over the course of the year and dropped after the snapshot was taken on April 21. The first airdrop, which is meant to be a dog with an orange hat, does not have a set date to drop but looks to capitalize on the fervent community behind the ecosystem.

Nonetheless, the Runestones community and its leader, the self-proclaimed NFT historian LeonidasNFT, have been relentlessly promoting the protocol, along with the desire to build the largest memecoin community in the world.

LeonidasNFT posted his thesis on April 23, explaining that most will “fade” Runes, only to watch the ecosystem explode with development.

Much like Ordinals have, despite the hate received by a large portion of the Bitcoin community, he said.

And Runes, which have garnered the ire of many due to its skyrocketing transaction fees – and the fact they have been dubbed “memecoins on Bitcoin”– will follow the same trajectory, according to Leonidas.

“In 2023, everyone faded "NFTs on Bitcoin" which was the most brain-dead obvious narrative of all time,” he wrote. “Now the same people are fading "memecoins on Bitcoin." You guys have no idea how excited I am to run this back as the underdog. The testnet memecoins will all bend the knee.”

That said, the first exchanges are beginning to list Runes, with Gate.io kicking off the race. LooksRare, an NFT marketplace, also teased the market today with a potential listing.

Magic Eden has listed a number of Runes, but not even 50 showcase any 24-hour volume.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.