Why MEV Matters and Other Post-Merge Revelations

PoS Ethereum Will Create Hidden Value But Block Construction is Vital

By: Matt Cutler • Loading...

Research & Opinion

The Merge was undoubtedly the most significant Web3 network upgrade to date, with implications that go beyond switching consensus mechanisms and reducing energy consumption. In fact, this upgrade was the first step towards a future in which your Ethereum wallet pays you to use it.

The Merge set the stage for changes that will ultimately enable the recirculation of hidden value throughout the Ethereum ecosystem.

Block Construction

The Merge introduced fundamental changes to how pending transactions are grouped into blocks and then added to the chain. The block construction process under Proof of Stake (PoS) is now very different from how it occurred under Proof of Work (PoW). And block construction matters. A lot.

To illustrate why, let’s meet Ella.

Ella took the dive into DeFi. She did her research, found a DEX, and sent her transaction with no issues. Now she needs to monitor the mempool until her transaction is confirmed and on-chain.

But wait! Her transaction settled with fewer tokens than she expected. Where did she go wrong?

She was probably sandwiched: Automated systems, or bots, moved the price on her trade by deliberately placing a transaction just in front of and just behind Ella’s trade. These systems purchased the token, moving the price up just before Ella’s transaction went through (so she received fewer tokens than she expected). The system then sold those tokens immediately after — capturing a small but far from negligible profit.

Superior Information

Ella experienced “slippage”, a negative change to the price of the token she was purchasing between the moment she submitted her transaction and when it was confirmed on-chain.

Slippage can happen as a consequence of normal changes to market conditions. In Ella’s case, an external actor with access to superior information – and the knowledge and capabilities to act – intentionally moved the price in a way that was favorable to them and unfavorable to Ella.

Under PoW, Value Flowed Downhill

Under the PoW regime, Ethereum miners did the job of both building and proposing the network’s blocks. This means miners determined both the transactions included in a block as well as how exactly to order transactions within a block.

Lido Floods Layer 2s with Staked ETH After Launching Incentives Program

Lido Scrambles to Counter Coinbase and Rocket Pool as Staked ETH Market Heats Up

This was a powerful position; specifying inclusion and ordering enabled miners to profit from on-chain activities in ways that other network participants could not. In fact, we refer to the value miners extract through modifying transaction ordering and inclusion within a given block, such as Ella’s sandwiching example, as Maximal Extractable Value (MEV).

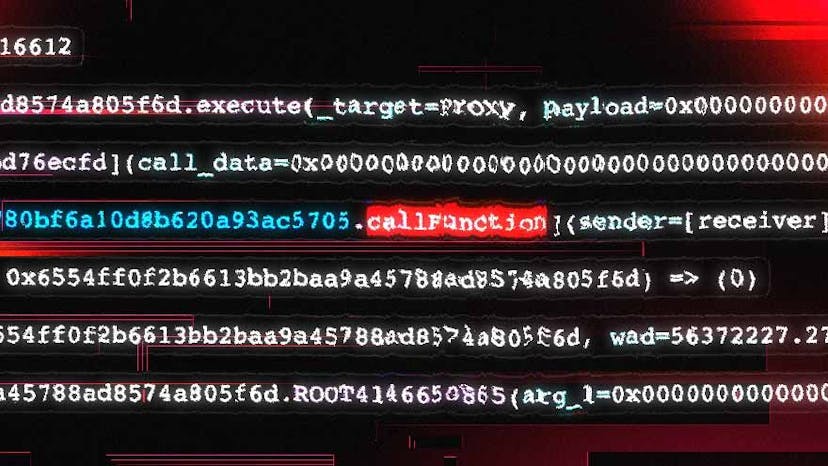

We call the individuals and groups that operate MEV bots “Searchers”. Searchers write code, often powered by proprietary, complex algorithms, that identifies MEV opportunities in the mempool.

Target Transactions

They compete to submit response ‘bundles’ that include the target transaction and corresponding response transactions. Under PoW, Searchers submitted bundles to miners, who then determined whether or not to include the bundle in the block they were attempting to mine and place on-chain.

If included in the miner’s block, a targeted user’s transaction (such as Ella’s) would likely have a less favorable outcome, while the searcher’s bundle would likely yield profits.

Most of this user-generated MEV value accrued to a small set of miners, who then removed that value from the ecosystem altogether.

To get miners to pick up their bundles, searchers paid fees directly to miners in return for inclusion and preferential ordering. These fees were calculated as a percentage of the expected profit associated with the bundle and, for competitive opportunities, could often exceed 90% of the projected profit.

While searchers did the work to identify the MEV opportunity and create the profitable response bundles, they needed a miner to insert the bundle Therefore, Searchers frequently paid the majority of their profit to a miner.

Sub-optimal

As such, under PoW, MEV value flowed ‘downhill’ from users to searchers to miners – who then converted that value to fiat in order to purchase additional mining capacity and the necessary energy to operate it. In other words, most of this user-generated MEV value accrued to a small set of miners, who then removed that value from the ecosystem altogether. This state of affairs was, to put it mildly, sub-optimal.

How PoS Block Building Enables MEV Value

The upgrades introduced by The Merge push Ethereum towards ever-increasing network modularity, enabling comprehensive decentralization of the network and its underlying infrastructure.

As part of this shift, The Merge instituted under-the-covers upgrades that transitioned block building under PoW from something controlled by a small, opaque group of mining pool operators to an open marketplace in which anyone can participate.

It Only Took An Hour for MEV Bot to Lose $1.4M in Brazen Heist

'We Got Careless' Victim Tells Hacker in Bid to Recover Lost ETH

This change is known as Proposer/Builder Separation (PBS). As the name suggests, PBS splits the role of block construction — that is, determining which transactions to include in the block and in what order — from the role of proposing a block for network inclusion.

This decoupling creates conditions for the emergence of a new class of core network actors: Block Builders. Block Builders are specialist providers that compete in a real-time marketplace to perform block construction on behalf of Validators, the entity responsible for verifying and proposing blocks to be added to the blockchain under PoS.

Creativity and Expression

Block building under PoS is open and programmable, providing room for a vast array of creativity and expression around block construction. Each member of the value chain— user, proposer (validator), and builder — now has the opportunity to actively participate in block building.

They can specify preferences. They can help dictate outcomes. Different network actors can opt-in to different approaches and regimes. The parties responsible for originating transactions – including dapps, wallets, protocols, exchanges, marketplaces, and others – could specify their preferences about how MEV is captured (or not) and MEV profit-sharing, including taking a cut of the profit and (ideally) ensuring users themselves benefit.

Chain Participants

Taken together, this creates the potential for a vibrant block construction landscape in which all transaction supply chain participants, including users themselves, can specify and enforce preferences about transaction orchestration. We believe this will lead to an Ethereum network that benefits the most important constituency: End-users who initiate on-chain transactions.

When a user’s transactions result in MEV opportunities, traditionally only the Searcher and the Miner/Validator receive profit. But what if economic value extracted from that MEV flowed back to the source of value?

Block Builders now have the opportunity to take recirculation of value into consideration when building blocks. Instead of giving the proceeds from MEV all to the Validator, which sits at the bottom of the PoS transaction supply chain, they can instead choose to share it with the user, the wallet, the protocol, and the dapp that originated the transaction.

Practically speaking, what does this mean? We see a future in which an Ethereum wallet pays users to use it. Likely, this would come in the form of subsidized (or even negative) gas prices, MEV rebates, or earning third-party tokens associated with the transactions conducted.

MEV Opportunities

Think of this as a super-charged version of credit card cash-back. Such MEV value recirculation could accelerate Web3 user adoption, transaction volume, and transaction value. Imagine different wallets with different techniques for capturing and sharing MEV profit with new factors and features to attract users to different wallets.

Given that when end-users conduct transactions, they originate MEV opportunities on the network, making an argument for returning some (or most) of this value to them.

The future will reveal new opportunities to enact value recirculation. We are only at the beginning of a journey into the various ways that post-Merge block building will fundamentally change web3 for the better.

Matt Cutler is the CEO and co-founder of Blocknative.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.