Aave - Page 9

Loading...

What is DeFi? The Ultimate DeFi 101 Guide to Ethereum, Layer 2s, Yield Farming, and More

This updated primer on DeFi explains Ethereum, layer 1s and Layer 2, top projects, and governance.

Loading...

MakerDAO’s Update is a Pure Expression of DeFi 2.0

IntoTheBlock explores how MakerDAO's update will allow it to interact with the secondary market with more control over DAI.

Loading...

Aave V3 is About to Pass in Governance Vote

All signs point towards lending giant Aave getting a V3 soon. Voting is now live on Snapshot, with well over 99.9% of the votes supporting the protocol releasing its next iteration.

Loading...

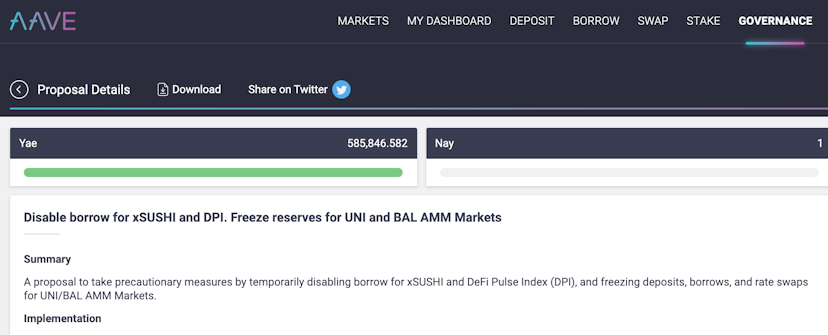

Aave Set to Disable Borrowing on xSushi and DPI Citing Potential Exploit

Aave token holders are voting to patch a vulnerability to DeFi’s biggest protocol by assets locked.

Loading...

DeFi Powerhouses Curve and Aave Deploy on Avalanche to Profit from Incentives

Incentives work. Or at least they do in terms of wooing DeFi protocols to deploy on other blockchains. Case in point, Curve Finance, the automated market maker, and Aave, the leading DeFi lending project, have each deployed their offerings on Avalanche as a part of the blockchain’s $180M incentive program called Avalanche Rush. It’s the…

Loading...

Fireblocks Draws Closer to Getting Wall Street Cash on DeFi Giant Aave

Fireblocks, the digital asset security firm, has posted a proposal on Aave’s forum to scrutinize and approve participants on the DeFi giant’s platform. If Aave governance passes the whitelisting proposal, Fireblocks would be able to onboard a slew of institutional clients into the lending protocol. Fireblock’s CEO, Michael Shaulov told The Defiant that roughly 50…

Loading...

Governance Wars Break Out Over Proposal to List BOND on Aave

DeFi’s latest DAO war is offering an inkling to just how thorny tokenized governance can get. Supporters of the tokenized risk protocol BarnBridge are upset as a proposal to list the project’s BOND token as collateral on lending platform Aave has been met with unexpected resistance from a handful of large token holders in the…

Loading...

Aave Hints at New Institutional Product

Aave is hinting at a new product for allowing institutions to practice DeFi. On Monday, Aave founder Stani Kulechov tweeted the words “Aave Pro for institutions” alongside a cryptic screenshot. According to Aave full-stack blockchain developer Emilio Frangella, the screenshot depicts the “technical implementation of an experimental version of the Aave protocol for institutions.” He…

Loading...

AITO Platform Builds Yield-Generating NFT On Top of Aave

Developed by NFT social media network AITO, the NFT is a first on Aave and also a first in that it’ll generate ongoing Aave yield for the artists. The artwork itself is a multimedia, audiovisual collaboration between the DJ Marshmello and Steven Messing, the concept art director for Avatar 2 and Avatar 3. The auction…

Loading...

Aave Liquidity Mining Catapults Lender to Become Top DeFi Protocol

On-Chain Markets Update by IntoTheBlock Almost a year since the initial release of COMP fueled DeFi Summer, Aave’s governance voted to implement a similar incentive program. The effects were just as momentous. Aave’s total value locked more than doubled within less than two weeks. As of May 5, 2021 through IntoTheBlock’s DeFi Insights This sharp…