MakerDAO - Page 9

Loading...

DAI Gets a Quick Bridge To Optimism

MakerDAO will soon launch a feature which may solve the biggest UX hangup of the Optimistic layer 2 (L2) scaling solution. The feature will allow users to move not only DAI, but eventually any Ethereum asset, off Optimism and to layer 1 (L1) within minutes. Considering the previous withdrawal wait period of one week, the…

Loading...

What is MakerDAO and How Does DAI Work?

MakerDAO is exactly what it sounds like –it’s a DAO, a decentralized autonomous organization and its purpose is to make DAI. DAI is a digital dollar backed by locked up cryptoassets like ETH, BAT, WBTC, KNC, and more. What Maker figured out years ahead of the explosive rise of DeFi is that a stablecoin could…

Loading...

MakerDAO is Piling on Fees as Dai Demand Booms

DeFi’s central bank is piling on fees. MakerDAO backend and oracles engineer Nik Kunkel tweeted that if the current market conditions remain stable, the protocol would generate ~$71M in annual stability fees. Stability fees paid by Maker borrowers (similar to borrowing costs), are then burned by the protocol, indirectly benefiting MKR holders by reducing the…

Loading...

MakerDAO Proposal Seeks to Boost DeFi Fixed-Rate Loans

Fixed rate lending has been slow to take off in DeFi. That’s what one of the latest MakerDAO proposals is seeking to change. Maker Improvement Proposal 43 would enable MakerDAO to buy fixed-rate loans. The goal is that having DeFi’s largest protocol buying tokenized loans issued by other protocols, at more favorable terms, will boost…

Loading...

Maker Stability Fee Increase May Boost MKR Price

MakerDAO has casually reintroduced stability fees for the ~$900M worth of DAI now in circulation. Maker’s MKR holders voted to raise the protocol’s stability fee – similar to interest rates for Dai borrowers – to 2% for ETH collateral from 0%, the highest since January. The reintroduction of stability fees sets Maker on track to…

Loading...

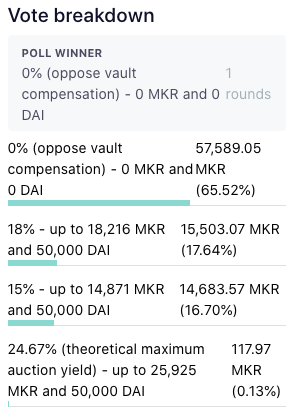

Maker Votes to Not Compensate Black Thursday Victims

MakerDAO traders who had their collateral wiped out during DeFi’s so-called Black Thursday, received bad news from the protocol’s decentralized court this week: they won’t be getting a penny (or gwei) back. Their only hope now lies in traditional/centralized courts. On March 12th, DeFi experienced its worst day on record as prices tanked by more…