DeFi - Page 48

Loading...

Evil Pickle Jars Makes Off with $20M

The latest affected project in a series of DeFi exploits is Pickle Finance – an automated yield aggregator with a mission to make stablecoins stable. Over the weekend, a hacker was able to exploit Pickle’s code to transfer $19M worth of Dai to an ‘Evil Jar’, leaving most LP’s in a pickle. The project allows…

Loading...

Aave Governance Picks Up Steam With Two New Proposals

Aave yesterday posted two new governance proposals for its lending protocol, the fourth largest in DeFi with more than $1.3B in deposits, one of which may lead to an increased pool of assets to be managed by token holders. The first – AIP2 – proposes to take protocol fees collected from Aave V1 to seed…

Loading...

The Nifty Ways That NFTs Become DeFi

Blockchain technology goes far beyond the digital currency use case. Over the past six months, headlines have been dominated by cryptocurrencies and related projects as they spiked in value. But these assets were fungible meaning that one ETH token is identical to another ETH token. In the shadow of the DeFi canopy blossomed NFTs, and…

Loading...

Hegic Interest Soars on Yearn Partnership

Hegic is back with a bang. Demand for the protocol, which temporarily suspended activity after a bug earlier this year, is soaring as its partnership with Yearn Finance’s rockstar founder compounds with increasing demand for trading protection. The HEGIC governance token has more than doubled over the past 30 days, after founder Molly Wintermut and…

Loading...

A New Andre Cronje Beta Project, a New Token That Pumps

As has become all too common in DeFi, Yearn founder Andre Cronje is tinkering with a new project and speculators are rushing to buy its token —aka aping in— before it’s even live. The project, called Keep3r Network, is a decentralized coordination ecosystem for projects to find developers that will work on their upkeep. “Projects…

Loading...

Bancor Aims to Eliminate Impermanent Loss With Upgrade

Bancor has unveiled the next step in their new AMM design. The 2.1 release introduces an elastic BNT supply, used to cover impermanent loss for LPs through a mechanism called Liquidity Protection. The update builds on the ability to add single-sided liquidity, or using one token to pool liquidity instead of two like Uniswap. LPs…

Loading...

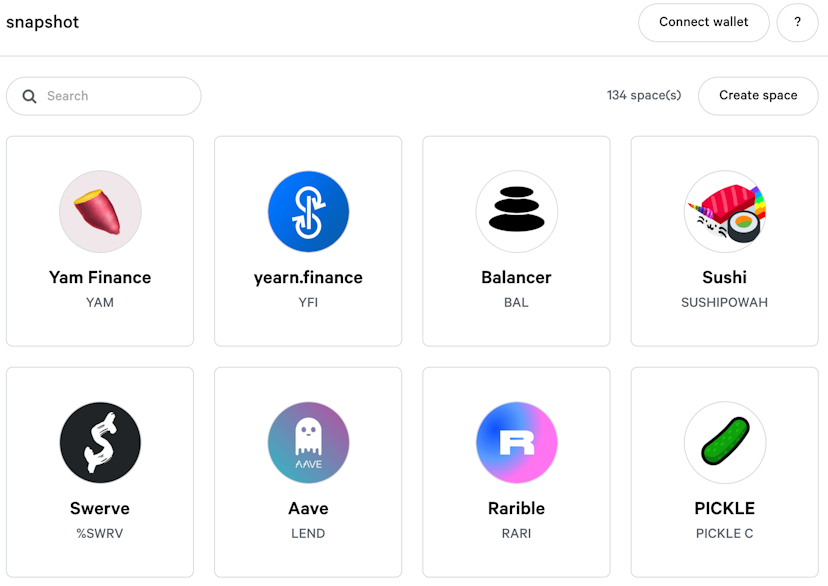

Snapshot Gets $200k From Aragon and Balancer for Governance Standards

Off-chain voting solution Snapshot got a stimulus boost thanks to $200k in funding from Aragon and Balancer yesterday afternoon. Both teams have pledged $100k in their native tokens, ANT and BAL, into a 50/50 Balancer pool to be used by Snapshot for future funding. @SnapshotLabs to get $200k in funding in a 50/50 BPT of…

Loading...

DeFi is About to Get More Tokenized Indexes

Set Protocol is doubling down on the success of the DeFi Pulse index by launching a new project – the Index Coop – focused on creating accessible crypto indexes. Tokensets, a platform for users to purchase sophisticated trading strategies in the form of ERC20 tokens called Sets, recently deployed the DeFi Pulse Index (DPI), a…

Loading...

YAM Finally Finds Fertile Ground After Succesful Rebase

Yam Finance’s first successful monetary exercise yesterday marks a new start to DeFi’s original food-based token YAM is an experiment in rebasing cryptocurrencies, plus token incentives (aka yield farming) to drive liquidity, plus full on-chain governance, plus a DAO-like treasury managed by token holders. It’s also testing the power of the emoji. Its Aug. 11…

Loading...

Cream Finance Crosses $300M in Deposits

What happens when you fork Compound and add lending pools for DeFi’s most degen assets? You get Cream Finance. In under a month since launch, Cream has aggregated more than $300M in TVL, according to DeFi Pulse, largely thanks to CREAM liquidity mining rewards. Image source: DeFi Pulse What started as a lending protocol for…