Alchemix - Recent articles

Loading...

DeFi Lender Alchemix Says Vyper Hacker Returned Stolen Crypto

Affected protocols had offered a bounty if the attacker returned the funds.

Loading...

Over $70M Stolen From Multiple DeFi Protocols Due To Vyper Code Bug

Hacker Used Re-entrancy Attacks To Drain Assets From Curve Pools

Loading...

Scoopy Trooples of Alchemix: "Liquidity Mining is Like a Drug; You Have to Wean Yourself Off Over Time"

In this week’s episode I speak with Scoopy Trooples, co-founder of Alchemix, a protocol that offers self-paying loans without the risk of liquidations. Think about that; here’s a DeFi application that promises to automatically pay users’ collateralized loans, and on top of that, guarantee they won’t be liquidated. Scoopy explains how something like that can work and…

Loading...

Defiant Degens: How to Farm Up to 30% APR with alETH by Alchemix

This is a weekly tutorial on the most compelling opportunities in yield farming, written by our friend DeFi Dad, an advisor to The Defiant. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs. Before reading this tutorial, a bug was discovered two weeks ago in the…

Loading...

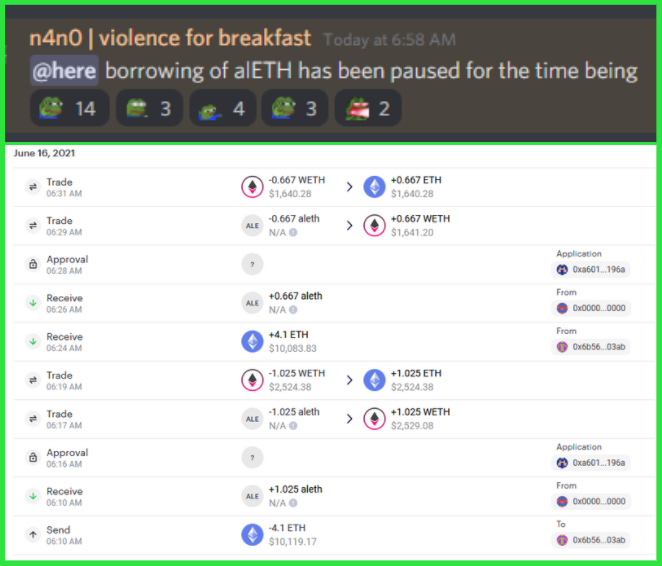

Alchemix Asks Users to Return Funds After alETH Bug

It isn’t often that a market player appeals to the morality of its customers to correct a mistake. But that’s what’s unfolding this week as Alchemix Finance made traders an offer to iron out the alETH debacle that unfolded on June 16. Alchemix Finance recently launched alETH, a synthetic yield derivative that lets DeFi users…

Loading...

Curve Drama Intensifies as New Proposals Target alUSD and Saddle Finance

In the wake of Alchemix’s troubled alETH release, Curve Finance has produced two governance proposals targeting tangential products of the automated loan repayment protocol. There’s also been a flurry of chatter about possible legal action as the dustup accelerates. The first target — Curve’s own alUSD pool. Charlie Watkins, project lead at Curve, proposed removing…

Loading...

Bug in Alchemix’s New ETH Vault Has Left a $6.4M Shortfall

A bug was discovered in the Alchemix Finance alETH contract on Wednesday morning, leaving the project undercollateralized by 2,688 ETH, or roughly $6.4M, as users were able to withdraw these funds without repaying their loans first. Alchemix Finance recently launched alETH, a synthetic yield derivative that lets DeFi users borrow 1 alETH for every 4…

Loading...

Alchemix Allows Users to Stay Long ETH With Auto-Loan Repayment

Last weekend, Alchemix, which offers automatic repaying loans, shipped a vault that accepts ETH. Alchemix users will now be able to borrow alETH, Alchemix’s token that’s soft-pegged to ETH, using ETH as collateral. The collateralization ratio: 400%. The launch came with a debt cap of 2,000 alETH and it was reached within a day of launch,…

Loading...

Magic Money: The Mystical World of Anchor, Alchemix, and Gyroscope

In last week’s episode we ventured into the dark forest where nothing at all was what it seemed and unimaginable horrors lurked round every corner. Well this week we’re labouring the fantasy metaphor yet further with a languid lunge through illusion magic and scarcely credible financial finagling in what critics are already calling the David…