Sushiswap - Page 2

Loading...

SushiSwap 'Head Chef' Narrowly Wins Vote

Contentious Debate Over Pay Continues as New Poll Approaches

Loading...

SushiSwap 'Head Chef' May Pocket a Third of All Tokens Paid to Staff

Debate Running Hot as DAO Members Vote on Howard's Hiring

Loading...

SushiSwap Triggers Dustup During Launch of Market Making Feature

Users Challenge SushiSwap's Claims It has First Cross-Chain AMM

Loading...

Here's Why DAOs Fail; Former SushiSwap CTO Reflects on Decentralized Orgs

Joseph Delong is the founder of Astaria, a recently created NFT lending protocol and the former CTO of SushiSwap

Loading...

Sushiswap Trident

Trident was first developed with the core focus of capital efficiency and cryptocurrency volatility protection using powerful, yet intuitive and easy-to-use, tools to provide DeFi with its new protocol standard. Our goal was to reinvent the wheel, without sacrificing user familiarity with Sushi’s newly revamped and consolidated interface.

Loading...

Sushi Introduces Miso Token Launchpad

The Sushi community voted and the protocol listened and is now introducing a token launchpad. The launchpad, called MISO, which stands for “Minimal Initial SushiSwap Offering,” is the latest product to arise from the community governance protocol that was built around the Ethereum-based decentralized exchange SushiSwap. It will be launched on May 20. The project…

Loading...

"It's Not About Fighting for People Already in DeFi, But About Bringing More People In:" SushiSwap's 0xMaki

In this week's episode we interview 0xMaki, an anonymous DeFi developer contributing to SushiSwap and Yearn Finance protocols. We talk about growing Sushi beyond its drama-filled beginnings as a fork of Uniswap, into a DEX that can hold its own as the second-most active trading platform in Ethereum DeFi. He goes into the main pieces…

Loading...

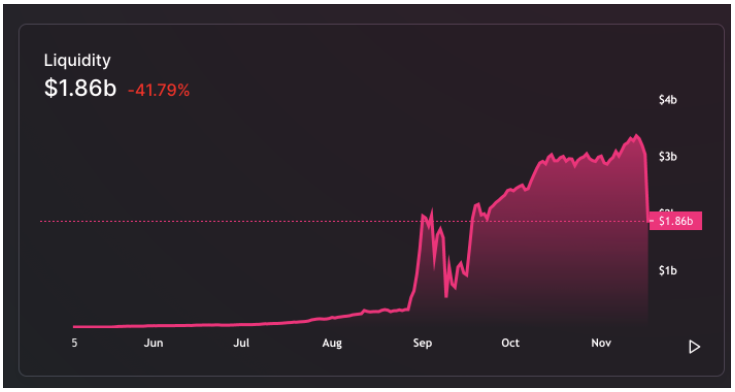

Uniswap Liquidity Plunges After UNI Rewards End

Uniswap’s total liquidity has almost halved after the decentralized exchange ended its token rewards program on Monday afternoon. Down to $1.8B from a peak of $3.3B just 24 hours earlier, the drop in liquidity goes to show how powerful UNI rewards were for attracting capital, good for the #1 spot on DeFi Pulse’s TVL leaderboard…

Loading...

DeFi Forks Are Moving Beyond Copy and Paste

In the last month, almost every major DeFi project has been forked. Some of the forks have even been forked themselves. But do these near-copies of projects actually add any value? Or are they simply opportunistic money-grabs? Like many things in life, the truth isn’t always clear-cut. Each fork, from SushiSwap, to Swerve, to Cream,…