Introducing Concentrated Liquidity with ApeSwap V3

External - Press ReleaseBy: coinzilla • Loading...

Press Releases

ApeSwap is excited to announce that as of April 4th, the latest industry standard approach to liquidity positions, known as concentrated liquidity, will be available on the ApeSwap decentralized exchange in the form of ApeSwap V3.

What is Concentrated Liquidity?

ApeSwap’s decentralized exchange has leveraged the traditional UniSwap V2 liquidity model since launch. V2 liquidity positions cover the entire range of the constant product formula, meaning all liquidity positions in these liquidity pools are reserved equally over the entire range of the applicable token’s relative prices (from $0 to $infinity). As a result, the assets within the majority of V2 liquidity positions are never put to use, because the relative prices of the tokens are often within a certain, more restricted range.

Since liquidity is spread thinly across all price ranges, liquidity providers (LPs) only earn fees on a small portion of their assets, and traders are subject to higher degrees of slippage when swapping tokens.

Unlike V2 liquidity positions, V3 liquidity positions are tied to a set price range, making them much more efficient in terms of earning trading fees. LPs set up concentrated positions, and users can trade against the combined liquidity of all of those individual concentrated positions with. Trading fees collected at a given price range are split pro-rata by LPs proportional to the amount of liquidity they contributed to the selected price range and fee option.

Why is ApeSwap Upgrading to V3?

Concentrated liquidity allows both ApeSwap as a protocol and its users to have a much higher degree of capital efficiency.

Other decentralized exchange platforms have implemented this approach and ApeSwap prides itself on offering the most innovative solutions in DeFi to its users. With ApeSwap V3, the protocol can provide more capability to existing users, as well as attract new users as part of its efforts to establish itself as an industry leader in sustainable DeFi. With this feature, liquidity providers, partners, and swappers can all use concentrated liquidity to maximize their opportunities and make for a more complete and valuable experience on the ApeSwap DEX

ApeSwap’s Head of Product, Obie Dobo, said: “ApeSwap’s V3 Liquidity is a leap towards capital efficiency, as we continue our multi-front effort towards sustainable DeFi. The enhancements V3 provides trickle down all across our ecosystem. Liquidity providers get more control. Users get better swapping rates. Partners stay on the cutting edge. A move to V3 allows ApeSwap to adopt best practices and maintain competitiveness in the fast-paced world of crypto.”

How to Create a V3 Position

As of April 4th, ApeSwap users will be able to create a concentrated liquidity position on the ApeSwap DEX. Follow the steps below to create a V3 liquidity position:

1) Select the two tokens you’d like to include in the liquidity position and enter an amount of one token. The other token amount will pre-fill automatically.

2) Select a fee option from the available fee options (0.01%, 0.05%, 0.3%, or 1%).

Selecting a fee tier is where users apply a strategy, seeing the percentage of liquidity for each fee tier. Lower fee pools get used more, so sometimes the amount of volume can make up for the lower fees!

3) Select a price range by dragging the boundaries in the graphic or entering a min and max price manually. The token amounts will update automatically.

4) Select Preview to review your liquidity position.

5) Select Add to finalize your position.

Once the transaction is complete, you will receive an NFT of the position (more on V3 NFTs below). The position will earn trading fees from trades of that pair that are facilitated with V3 liquidity, as long as those trades are within the price range and fee tier selected for that position. Liquidity providers will earn the respective fees which are calculated based on the available pair liquidity and price ranges.

Earned trading fees need to be CLAIMED in the V3 Positions tab.

Note that there will not be any incentives to “stake” V3 positions initially (i.e., there will not be any V3 farms).

About V3 NFTs

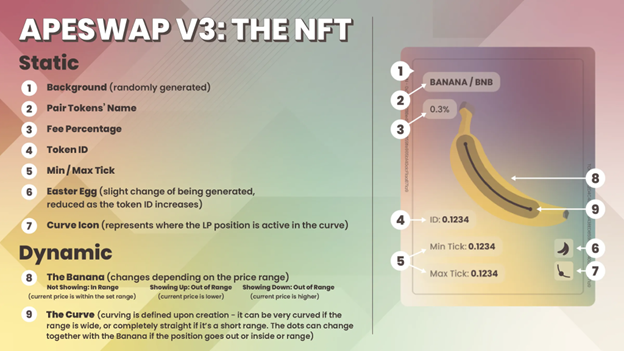

When a user opens a concentrated liquidity position, they receive an NFT that includes key information about the position. The guide below explains where this information can be found on each NFT.

FAQs

How is the V3 fee calculated for each trade?

It’s based on the liquidity pools you route through. Our router does all the logic to get the cheapest fee overall accounting for all factors.

Does this impact the swaps in any way?

Swappers won’t notice a difference in our DEX, aside from getting better rates.

Does this impact the Pro Trading platform?

No, ApeSwap Pro is not affected by this update.

Why would anyone select a lower fee when creating a V3 position?

It comes down to a farmer’s strategy. Lower fee pools get used more, so sometimes the amount of volume can make up for the lower fees!

If you have more questions, please reach out through ApeSwap’s Telegram & Discord channels.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.