DeFi - Page 32

Loading...

dYdX Now Accounts for More Than All Other DEX Trading Combined

Non-custodial exchange dYdX has climbed to the top of the DEX rankings by trading volume, beating out Uniswap, for the first time. More than $9B has been exchanged on the trading platform in the last 24 hours, according to data provider CoinMarketCap. Uniswap’s V3 lands in second at $1.2B, the only other DEX to trade…

Loading...

Liquidity Mining Set to Begin Friday on the Risk Tranching Gro Protocol

Everyone is looking for stronger yields in DeFi. Gro is a new yield platform that aims to offer boosted returns on leading stablecoins to users willing to accept some risk. Gro is set to launch liquidity mining shortly for its depositors, which means they will begin receiving its governance token, GRO, based on the funds…

Loading...

Beat the DROPS with Barnbridge's SMART Alpha

SMART Alpha allows users to calibrate their exposure to the performance of an underlying asset. It does so by regularly redistributing an aggregated pool of the underlying asset between two groups of users: a senior side, and a junior side. When price goes up, seniors give up some of their assets to the juniors, and…

Loading...

DAOs Accelerate Token Swaps in Push to Diversify Their Treasuries

DeFi DAOs have made some serious cash in 2021 — but generally only in their native tokens. Now they’re looking to diversify. Fueled by a combination of rising token prices and an explosion in fee revenues as DeFi continues to attract new users, the decentralized autonomous organizations (DAOs) that act as a management layer for…

Loading...

Fireblocks Draws Closer to Getting Wall Street Cash on DeFi Giant Aave

Fireblocks, the digital asset security firm, has posted a proposal on Aave’s forum to scrutinize and approve participants on the DeFi giant’s platform. If Aave governance passes the whitelisting proposal, Fireblocks would be able to onboard a slew of institutional clients into the lending protocol. Fireblock’s CEO, Michael Shaulov told The Defiant that roughly 50…

Loading...

DeFi Lending Venture Rides Solana’s High-Speed Chain to $100M in Deposits

Solend, a lending platform built on the proof-of-stake blockchain, Solana, has hit $100M in deposits, according to its team. Solend has done so without liquidity mining opportunities, but those are coming. Solend works basically the same way Compound and Aave do. Users can post assets that will earn interest, and they can borrow a certain…

Loading...

How to Earn Fixed Rate of Interest on 88MPH

88MPH is a non-custodial, fully on-chain protocol acting as an intermediary between you and third-party variable yield rate protocols to offer the best fixed yield rate on your capital.

Loading...

Ape Diaries: The Early Bird Gets The Airdrop

It has historically paid to be early in DeFi — literally. Traders (including yours truly) are betting that will also be the case on Arbitrum and Optimism. DeFi has long fostered a culture of rewarding early adopters, with a great example being last year’s massive Uniswap airdrop in which the decentralized exchange airdropped 400 UNI…

Loading...

dYdX Drops Over $1B to Past Users in Airdrop

Margin trading protocol dYdX launched its native token with one of the largest distributions in decentralized finance. dYdX dropped 7.5% of its initial billion-strong token supply on Sept 8. At the current price of $11.12, those 75M tokens are worth more than $800M. At one point the airdropped tokens’ value eclipsed $1B. That’s up there…

Loading...

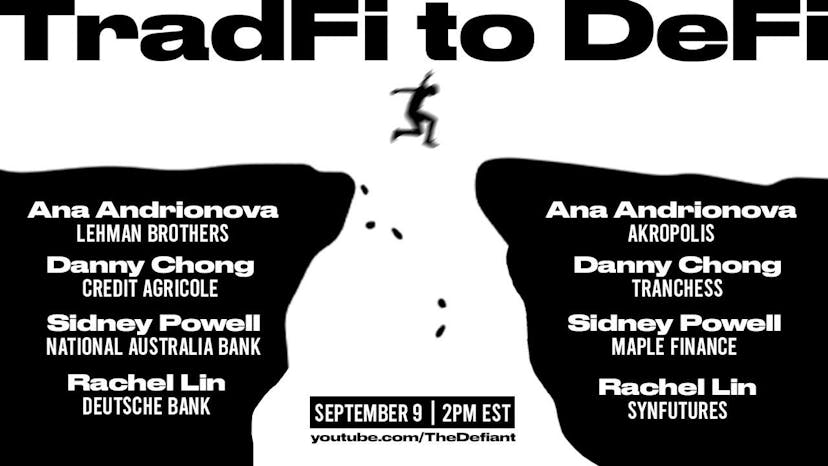

Jam Session #6: TradFi to DeFi

We’ll be talking with DeFi founders who made the move from big banks in traditional finance into the wild west of crypto. We’ll chat about what it was like leaving their comfy jobs, what convinced them to take the leap, how they’re finding this new world compares with the old one, and what advice they…