MakerDAO is Piling on Fees as Dai Demand Booms

DeFi’s central bank is piling on fees. MakerDAO backend and oracles engineer Nik Kunkel tweeted that if the current market conditions remain stable, the protocol would generate ~$71M in annual stability fees. Stability fees paid by Maker borrowers (similar to borrowing costs), are then burned by the protocol, indirectly benefiting MKR holders by reducing the…

By: Owen Fernau • Loading...

DeFi

DeFi’s central bank is piling on fees.

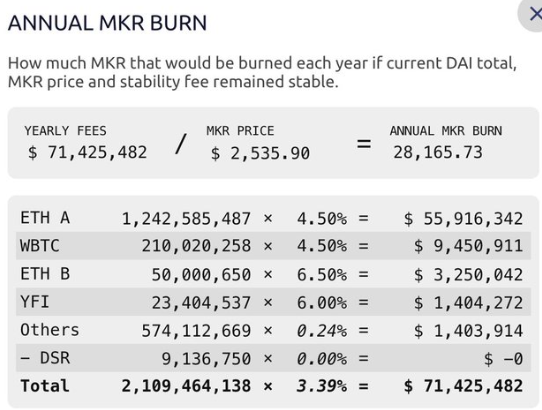

MakerDAO backend and oracles engineer Nik Kunkel tweeted that if the current market conditions remain stable, the protocol would generate ~$71M in annual stability fees. Stability fees paid by Maker borrowers (similar to borrowing costs), are then burned by the protocol, indirectly benefiting MKR holders by reducing the token supply. .

Fees would result in the equivalent dollar amount of $28K worth of MKR burned. As that burning cuts into the remaining supply of MKR, holders are betting that the remaining ~995K tokens would accrue value.

Holding Maker

“The cash flow is important because MKR token holders can decide to get that money as a DAI dividend (minus expenses but those are minimal and we have other sources of revenues),” Sébastien Derivaux, a cryptoeconomist at Maker, told The Defiant.

This means that “MKR holders are absolutely printing,” as the crypto researcher who goes by Hasu said in a post.

MKR holders are “printing” partially because with the Dai Savings Rate as 0%, lending rates don’t cut into borrowing rates.

As DAI Demand Goes, So Goes MKR?

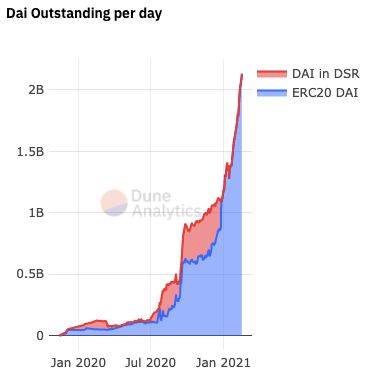

More DAI minted means more stability fees in aggregate, and outstanding DAI supply has grown to almost $2.2B, up more than 17 times what it was Feb. 17 last year at $125M. The future is bright for MKR holders if demand for DAI continues to explode.

“At current price, it means a 3% yield for something that has grown 20x in twelve months.

What if we achieve another x20 growth? It’s a 60% yield (or a x20 the price),” Derivaux said .

As DAI is a key asset in many DeFi protocols, and DeFi as a whole continues to gain steam, another four-digit percentage increase in the stablecoin’s supply is not out of the question.

“The global market (Eurodollars, i.e. dollars outside of the US) is $13,000B. We are at $2B today. That gives a perspective on the opportunity we are chasing. It’s only the beginning,” Derivaux told The Defiant, giving a sense of the Maker team’s ambitions.

The two metrics are not fully tied to one another: MKR is up 314% in the last year, while outstanding DAI has increased more than 1600% over the same time period.

Maker’s price may be a lagging indicator to demand for DAI.

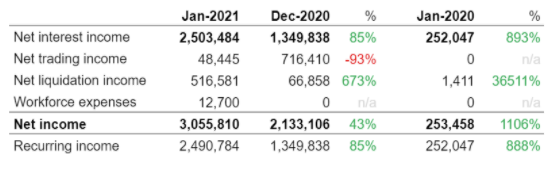

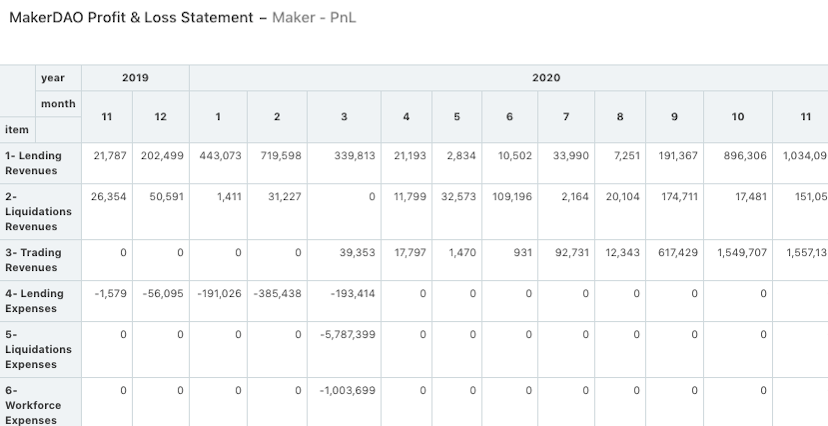

The protocol’s income is up 1106% from Jan. 2020 to Jan. 2021, while the token’s price has only increased 179% in the same period, said Derivaux on Twitter, referring to a January presentation of the DAO’s financials.

Fork Resistant

As MakerDAO mints DAI through its vaults, the protocol potentially has a much stronger moat than other DeFi protocols.

Enterprising DeFi heads may want to fork the protocol’s mechanics, but they can’t fork the generated DAI.

On-Chain Accounting

Maker has also released a public dashboard with which to keep track of the protocols basic financial statements in real time.

The gains may just be enough to bring Maker back into favor in the fast-moving DeFi world, where a five-year-old project may appear to be old news.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.