Grayscale DeFi Fund Starts Trading

DEFG Tracks A Basket Of UNI, AAVE, MKR, CRV and COMP

By: Owen Fernau • Loading...

DeFi

Digital asset manager Grayscale’s new DeFi-focused product has started trading on public markets.

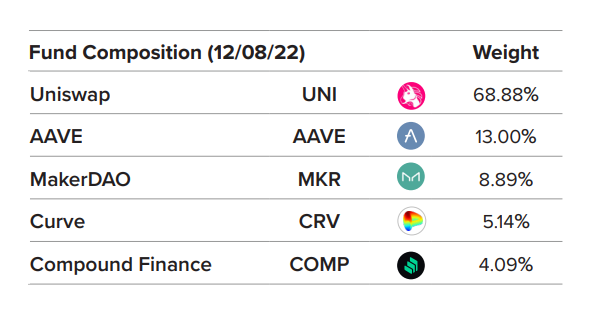

The Grayscale DeFi Fund (DEFG) will track a basket of the largest DeFi protocols — UNI, the token for Uniswap, the decentralized exchange, makes up nearly 70% of the fund, according to a press release.

DEFG Composition

Grayscale began taking deposits of the underlying assets from accredited investors in June 2021. The product has only $3.2M in assets under management so far, a drop in the bucket compared to its flagship GBTC fund, which holds $10.8B of Bitcoin.

For those who have been following DeFi for a while, the selection of assets isn’t necessarily compelling. “This feels like a fund that was supposed to be launched two years ago,” tweeted Hsaka, a popular trader.

Indeed, over the last year, all the included tokens have dropped over 60%. The launch also comes at a time when compressed yields and prices have hampered enthusiasm about DeFi, which may have led to the muted response to DEFG.

Grayscale has faced scrutiny since FTX’s collapse left its sister company Genesis with a hole in its balance sheet. The company was compelled to reassure the public last month that the crypto assets underlying its trusts were indeed safe and accessible.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.