CAKE Plummets On Syrup Pool Unlocks

Another 190M Tokens Remain To Be Released

By: Owen Fernau • Loading...

DeFi

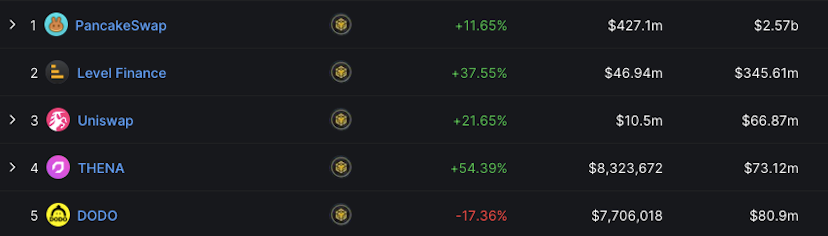

The governance token of PancakeSwap, DeFi’s second-largest exchange with $2.6B in trading volume over the past week, has taken a beating this week after a large number of tokens entered circulation.

CAKE is down over 24% in the past seven days. That makes it the worst performer among the top hundred digital assets.

0xGeeGee, a crypto trader, told The Defiant that CAKE dropped this week after a large number of tokens were unlocked from a mechanism called Syrup Pool this week. Syrup Pools allow users to lock tokens for up to one year in order to earn CAKE rewards. The longer a user locks, the higher the rewards.

The trader said that roughly 6M CAKE tokens were unlocked this week, representing only 0.08% of the token’s capped 750M supply. 0xGeeGee added that there is an additional 190M CAKE, or another 25.3% of the supply, locked in the Syrup Pool, with additional unlocks expected in the coming weeks.

The PancakeSwap team and the BNB Chain ecosystem at large are trying to figure out how to offset the selling pressure that comes with the increased supply.

Tokenomics Overhaul

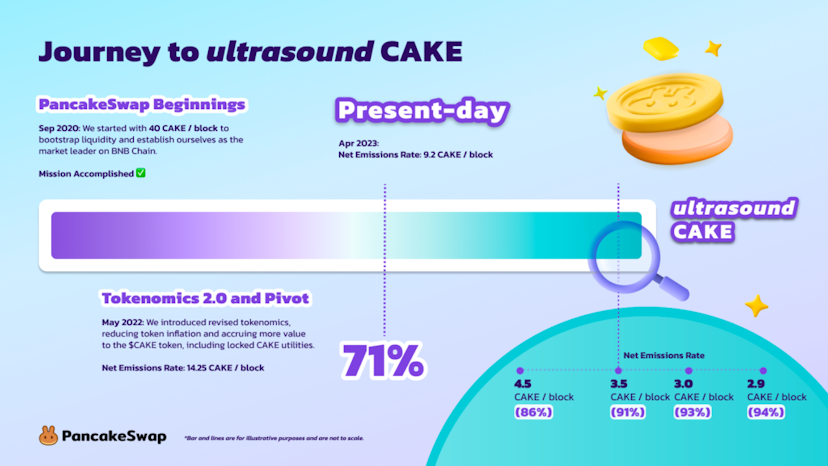

To that end, multiple proposals to tweak CAKE’s tokenomics to become more sustainable went live in the past week.

Proposed CAKE Overhaul

PancakeSwap is unique in that it’s arguably the most successful DeFi protocol which didn’t originally launch on the Ethereum blockchain. At $2.2B, the decentralized exchange has the most total value locked of any project in that category.

This makes the efforts to make CAKE’s tokenomics particularly noteworthy — few projects besides those originating on Ethereum have established themselves as leaders in DeFi. With the revisions to its tokenomics, PancakeSwap could be the first major player to do so.

Beyond the debate swirling around CAKE’s tokenomics, it’s been a time of change for the protocol — it deployed its third iteration earlier this month. PancakeSwap also moved onto Aptos and Ethereum this year, breaking the protocol’s exclusive association with Binance Chain.

Those developments, as well as the impending unlocks, provide the backdrop for efforts by the project’s community to bolster CAKE’s value. A vote to cut down CAKE emissions to the syrup pool was narrowly shot down last Friday.

The project’s team has since held an AMA addressing CAKE’s tokenomics, and posted a recap of the event. On the same day, another proposal to modify CAKE emissions went live. This one is on track to pass, with 67% of voters agreeing to reduce CAKE emissions for the Syrup Pool from 6.65 CAKE to 3 CAKE per block.

Were the vote to pass, rewards would be reduced monthly by 0.5 CAKE per block over five months. After month six, a reduction of 3.8 CAKE per block would happen, with emissions finally settling at 0.35 CAKE per block.

CAKE’s tokenonomics already include burning mechanisms which permanently reduce the supply of the asset. Actions which burn CAKE include fees taken on all trades which use PancakeSwap V2.

The PankcakeSwap team thinks that despite the week’s selloff, the new tokenomics would make the project more robust. “We believe this transition will make our protocol more sustainable in the long term and attract more users to the PancakeSwap ecosystem,” the protocol’s pseudonymous leader, known as Head Chef Mochi, told The Defiant in an email.

Chef Mochi also said that the big-picture strategy for PancakeSwap was to become an “all-in-one” DeFi protocol. To that end, the project is pursuing verticals beyond vanilla trading by offering perpetual futures trading, NFT trading, and a lottery component.

The head chef indicated a willingness to continue to expand to other chains, while also emphasizing that they would continue to work with Binance moving forward.

Just as PancakeSwap looks to make its tokenomics more sustainable and expands to other chains, competitors are encroaching on the decentralized exchange’s native land, the BNB Chain.

Competitive Market

Uniswap, the only decentralized exchange with more volume than PancakeSwap, deployed on BNB Chain in March based on a governance process started in January. PancakeSwap still dominates its home turf, processing over 200 times more volume than Uniswap in the past week.

Top BNB Chain DEXs

There are other projects gunning for market share on BNB Chain as well. Volume for Levels, a decentralized exchange for perpetual swaps, has jumped 37.6% this week, good for second among all exchanges on the blockchain.

And Thena, another decentralized exchange, has seen a 54.4% rise in volume this week, placing it fourth on BNB.

CAKE is trading at $2.64 at the time of writing. 0xGeeGee, for one, isn’t looking to buy today’s dip. “My journey this cycle started with CAKE at $0.50,” they said. “If it ever returns there, I guess I’ll buy, at least for the nostalgic value.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.