Solend Struggles to Liquidate Souring Loan as On-Chain Liquidity ‘Evaporates’

SOL Has Crashed 55% In Rough Week for Crypto

By: Aleksandar Gilbert • Loading...

DeFi

The apparent collapse of crypto exchange FTX is wreaking havoc on the Solana ecosystem, with another centralized exchange reportedly halting stablecoin deposits to and from Solana and the blockchain’s largest protocol hanging on by its fingernails on Tuesday.

Lending platform Solend is struggling to liquidate a large account that went underwater as Solana’s native SOL token tanked early Tuesday. Trading at $38 as recently as Saturday, SOL was changing hands under $15 on Tuesday afternoon.

In screenshots of an email shared widely on social media, the Crypto.com exchange told users it has halted deposits and withdrawals of the USDC and USDT dollar-pegged stablecoins to Solana. Crypto.com did not immediately respond to a request for comment.

Liquidity Crunch

Solend initially blamed the failure to liquidate on network congestion. As the day went on, however, a member of the core team addressing user questions on Discord said the issue was a lack of on-chain SOL liquidity – something the protocol has tried to address by raising the interest rate on SOL to more than 2,500% in a bid to attract deposits and encourage borrowers to repay their loans.

That interest rate is the “only thing keeping the protocol alive [right now],” Soju, the protocol’s pseudonymous head of business development, wrote in Discord.

Early on Tuesday morning, an unidentified whale on Solend who had borrowed $44M USDC against $51M in SOL began to be slowly liquidated. As of 3 p.m. New York time, the whale owes $27M USDC against about $20M SOL.

‘Pray For Us All’

“It’s looking very bad now btw,” Soju wrote in the Solend Discord. “Pray for us all.”

On-chain SOL liquidity has “evaporated” as the price of SOL has plummeted 43% in the past 48 hours. According to Soju, this is because most SOL has been staked via Marinade or Lido and users looking to swap those derivative tokens back for SOL are facing high slippage and technical glitches. Soju did not immediately respond to a message seeking comment.

A community moderator in the Solend Discord said Solend was able to create a Binance account and process SOL liquidations there, where there is deeper SOL liquidity than on Solana itself.

More than $800M worth of SOL is due to be unstaked early Wednesday as stakers rush to exit their positions, according to solanacompass.com. The flood of SOL is expected to provide much-needed liquidity. But, with Solana’s market cap dropping below $5B on Tuesday, there are also fears that a fire sale would decimate SOL’s remaining value.

SOL In Freefall

SOL began its freefall shortly after Binance CEO Changpeng Zhao (CZ) announced that the world’s largest crypto exchange would sell $500M in FTT, a token issued by competitor FTX, due to recent “revelations.” A report published by Coindesk several days earlier suggested that an FTX sister company, crypto hedge fund Alameda Research, had much of its balance sheet denominated in FTT that it could not sell without also destroying the token’s value.

FTT holders began selling the token en masse, afraid its price would crater due to the Binance sale, triggering the very freefall they had feared. SOL began falling shortly thereafter, with on-chain observers speculating FTX and Alameda were selling their reserves of SOL in order to raise money with which they could prop up FTT.

Alameda held roughly $1.15B in SOL as of June 30, according to the CoinDesk report. That represented 10% of Solana’s market capitalization at the time.

Solana Supporters Buck Up Network As FTX Contagion Takes Toll

Alameda and FTX Have Extensive Links with Layer 1 Blockchain Network

Alameda has also invested in seven Solana-based projects, according to data from DeFi Llama. This makes Solana the most favored chain at Alameda; Ethereum is second, with four investments.

TVL Plummets

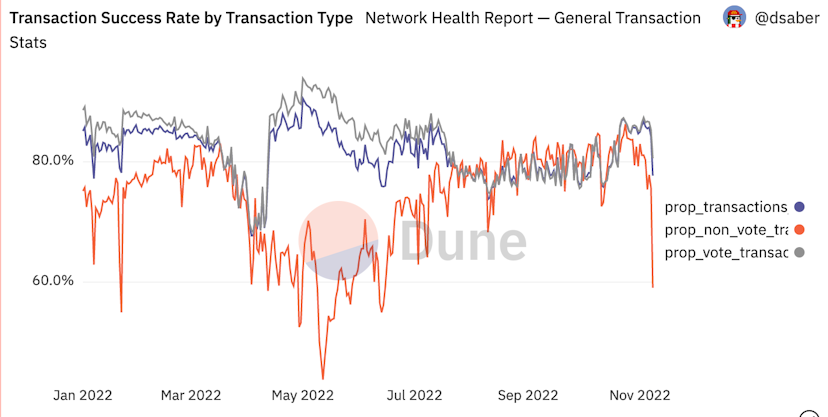

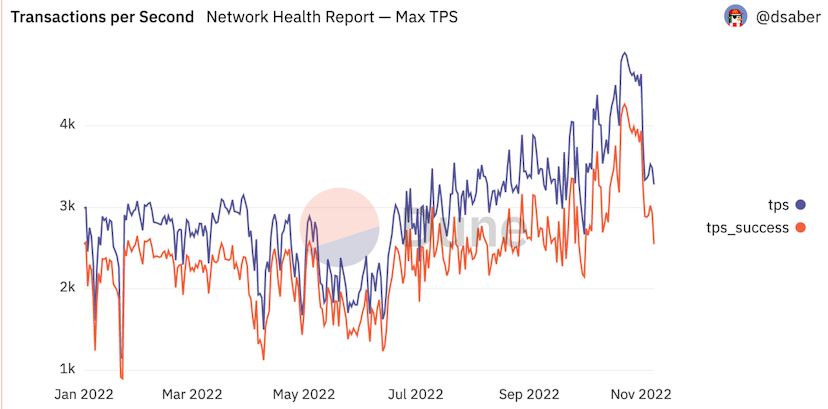

Solana has lost almost half of its total value locked (TVL) in the past seven days, according to Defi Llama, and transactions per second and transaction success rates have plummeted, according to a Dune Analytics dashboard created by the Solana Foundation’s data chief.

Solana Transaction Success Rate

“Tons of compute-intensive txs failing (not network’s fault, but things like liquidations), and blocks just slightly long,” Solana Foundation communications chief Austin Federa tweeted. “All that building being put to the test.”

Solana Transactions Per Second

Solana co-founder Raj Gokal struck a defiant tone on social media Tuesday morning.

“This crucible moment for [the] Solana ecosystem is as difficult as the last one,” Gokal tweeted. “The difference is, there are 10x more of us to band together this time.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.