Centre Bans USDC Addresses After Tornado Sanctions

Investors Eye Decentralized Stablecoins as Consortium Bars 38 Addresses

By: Owen Fernau • Loading...

DeFi

Stablecoins are in the spotlight yet again.

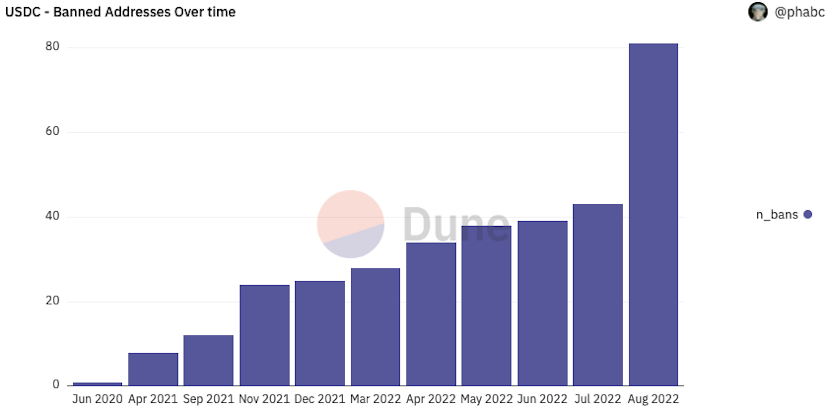

Centre, the consortium behind USDC, the world’s second-largest stablecoin, banned 38 addresses on Aug. 8. This means that the USDC tokens in those addresses are frozen and cannot be moved. 81 addresses have been banned in total.

Source: Dune Analytics

Centre’s move came in response to the US Department of the Treasury’s decision to sanction Tornado Cash, a protocol which facilitates private crypto transactions by using a set of smart contracts to commingle and mix user deposits.

Before Aug. 8, the Treasury had never sanctioned an open source protocol, wrote Circle founder Jeremy Allaire. Circle is a financial services company that founded Centre with Coinbase in 2018. Circle promotes a suite of products which involve USDC.

The shockwaves from the asset freezes are rippling throughout DeFi.

USDT Demand Rises

Curve Finance, the automated maker maker (AMM) geared towards like-priced assets, has seen the proportion of USDT in its 3-pool go from 29.60% to 25.71% since the sanctions on Tornado were announced..

At $987M in assets, 3-pool is Curve’s second largest pool — the drop in USDT is likely because users are using the pool to swap their USDC for USDT and DAI, 3-pool’s other two dollar-pegged assets.

DAI Concerns

As just over 50% of DAI is collateralized by USDC, users like Erik Voorhees, the founder of ShapeShift, are concerned that the USDC locked in Maker’s smart contracts, may also be banned.

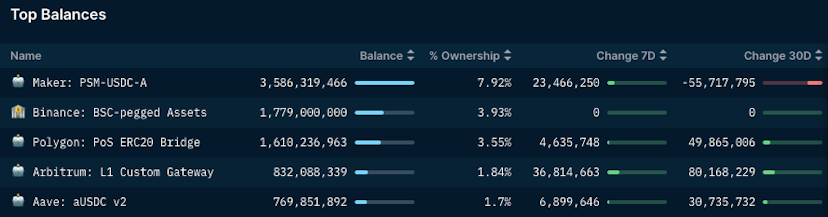

Indeed, with $3.59B of USDC, MakerDAO’s peg stability contract (PSM), is actually the number one holder of the stablecoin, according to Nansen, the analytics provider. The PSM allows USDC to be swapped for DAI at a fixed rate.

Top five smart contacts holding USDC. Source: Nansen

The market capitalization of USDC stands at $54.1B, according to Etherscan. That makes the stablecoin the second largest token on Ethereum after USDT, the stablecoin issued by Tether.

Decentralized Alternatives

With concerns about USDC on the rise, DeFi users are looking for alternatives beyond the big three stablecoins.

Liquity, a protocol which relies on collateralized debt positions, has seen its USD-pegged LUSD jump to $1.04, according to DEX Screener. LUSD has been gaining favor as a more decentralized option, since Liquity only accepts ETH as collateral.

Influencers like Tetranode are also talking about RAI, which isn’t pegged to the USD but is backed by only ETH and designed to maintain a stable price.

Some in the Synthetix Discord are speculating that the sUSD stablecoin also has a shot at gaining market share, given the devolving trust in USDC and centralized stablecoins in general. sUSD is primarily minted by borrowing against SNX, Synthetix’s native token.

The stablecoin sector is set to get even more crowded — both Aave and Curve have announced plans to launch their own stablecoins.

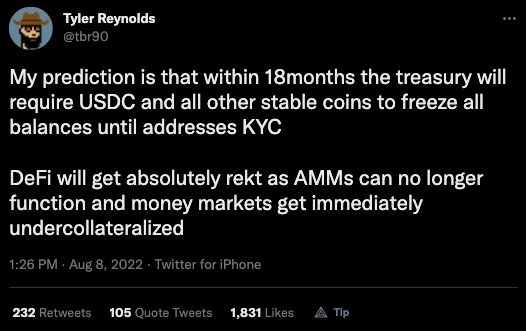

Tyler Reynolds, an angel investor and crypto advisor, doesn’t necessarily think users will abandon the likes of USDC just yet. “I’m not sure how much people will move away until the regulations actually start getting stricter,” he told The Defiant. “I think a lot of people are still in denial that regulations are going to come cracking down hard.”

Reynolds predicts that KYC restrictions are coming to all stablecoins within the next 18 months. He later clarified to The Defiant that he only believes this will happen to centralized stablecoins like USDC.

Legal Action

In a Twitter Space hosted by Liquity, there was talk of legal action from Ameen Soleimani, the co-founder of Reflexer Labs, which developed RAI. This was echoed by Ashleigh Schap, chief strategy officer at RISC Zero and advisor to Liquity. During the Space, Schap referred to a prior conversation with attorney Collins Belton about taking some of the anti-DeFi actions taken by the US government to the Supreme Court.

The stakes have certainly risen for stablecoin issuers. With censorship, which runs counter to crypto’s core beliefs, becoming more of a reality, the importance of decentralization has come to the fore once again.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.