X2Y2 Dives Into NFT Lending With 0% Fees

Competition in the NFT Lending Space is Heating Up

By: Tarang Khaitan • Loading...

NFTs & Web3

X2Y2, an NFT marketplace that did $143M of trading volume in the past month, has launched a new NFT Loan feature. The project aims to attract users by not charging any fees.

Lenders can make multiple loan offers with different durations to better utilize their ETH. This is vastly different from existing lending platforms, where users need to bid using different accounts, which is not capital efficient.

“For instance, you can make 3 loan offers each with 7, 14, and 30-day durations on the same spirit azuki for 50 ETH at X2Y2. Whereas on other platforms you will need to spread 150 ETH across 3 accounts to make those same offers,” the project said in a tweet introducing the new feature.

Users will be able to make both collection-wide loan offers and specific offers on NFTs with unique, sought-after traits.

Borrowers can use their NFTs as collateral to borrow ETH. After choosing a loan offer, their NFT gets locked on the platform, and they receive ETH from the lender. Borrowers must repay their loans before their due dates to avoid defaulting and losing their NFTs.

Only select NFTs that are not flagged as stolen on any marketplace are accepted as collateral. The current list of whitelisted NFT collections includes popular blue chips like the Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki and Moonbirds.

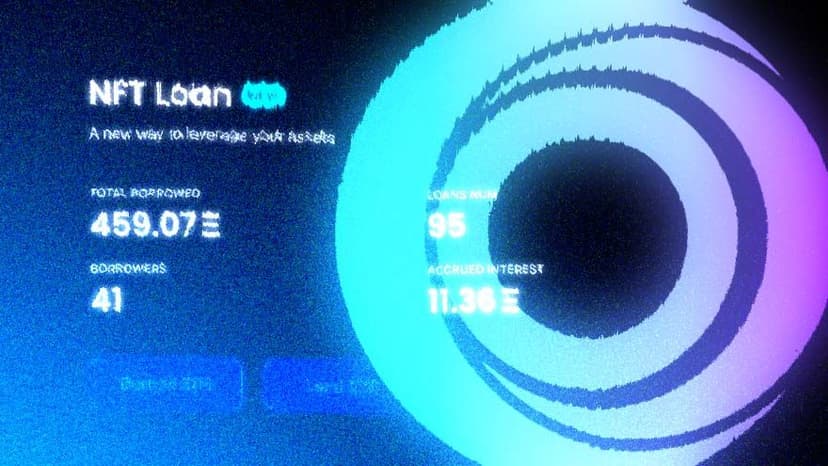

As of Oct. 21, the platform has 557 ETH ($724,100) in loans outstanding, while lenders have earned 12.78 ETH($16,614) in interest.

Security firm SlowMist conducted the security audit for the new feature.

X2Y2 faces an uphill battle if it is to compete with well-established NFT lending platforms such as NFTfi, and BendDAO. NFTfi isthe market leader with $275.54M of loans outstanding. Meanwhile, BendDAO ranks second with $153.26M.

Rocky Start

In February, X2Y2 launched its NFT marketplace, along with its eponymous token. It received a mixed reception from the community, due to the launch being marred by technical issues.

It has since recovered from its rocky start and the platform has facilitated $142.68M worth of trades in the past 30 days, according to DappRadar. There’s also been a 36.33% increase in unique active wallets that have interacted with the platform’s smart contract during the period.

This success can be attributed to the platform changing its fee structure. In April, users were allowed to trade on the platform free of charge. Since then, the platform has begun to charge trading fees of 0.5%. This is much lower than major marketplaces OpenSea and Magic Eden, which charge 2.5% and 2% respectively.

Last month, X2Y2 made royalties optional on its platform, which caused an uproar in the community. The X2Y2 token is down 3.3% in the past 7 days, according to CoinGecko.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.