Bancor - Recent articles

Loading...

Bancor TVL Drops 30% After Suspending Protection from Impermanent Loss

Users seem to have pulled assets out of Bancor since it suspended impermanent loss protection a month ago.

Loading...

Bancor Suspends Impermanent Loss Protection in ‘Hostile Market’

One of the First DeFi Platforms Takes Fire from DeFi Community

Loading...

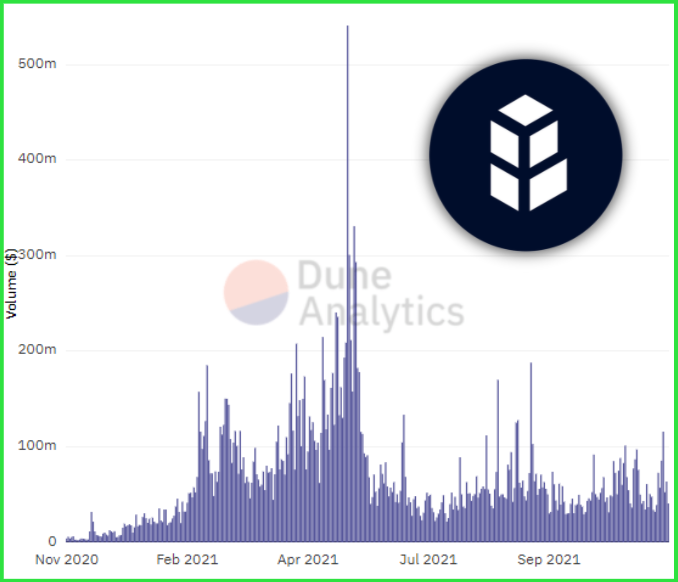

Bancor Launches V3 AMM In Bid to Regain Dominance

Bancor V3 will cut gas costs for traders in half and offer instant IL protection.

Loading...

Say ADIOS to Impermanent Loss with Bancor V2

Contrary to other AMM protocols, Bancor uses its protocol token, BNT, as the counterpart asset in every pool. Using an elastic BNT supply, the v2.1 protocol co-invests in pools alongside LPs to support single-sided AMM exposure and to cover the cost of impermanent loss with swap fees earned from its co-investments.

Loading...

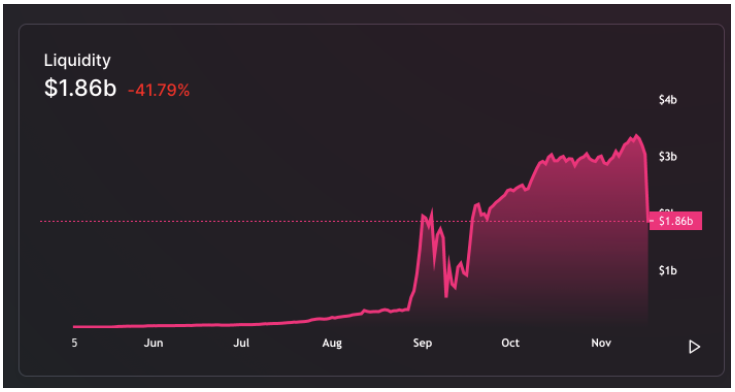

Uniswap Liquidity Plunges After UNI Rewards End

Uniswap’s total liquidity has almost halved after the decentralized exchange ended its token rewards program on Monday afternoon. Down to $1.8B from a peak of $3.3B just 24 hours earlier, the drop in liquidity goes to show how powerful UNI rewards were for attracting capital, good for the #1 spot on DeFi Pulse’s TVL leaderboard…

Loading...

Bancor Aims to Eliminate Impermanent Loss With Upgrade

Bancor has unveiled the next step in their new AMM design. The 2.1 release introduces an elastic BNT supply, used to cover impermanent loss for LPs through a mechanism called Liquidity Protection. The update builds on the ability to add single-sided liquidity, or using one token to pool liquidity instead of two like Uniswap. LPs…