SBF Replies to 'Constructive Feedback' on His Regulatory Proposals

FTX Honcho Roiled DeFi With Proposed 'Industry Norms'

By: Samuel Haig • Loading...

CeFi

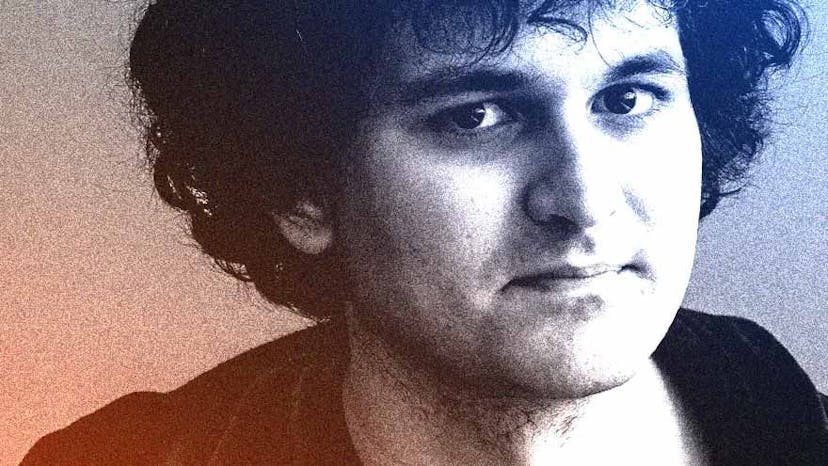

Sam Bankman-Fried, the CEO of centralized exchange FTX and founder of trading firm Alameda Research, is trying to regain favor in the DeFi community after coming under fire for his opinions on regulation last week.

“Whelp, that was an interesting few days,” Bankman-Fried tweeted after receiving sustained backlash. “Huge thanks to everyone who provided constructive feedback.”

On Oct. 19, Bankman-Fried published a document laying out principles he believes should drive digital asset policy in the U.S.

Oversight

Critics took exemption with Bankman-Fried’s prescriptions for regulating DeFi, which call for U.S. persons hosting front-end interfaces for popular DeFi protocols to observe know-your-customer obligations.

“If you host a website aimed at facilitating and encouraging U.S. retail to connect to and trade on a DEX, this may end up falling under something like a broker-dealer/FCM/etc,” Bankman-Fried said. He added that entities marketing DeFi products to U.S. retail investors should also be subject to regulatory oversight.

“Figuring out how and where DeFi and things tangentially related to DeFi do and don’t fit into regulatory contexts is a hard problem, and one on which there is not yet firmly settled thought,“ Bankman-Fried wrote.

Despite Bankman-Fried revising his policy handbook, many critics of the billionaire are unconvinced by his regulatory stance.

“Even the revised version still reads at how can there be a moat that lets centralized entities control at least part of the flow into DeFi, so they can profit from it,” tweeted Adam Cochran of Synthetix and Yearn Finance.

Prominent figures in the crypto community also speculated that Bankman-Fried may be supporting the Digital Commodities Consumer Protection Act of 2022, a bill known as the DCCPA.

Detractors argued that the DCCPA’s language could threaten the decentralization of the DeFi industry by requiring that decentralized exchanges “provide a centralized market for executing transactions.”

Running Afoul of Regulations

Language contained in the draft bill also suggests that liquidity providers could be treated as “digital commodity dealers” and subjected to regulatory oversight.

On Oct. 23, Bankman-Fried said his policy recommendations were concerned with how centralized platforms like FTX can interface with DeFi contracts without running afoul of regulations.

“The core goal of the bill is to regulate *centralized* crypto venues,” he argued in an Oct. 23 tweet. “The main *DeFi* touchpoint is: *how can a regulated centralized entity interface with DeFi?*”

EU Report on Crypto Regulations Draws Praise From Crypto Attorneys

Measured Approach Stands In Contrast To U.S. Stance

Bankman-Fried said centralized platforms may face reporting requirements when offering access to DeFi protocols, suggesting that “customer suitability tests” may prevent inexperienced users from accessing products with high risk profiles.

He also stressed that developers and validators should not be bridled by regulation. “You don’t need a financial license to upload code to the blockchain… smart contracts should remain permissionless and free,” he wrote. “Similarly, validators have a core duty to correctly validate blocks-not to judge or police them. Validators should remain permissionless and free.”

Blacklisted Smart Contracts

However, Bankman-Fried did not directly address the concerns surrounding his suggestion that U.S. persons operating front-end interfaces for DeFi protocols should face regulatory oversight.

The controversy comes as the crypto and DeFi communities are on high alert regarding potential regulatory risks.

In August, the U.S. Treasury Department took the unprecedented action of adding smart contracts associated with the crypto mixing service, Tornado Cash, to its list of Specially Designated Nationals.

The move sanctioned Tornado Cash, making it illegal for U.S. persons to interact with the blacklisted smart contracts.

The Tornado Cash sanctions sent shockwaves through the web3 space. Many front-end interfaces for popular DeFi protocols such as Uniswap and Aave blacklisted the sanctioned addresses. Other teams feared their contracts could be the next to face sanctions should nefarious actors choose to interact with their immutable code.

Earlier this month, Coin Center, a non-profit web3 advocacy organization, filed a lawsuit challenging the Treasury Department’s authority in sanctioning Tornado Cash’s contracts.

Exemptions

The Biden administration also signed the controversial Infrastructure Bill into law last November. The bill requires that crypto brokers report digital asset transactions of more than $10,000 to the Internal Revenue Service.

However, no exemptions were made for network validators or software developers, suggesting that devs or stakers could be held accountable for failing to report when five-figure transactions are executed using open-source code they wrote or a blockchain that they validate.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.