A Radical Proposal to Revive MakerDAO Roils Community

MakerDAO's surplus fund is dwindling and members are worried.

By: Samuel Haig • Loading...

DeFi

MakerDAO, the trailblazing DeFi lending and savings project, has reached a crossroads.

Its token, MKR, is languishing. Rivals are challenging its position as the go-to decentralized stablecoin provider. And more worrisome, its dwindling surplus fund is raising fears that the platform might suffer heavy liquidations in a long bear market.

But help is on the way, maybe.

Aggressive Growth Strategy

On March 17, Hexonaut, a protocol engineer at MakerDAO, joined forces with colleagues and submitted a new governance proposal called “Aggressive Growth Strategy.” It’s urging Maker’s membership to consider a bevy of radical moves to rejuvenate the popular DeFi project, including tapping real world assets to shore up its surplus fund. The authors estimate that move will generate an additional $20M to $40M in annual revenues.

It’s striking to see that MakerDAO, a five-year-old OG in the DeFi movement, is considering cozying up to TradFi to stabilize its financial bedrock. The project remains a steadfast and sizable force in decentralzied finance, with a market cap of $1.8B and total value locked of $16B, according to DeFiLlama. But Hexonaut and the engineer’s fellow authors say the problem has become acute.

Proposal Aims to Shake up MakerDAO’s Tokenomics and Light a Fire Under MKR

Proposal Aims to Shake up MakerDAO's Tokenomics and Light a Fire Under MKR

A new proposal takes aim at the disparity between MKR and DAI.

“Inevitably we will need to rely on Real World Assets or other complex and more innovative use cases to scale to the next order of magnitude and beyond,” they write in the proposal. “The system surplus is currently at $65M which is peanuts compared to the total DAI supply of $9.7B It adds that Maker ranks below the riskiest institutions in the legacy finance sector. “We want to be better than traditional lending institutions.

That’s not the only change they propose. MakerDAO should also raise funds from the public for a rainy day insurance fund, and it could also issue tokenized equity in the project to venture capitalists.

As you’d expect, the MakerDAO community’s response to the proposal was emotional and intense. Some commenters weren’t sold on the idea of using real world assets (RWAs). Prominent DeFi developer Foobar described the proposed integrations with RWAs as “a terrible idea.”

Risk Factors

“Complexity is a bug, not a feature. DAI needs to stand on its own, without real-world risk factors being introduced for no reason,” he continued. “You like RWA, fine. Go build a RWA protocol. But don’t vampire attack Maker under moral guises.”

“Purplehat” of Artblocks asserted that adding assets other than Ethereum to collateralize DAI introduces “unnecessary systemic risk.” He said that “everything else should have been bundled into a separate asset.”

“Wandering Doge” warned that real world assets “can be frozen immediately by government and confiscated forever.”

Much of the feedback focused on the proposal’s capital-raising elements. On the governance forum, “Calchulus” suggested that a raise be restricted to individuals who have previously held and used the DAI stablecoin.

“I think a very important step should be that the treasury raise should be specifically conducted in DAI, and somehow have a cap relative to in the past holding DAI,” they said. “Why let any funds invest in MKR if they don’t actively utilize DAI?”

“Luca_pro” argued in favor of debt over equity issuance. They asserted that debt is “cheaper and less dilutive than equity/token financing.” They also emphasized that debt issuance can be easily adjusted according to market needs, unlike equity financing.

“Psychonaut” suggested that Maker create multiple debt tranches catering to “different risk appetites.”

Crisis of Collateralization

The debate over the proposal marks a pivotal moment for a project that played an instrumental role in the development of DeFi. DAI was first described by Maker CEO and co-founder, Rune Christiansen, in 2014, before being launched on the Ethereum mainnet in 2017. Users could deposit Ether into the MakerDAO protocol and mint DAI against it, with the stablecoin being destroyed when users repaid their DAI to claim their ETH back.

In November 2019, the protocol launched Multi-Collateral Dai, allowing additional crypto assets to collateralize the creation of DAI, including Basic Attention Token (BAT), and Wrapped Bitcoin in May of the following year.

While DAI has weathered several bear trends and retained its peg unlike many rival stablecoins, the protocol faced a crisis of under collateralization following the March 2020 “Black Thursday” crash that saw most leading crypto assets shed 50% of their value in less than two days.

‘There is no need to reinvent the wheel here… Maker needs to focus on being a competitive and innovative credit wholesaler rather than assessing individual loans.‘

MakerDAO proposal

The event resulted in the protocol’s only ever “Debt Auction,” where MKR was printed and auctioned in exchange for DAI to rebalance outstanding debts. While the auction was successful in recollateralizing the stablecoin, MKR lost more than 60% of its value during the events.

Hexanaut elaborated on the challenges MakerDAO is confronting as a bear market looms. The proposal says that in order to maintain DAI’s peg, the protocol needs to onboard “more and more non-interest-bearing USDC,” resulting in falling revenues and “increasing counterparty risk” from USDC’s centralized issuer, Circle.

The authors highlighted several protocols that deal with RWAs. The proposal calls for partnerships with undercollateralized lending protocols Maple and TrueFi that would give the teams DAI minting rights. It adds that Maker should also integrate with other DeFi projects “which are solely focused on connecting RWA borrowers to on-chain lenders.”

Black Thursday

“Granted we need to expect losses, but over time we can create a forward-looking model of how big we expect these losses to be,” the proposal continues. “We want to stress the importance of maintaining a rigorous understanding of the losses potentially involved, and we are not advocating to become the last option for low-quality borrowers. We need to balance both sides of the equation… Let’s use DeFi legos to grow exponentially.”

The proposal notes that Maker has historically been very risk-averse in its operations, perhaps due to being “scarred by the events of Black Thursday.”

“But this is not how lending normally works,” they argue. “We should instead expect losses on individual loans and offset that with overall interest rates. We believe this conservative attitude needs to improve for us to thrive.”

The proposal adds that Maker “should be connecting to lenders that have existed in TradFi for hundreds of years.” “There is no need to reinvent the wheel here… Maker needs to focus on being a competitive and innovative credit wholesaler rather than assessing individual loans,” it says.

The post also suggests loaning DAI to centralized market makers, and launching multi-collateral DAI on the Polygon PoS chain to drive growth for the protocol. “The risk of losses in all these scenarios is definitely higher than our current state, but they are individually still relatively small. We just need to be okay with a few of these loss events occurring on occasion,” it says.

The authors also advocate that Maker stop burning its revenues and instead “focus on building a massive system surplus.” Currently, the fees collected by the Maker protocol are used to purchase MKR from the open market and then burn the tokens. Instead, the proposal advocates for stopping the burn, and for the funds to be used to build up Maker’s surplus buffer.

“The system surplus is currently at $65M which is peanuts compared to the total DAI supply of $9.7B,” the proposal states. It adds that Maker would currently rank below the riskiest institutions in the legacy finance sector. “We want to be better than traditional lending institutions.”

The authors believe Maker should grow its surplus by roughly five times through a combination of debt issuance and equity sales.

Loss Event

To issue equity, the proposal suggests selling a portion of the 84,000 MKR tokens currently sitting in Maker’s treasury over a multi-year vest. “Despite uncertainty in the markets, there are still VCs interested in making large investments, especially in a protocol as central as Maker to the ecosystem,” it says.

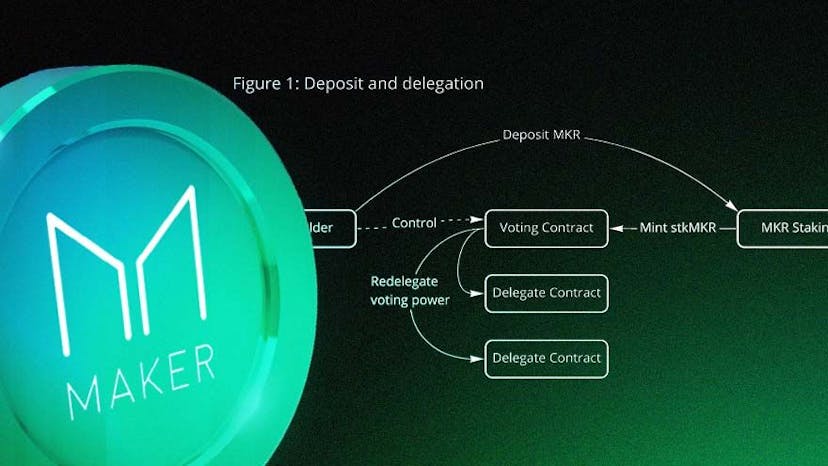

The authors also advocate for issuing debt by creating an insurance module that allows time-locked depositors to collect an APY. Capital locked in the module will be designated as an insurance fund protecting against a “large loss event.”

“If there is some large loss event it will eat into the insurance buffer and users will no longer be able to withdraw their full amount,” the authors write. “They can always wait for the buffer to refill. They get the senior-most position. This revenue sink can be offset by new revenues from the riskier loans.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.