MakerDAO Passes Emergency Measures To Reduce USDC Exposure

The proposal increases support for Paxos' stablecoin.

By: Samuel Haig • Loading...

DeFi

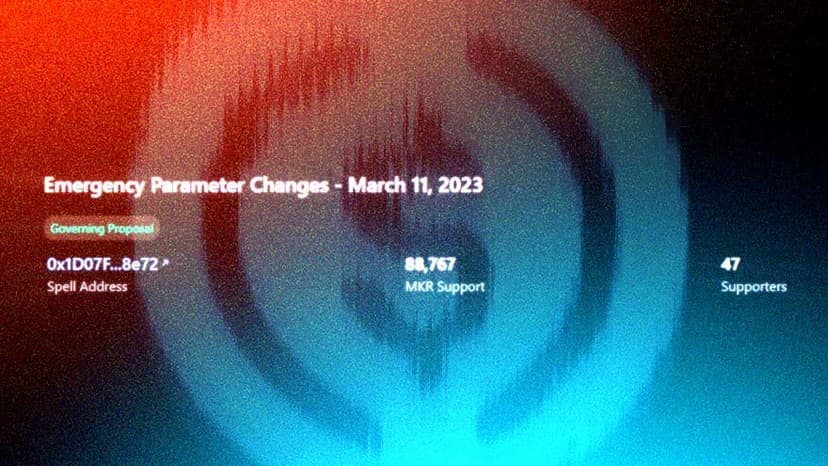

MakerDAO, the issuer of the DAI stablecoin, will execute emergency governance measures to reduce the protocol’s exposure to USDC on Tuesday after bank failures over the past week highlighted the risk of centralized stablecoins.

MakerDAO will implement a “circuit breaker” feature allowing the protocol to slash the debt ceiling to 0 in the future. The governance proposal behind the changes was published and passed on Saturday after USDC suffered a violent depeg.

“The proposed changes are intended to limit Maker’s exposure to potentially impaired stablecoins and other risky collaterals,” the proposal said.

Centralized Risk

The move highlights the risk of backing stablecoins with assets that need to be custodied in banks. In this case, USDC slipped below its peg over the weekend after its issuer, Circle, said it held about 8% of assets backing it in Silicon Valley Bank, which failed on Friday. USDC, in turn, makes up 40% of DAI’s collateral.

Maker reduced the debt ceiling for four Uniswap vaults supporting USDC to 0 as “these collaterals are exposed to potential USDC tail risk,” the proposal said. The move would effectively reduce the amount of USDC used to collateralize DAI.

Expanding Paxos Support

While it slashed USDC exposure, the protocol expanded support for Paxos’ USDP stablecoin, increasing the debt ceiling for its USDP vault to 1B from 450M, and reducing fees for USDP to DAI swaps to 0% from 0.2%.

The proposal argued that Paxos has stronger reserves compared to other centralized stablecoins, consisting of US treasury bills, reverse repurchase agreements collateralized by US treasury bonds and insured bank deposits, with a relatively small portion of uninsured bank deposits.

Reducing GUSD Exposure

The opposite is true for Geimini’s stablecoin, GUSD, according to the proposal, which argued Gemini has “large uninsured bank deposit exposure which potentially could be associated with at risk institutions.” To limit potential losses, Maker is reducing the daily mint limit for GUSD to 10M Dai from 50M DAI.

The proposal also aimed to limit the potential for DAI to trade above its peg by reducing the daily mint limit for the stablecoin to 250M from 950M, and by increasing fees for swapping USDC to 1% from 0%, to make it more expensive for investors to offload their USDC for DAI.

Finally, the proposal also argued for temporarily pulling all funds from Aave and Compound to reduce overall risk.

[ CORRECTED ON 3/15 @ 9:20PM EST to add that MakerDAO will implement a circuit breaker feature to allow USDC debt ceiling to be slashed to 0 in the future. ]

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.