Staked ETH Withdrawals To Activate On April 12

Ether Rallies 5%

By: Samuel Haig • Loading...

DeFi

Ethereum’s long-awaited Shanghai and Capella (Shapella) upgrades will be deployed on mainnet on April 12, allowing ETH stakers to withdraw their coins for the first time.

Shapella’s scheduling drove a spike in the price of Ether, with the second-largest digital asset rallying 5% on the news, according to The Defiant Terminal.

Ethereum node operators must ensure that their client software is up-to-date prior to the upgrade’s deployment. Stakers and node operators that do not update in time will experience their client syncing to the old version of the blockchain, meaning they cannot operate or transact on the post-Shapella network until upgrading.

Ethereum users and ETH holders do not need to make any changes to accommodate the update, which includes five Ethereum Improvement Proposals necessary to enable withdrawals.

Proof of Stake

Ethereum transitioned to Proof of Stake consensus with the activation of the Merge last September. The Merge unified Ethereum’s Proof of Stake Beacon Chain with its mainnet execution layer, eliminating energy-intensive Proof of Work miners from the network.

However, ETH stakers have been unable to withdraw their coins until now, despite staking launching alongside the Beacon Chain in December 2020. Many in the Ethereum community expected withdrawals to activate last year.

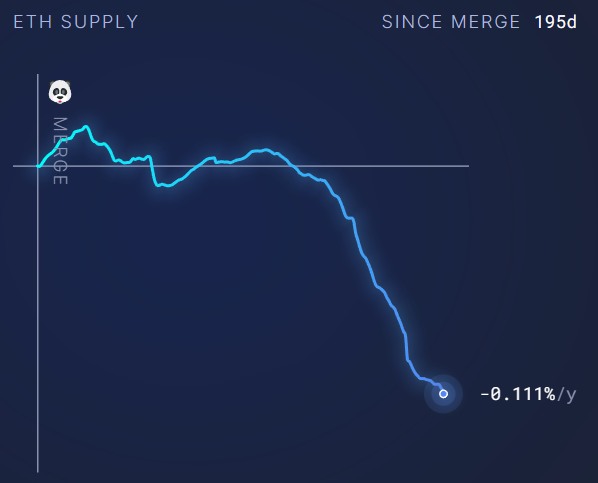

The Merge reduced Ethereum’s energy consumption by more than 99.9% and dropped new ETH emissions by around 90%. Coupled with the fee-burning mechanism introduced with the EIP-1559 upgrade in August 2021, Ethereum is currently deflationary, meaning the network is destroying ETH faster than new supply is created as staking rewards.

Ether supply since the Merge. Source: ultrasound.money

Ethereum’s supply is down by 70,835 ETH ($128.5M) since the Merge, according to Ultrasound Money.

Shapella Upgrade

Shanghai and Capella will upgrade Ethereum’s execution and consensus layers, respectively.

Shapella has already undergone rigorous scrutiny on Ethereum’s testnets. The code passed its final dress rehearsal on the Goerli network on March 14, following successful deployments on Sepolia on Feb. 28 and Zhejiang on Feb. 8.

Goerli’s activation experienced delays due to many testnet validators updating their client software late. However, Tim Beiko of the Ethereum Foundation attributed the delay to the lack of incentives for testnet validators to ensure timely upgrades. Beiko predicts validators will update their software in time for Shapella’s mainnet deployment.

The Ethereum Foundation has also doubled the value of the bug bounties it is offering to coders that identify any vulnerabilities with the Shapella code until April 5. Bounties of up to $500,000 are available to security sleuths depending on the severity of code bugs identified.

Roughly 15.5% of Ethereum’s supply, worth roughly $34B, is currently staked.

Liquid Staking

The Shapella upgrades are tipped to increase staking participation on the network by removing the barrier to exiting staked positions.

However, Shapella also opens the floodgates to users withdrawing ETH from the Beacon Chain, igniting concerns that early stakers may race to unstake and offload their coins. The Ethereum Foundation is implementing measures to prevent a flood of ETH from getting dumped on the open market.

Roughly 2,200 staked Ether withdrawals will process each day, restricting withdrawals to around 0.4% of the staked ETH capitalization.

“We anticipate that demand for unstaking will be high soon after the upgrade, and it may take the protocol weeks to months [to] process unstaking requests,” tweeted Coinbase.

Analysts tip that Shapella boon to liquid staking token (LST) providers as arbitrageurs step in to take advantage of the spread between LSTs and Ethereum. LSTs are yield-bearing tokens representing staked Ether positions, allowing users to remain liquid and utilize the value represented by their staked ETH in DeFi protocols.

LSTs already represent 44% of Ethereum’s staked capitalization, followed by individual whales with 39%, and centralized exchanges with 14.5%, according to Dune Analytics.

Lido, the top LST provider, is currently the largest Ethereum staker, commanding a market share of 31%. Kraken, a centralized exchange, ranks second with around 7% of the staked ETH.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.