The Road to Uniswap’s $100B in Trading Volume

Uniswap has become the first decentralized trading platform to process over $100B in volume, a sign DeFi is starting to compete in the big leagues of crypto. The milestone for the DEX, which launched just over two years ago, shows that automated market makers, which are based on token liquidity pools instead of centralized order…

By: Sydney Lai • Loading...

DeFi

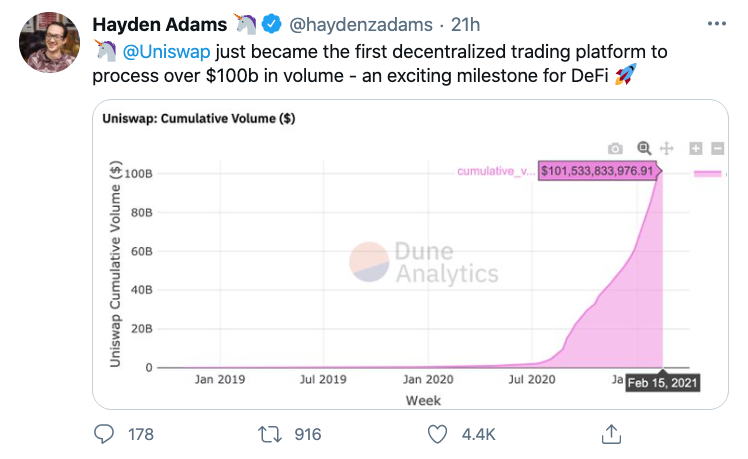

Uniswap has become the first decentralized trading platform to process over $100B in volume, a sign DeFi is starting to compete in the big leagues of crypto.

The milestone for the DEX, which launched just over two years ago, shows that automated market makers, which are based on token liquidity pools instead of centralized order books, are handling volume that’s coming to rival trading on centralized exchanges. The success bodes well for DeFi as the center for mainstream finance.

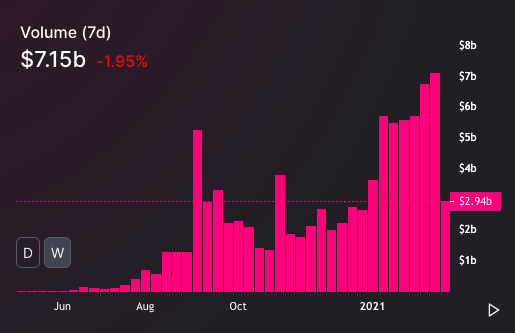

While Uniswap is still far from Binance’s daily trading activity of over $20B, daily volume of about $1B makes it the 20th largest exchange, beating centralized exchanges including Bitstamp and FTX, according to data by CoinGecko. Weekly trading volume climbed to a record $7B in the seven days ending Feb.13, according to uniswap.info.

Uniswap’s growth has helped push its governance token UNI to an all-time high of almost $23 in February, a 480% change in just 6 months.

Backstory

The current team of 11 is backed by renowned venture funds including a16z and Union Square Ventures, raising an $11M Series A round in August. But it was an Ethereum Foundation grant of $100k that helped propel its October 2018 launch. Founder Hayden Adams created Uniswap on the back of a 2016 Reddit post by Ethereum creator Vitalik Buterin.

In May 2020, V2 was launched to add the main feature of ERC20 to ERC20 liquidity pools, allowing direct trading from tokens like USDC to DAI, without having to go through ETH, minimizing gas fees and slippage.

Milestones

UNI token was distributed in September with 400 UNI allocated to 250K+ past users. UNI holders can vote on major protocol changes. By launching UNI, the Uniswap team aims to further decentralize the protocol, making it a publicly-owned and self-sustainable financial infrastructure.

In the Fall of 2020, amidst the yield farming craze, SushiSwap aimed to compete with Uniswap by forking the project and adding a reward for Uniswap’s liquidity providers, sucking $800M worth of Uniswap’s liquidity in its so-called “vampire attack.”

UNISOCKS testnet was launched in the summer of 2019. The tokenized Uniswap merchandise item or $SOCKS is a real sock with a current supply of 314 is now worth over $70K, nearing a $22M market cap. Unisocks was first traded in February 2020 at $103.

More and more projects are being built on Ethereum, therefore more ERC20 tokens are being issued and Uniswap has become the de-facto listing site, as anyone can create a market for their token, and anyone too, can trade. Uniswap is currently working on V3, an update which is expected to increase the capital efficiency of the protocol. But DeFi traders aren’t waiting around as volume continues to climb.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.