Red Flag Alert: A Framework for Vetting Crypto Projects Part III

Hey there! ? Welcome to the final part of the series. Give yourself a pat if you’ve made it so far! In this three-part series, we have provide a framework to help identify red flags in crypto projects. Part I analyzed tokenomics, Part II analyzes team, social media and backers and Part III will analyze…

By: Eugenio Croitoru • Loading...

Research & Opinion

Hey there! ? Welcome to the final part of the series. Give yourself a pat if you’ve made it so far! In this three-part series, we have provide a framework to help identify red flags in crypto projects. Part I analyzed tokenomics, Part II analyzes team, social media and backers and Part III will analyze mental models to follow.

We’re at the final article of this series where we’ll be mental models to help you navigate this space better and common effects/patterns that you’ll observe in the crypto space. This is not an exhaustive list by any means. So without further ado, let’s get to it!

- First Principles Thinking

Obviously, many of you might’ve heard of this one before, but there are hardly any other mental models which will help you get to the root of the problem quicker. Most of this has to do with taking the time to learn the basics of any concept that you start to learn. A solid foundation that allows you to deconstruct any complex problem into simpler subparts and build your understanding from the ground up.

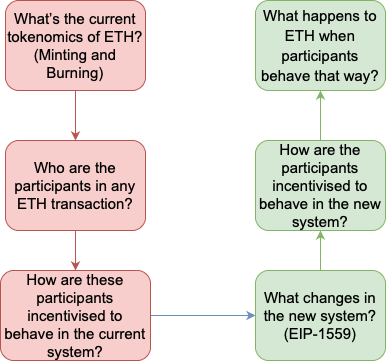

This is essential in the space of crypto where people mostly rely on shoddy reasoning and analogies, just by thinking through things using first principles will put you in the top 10%. This sounds great but how do I do it? Let’s pick an example and a recent trend that everyone’s talking about is Ethereum’s bull case and how its price will go up come EIP-1559. But why will it go down once EIP-1559 comes?

The way you want to work through this is:

So this is like first working from top level to the base level assumption and then working your way up from there. If you start to think of problems in this way then you should be able to reverse engineer and comprehend a lot of things that seem completely random right now.

- Feedback Loops

Feedback loops are an incredibly useful and complex concept widely used in systems thinking but it’s useful to understand the basics and apply them to cryptocurrencies. The types of feedback loops that we’ll be focusing on are of two types: Reinforcing Loops and Balancing Loops.

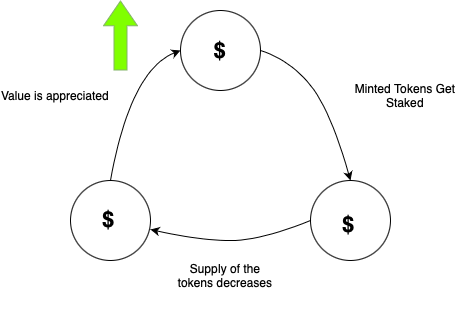

Reinforcing loops are of two types, positive and negative. As the name suggests, positive feedback loops positively compound the value of an asset and negative will do the opposite. I briefly talked about it in the “Usage of tokens in the ecosystem” part of the first article. A simple example of this would be staking tokens and why that increases the price of tokens. When tokens are staked and taken out of supply, it creates an ideal context for increasing the price of tokens. As the supply of the token decreases, but the demand remains the same, the price of the tokens goes up.

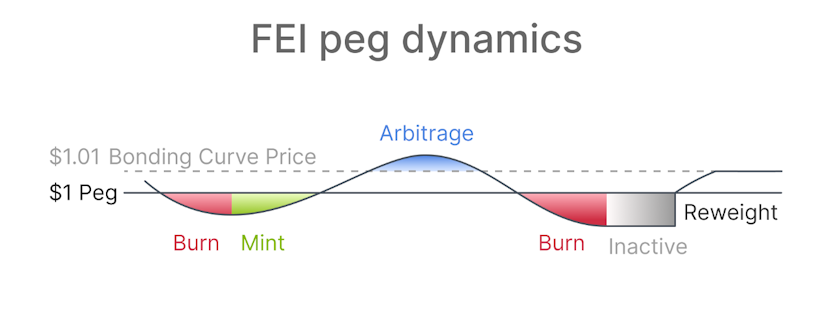

Balancing loops, as the name suggests are loops that bring the system back in balance. The best example of this would be a thermostat installed in a house, it tries to keep the temperature constant and ideally, doesn’t deviate too much in either direction.

Source: Fei Protocol Medium

Sound familiar? Yup, this is exactly the idea that dollar-pegged stablecoins try to achieve. So the next time you find yourself confused by the tokenomics, try to think about it using feedback loops and things will become much easier.

- Information Totem Pole

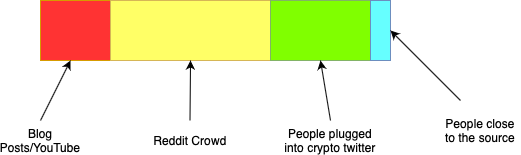

Now, this is something that I understood intuitively for some time but I used to think of it as informational asymmetry. I was recently listening to the Big Brain Crypto Club episode from the UpOnly podcast and Light was also describing the same concept, calling it the information totem pole. That sounds cooler so let’s stick with that for now.

The basic idea behind this is that you need to figure out how quickly you get the news after something occurs. This is a very important thing to understand. Say you saw your favourite influencer talking about a coin getting major adoption, then you have to think about how many people already know about it before you do and has it already been priced in?

The diagram is just for representation and doesn’t necessarily represent the reality of the situation. Of course, this becomes less important if you plan to keep your tokens for a long time, but it’s important if you’re a short term trader trying to take advantage of the volatility in the market.

But sir, how do I get into the blue zone? Honestly, I have no idea. But I have gotten into some trades before the news propagates and I find that Twitter lists like this one are great because they’re ordered chronologically and not algorithmically. But if you’re really interested in trading, then you probably want to build a bot that analyses the trends and sentiments on Twitter. That’s outside the scope of this blog post.

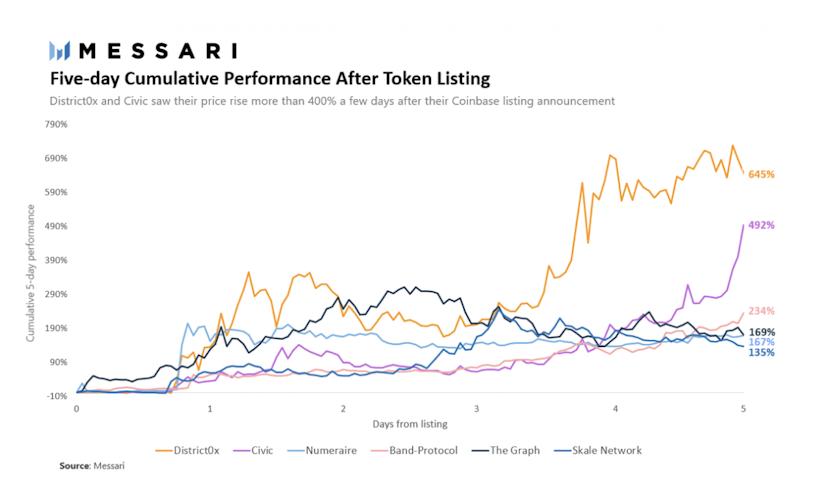

- Coinbase Effect

Every once in a while, you’ll see a token getting absolutely sent! There might be plenty of reasons this might be happening, but few reasons produce a pump bigger than a big exchange listing. This is a well-known effect known as the Coinbase effect.

(Source: Messari)

This, however, is not just restricted to Coinbase. A listing in a major exchange like Binance or FTX might also produce a major increase in price. A reason as to why this happening could be the disparity of volume on the trading between CEX and DEX exchanges. Hopefully, this might start to change with the advent of decentralised exchanges like hashflow which offer many advantages over AMM’s. You can read more about hashflow here.

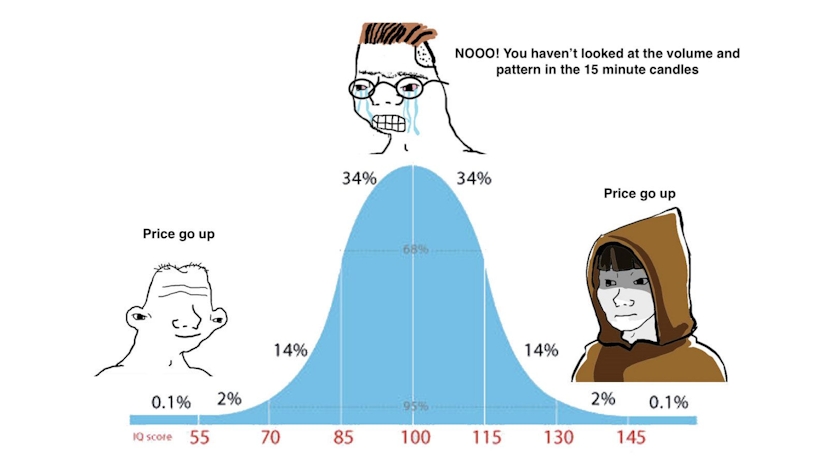

- The Crypto IQ Bell Curve

This is somewhat of a long-running joke in the crypto community that the smarter you try to be and use complicated logic, the more you get lapped by people who’re absolute noobs. There’ll be plenty of times in your journey that your friend who saw someone shilling a shit coin on TikTok and went all in, making an absolute killing.

This will make you question why you’ve been putting in the hours, not watching Netflix and listening to podcasts, reading whitepapers, trying to understand more every day. All I can say is keep going, and it’s a long journey. Ultimately, the time you took to understand things at a more fundamental level will pay dividends and you won’t have to depend on luck that way you’re definitely gonna make it ?

The space of mental models and exhibited behaviours is immense, there’s a lot more that I wanted to cover like Unit Bias, Network Effect, Hype Cycle, Critical Mass, Opportunity Costs, Second Order Thinking etc. but maybe in some other time.

I hope y’all enjoyed this series of articles and got something out of it. Be sure to follow me on twitter to learn more about crypto.

Until next time ?

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.