Markets - Page 15

Loading...

Stablecoin Swapping Heats Up with Coinbase Following DeFi

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock When Curve launched back in February 2020, many might have thought a DEX for stablecoins was a niche segment. Fast forward to today and Curve is averaging over $300 million in daily volumes, and has recently seen competing moves from the likes of Uniswap and Coinbase as the…

Loading...

It’s a Most Welcome Rally, but is It Just a Dead-Cat Bounce?

After 14 days of mayhem in the crypto markets, DeFi investors have stopped hyperventilating. Yes, it’s true that Ether lost more than half its value in the last two weeks, hitting $1,853 on May 23. That’s a pretty heavy drop even in the wild and woolly world of crypto. Then it jumped 40% to $2,591…

Loading...

DeFi Protocols Show Resilience in Stress Test

In a selloff which saw Ethereum’s ETH and the DeFi Pulse Index basket of DeFi tokens dropping over 20% in an hour and more than 40% overall yesterday, DeFi protocols never stopped running and generally behaved as designed. As DeFi grows to hold $100B in assets with millions of users, yesterday was a test on…

Loading...

DeFi Outperforms Post Crash as On-Chain Indicators Remain Strong

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock Following the biggest crash since Black Thursday, DeFi protocols have managed to withstand major headwinds and liquidations. While DeFi tokens dropped significantly along with the rest of the market, they sustained above their lows relative to Ether and still managed to grow in key on-chain metrics. The DeFi…

Loading...

BSC's Venus Protocol Left With Bad Debt After Liquidations

Binance Smart Chain’s most popular lending protocol, Venus, experienced a massive string of market liquidations totaling over $200M on May 18, and Venus, itself, has been left with $100M in bad debt because of it. The liquidations were primarily caused by the massive price swing of Venus’ governance token, XVS. The token jumped 88% from…

Loading...

Yearn Finance Seizes Dip and Buys Back $1.47M of YFI Token

DeFi gateway Yearn Finance is buying its own YFI token dip. In accordance with mandates in Yearn-Improvement-Proposal 56 (YIP-56), the protocol uses YFI staking rewards to buy back the token and “use bought back YFI for contributor rewards and other Yearn initiatives.” As such, Yearn Finance periodically buys back its own tokens, recently announcing a…

Loading...

Crypto Makes First Attempt to Recover After Worst Bloodbath in Over a Year

It’s bad out there — in the past 24 hours Bitcoin plunged as much as 30%, while Ether fell as much as 44%, crypto exchanges were down, price tracking websites collapsed, China crackdown news flashed, crypto Twitter panic ensued. All in all, a classic crypto sell-off. But there are signs the market is starting to…

Loading...

Crypto Market Downturn Mostly Shakes Out Short-Term Bitcoin Traders

It’s been a rough week for the crypto market̶ and it appears to be at the hands of “n00bs.” Ethereum’s ETH is down 15% from its all-time high of $4,356 on May 12, trading just above $3,300 at the time of writing. And Bitcoin has been hit especially hard with a 25% loss over the…

Loading...

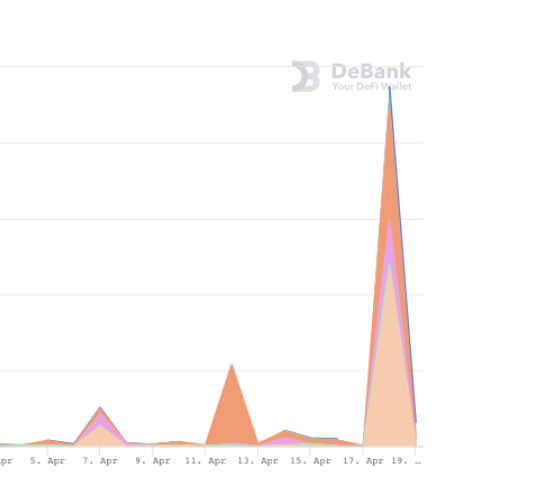

Ether Locked in DeFi at All-Time High After Market Crash

An all-time high of 11.2M Ether is locked in DeFi protocols, despite a weekend sell-off. Liquidations spiked, while tokens continue sliding. Locked Ether’s resilience may show that DeFi participants do not consider the recent drop in price to signal a long-term trend and thus are not unlocking their ETH in order to sell. Borrowers may also…

Loading...

Filecoin Rallying The Most Among Largest Crypto Tokens

Filecoin’s token is soaring by the most in all of crypto. FIL has jumped 168% to $231 in the last week, the most among the top 100 tokens listed on CoinGecko. The project raised $52M in a presale and $205.8 million dollars in an ICO during the 2017 crypto boom only to largely fall off…