SushiSwap Drains Uniswap Liquidity. Still, Everyone Won

DeFi experienced what seemed like its first-ever hostile takeover today, except instead of stock buyouts and management shakedowns, it was driven by users switching platforms following their own economic incentives. Crypto capitalism at its finest. 1) well the migration is done; sushiswap is livehttps://t.co/c2JGZJ65Ch — SBF (@SBF_Alameda) September 9, 2020 SushiSwap, a fork of Uniswap,…

By: Camila Russo • Loading...

DeFi

DeFi experienced what seemed like its first-ever hostile takeover today, except instead of stock buyouts and management shakedowns, it was driven by users switching platforms following their own economic incentives.

Crypto capitalism at its finest.

1) well the migration is done; sushiswap is livehttps://t.co/c2JGZJ65Ch

— SBF (@SBF_Alameda) September 9, 2020

SushiSwap, a fork of Uniswap, successfully migrated Uniswap liquidity into its own protocol. It was the first time the scheme that has come to be known as Vampire Mining (thanks to crypto analyst Martin Krung and Defiant contributor Cooper Turley), had ever been attempted.

Half of Uniswap

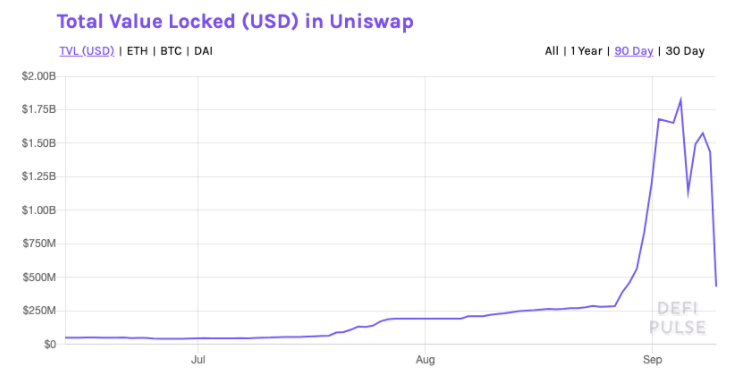

There was about $810M of tokens in SushiSwap, or 55% of Uniswap liquidity, when the migration started earlier today. By the end of the process, value in SushiSwap had increased to about $860M, according to DeBank. Total value locked in Uniswap has more than halved since yesterday to $430M, today according to DeFi Pulse.

Still, Uniswap has hugely benefited from SushiSwap; total value in the protocol is up by 50% from $285M, before SushiSwap launched. Thanks to the SushiSwap frenzy, it was able to overtake Coinbase Pro volume two weeks ago.

For background, traders poured tokens representing deposits in Uniswap liquidity pools into SushiSwap to get SUSHI token rewards, and those who kept them there through the migration got extra tokens. The migration consisted of swapping Uniswap LP tokens for their underlying asset, and taking those tokens to SushiSwap.

Net Positive

SushiSwap was able to pack many seasons worth of soap opera drama in the two weeks since it launched (read The Defiant’s take on HERE and HERE), but the takeaway so far is that it’s been a net positive for DeFi.

It hasn’t fragmented liquidity, like some had feared. Instead, it grew the pie, drawing more people into both Uniswap and SushiSwap. Users also won: they have another choice of AMM. The biggest losers so far are SUSHI holders who founder Chef Nomi dumped his/her tokens on.

SUSHI price signals the market is becoming more bullish on the Uniswap spinoff. It continues to rebound from its $1.2 low, up more than 20% today to around $3.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.