Global Report on Women, Cryptocurrency and Financial Independence

By Marina Spindler and Paulina Rodriguez According to a recent study, the total number of global cryptocurrency users has surpassed 100 million for the first time. The highly specialized crypto landscape is increasingly diverse. Exchange platform surveys indicate women make up 15-55% of crypto users, depending on the region. Tonya Zhang, head of marketing of Hong…

By: Marina Spindler • Loading...

DeFi

By Marina Spindler and Paulina Rodriguez

According to a recent study, the total number of global cryptocurrency users has surpassed 100 million for the first time. The highly specialized crypto landscape is increasingly diverse. Exchange platform surveys indicate women make up 15-55% of crypto users, depending on the region.

Tonya Zhang, head of marketing of Hong Kong-based exchange AAX, said that women make up 25% of their users and a third of their top users. Plus, when it comes to working in the industry, the international peer-to-peer trading platform LocalBitcoins reported that 46% of its staff is female.

These women are driven by a desire for increased financial independence. Even back in January 2019, when Coinbase surveyed over 6,000 women from the US and UK, researchers found that 32% of millennial women did not believe they had control over their financial future. This year, Gemini surveyed over 2,000 people in the UK and found that 45.4% of crypto investors are more likely to have increased their savings and investments despite the impact of the COVID-19 pandemic. The following report details new testimonies and unique insights from women in the crypto community, particularly users from emerging markets.

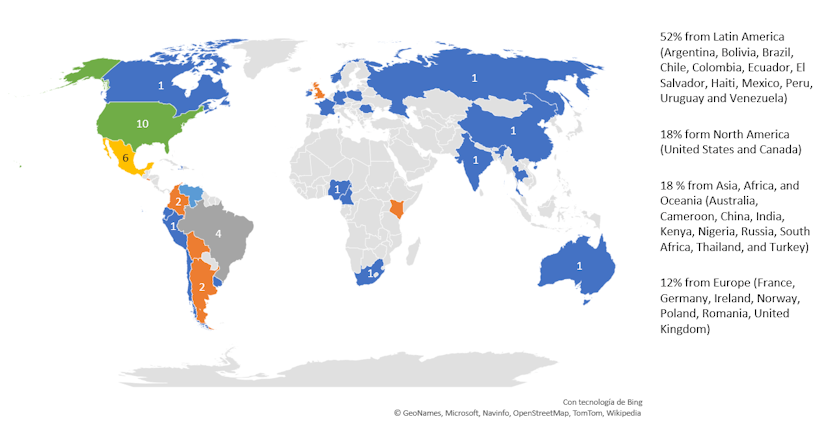

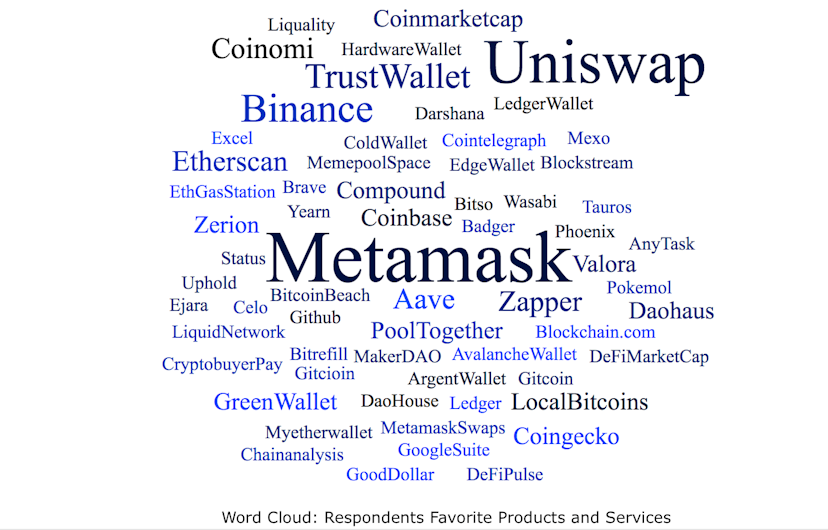

Beginning in March 2020, we interviewed 60 women from 31 countries to understand their motivations for owning cryptocurrency, plus how they are safeguarding their assets to grow their wealth. Half of the respondents are from Latin America, as both authors lived and worked in the region. This research was conducted with help from a wide variety of industry institutions, including Women in Blockchain Boston, Meta Gamma Delta DAO, Blockchain for Humanity, Blockchain Education Network, Gitcoin, Avalanche, Celo and SheFi. Contributors spanned the globe, from Ankara to Caracas and New York.

This report includes many women who are using cryptocurrency to support themselves, rather than merely speculating on Bitcoin or tokens. All these women volunteered to participate in our research, they were not compensated, which means our report findings are favorable towards cryptocurrencies due to the participants’ self-selection.

In addition to collecting user data and analyzing behavior patterns, during 2,000 hours of intimate interviews we asked these early adopters about their motivations and shared experiences. We learned how this new technology is enabling women to become financially empowered and economically independent.

Key Findings

- Even though 32% of the respondents are from developed countries with high-tech infrastructure, most women across the globe rated their access to the financial system in their home country as a meager 3 on a scale of 1-10.

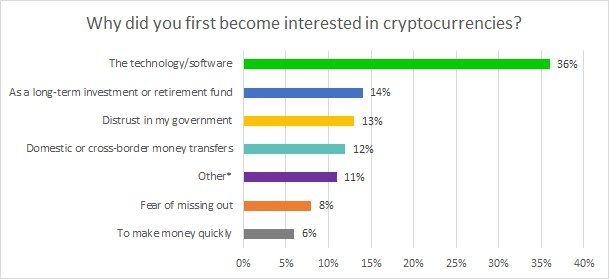

- Participants were not primarily interested in making money quickly through trades – 36% were most interested in the underlying technology, while 14% saw cryptocurrency as a long-term investment vehicle.

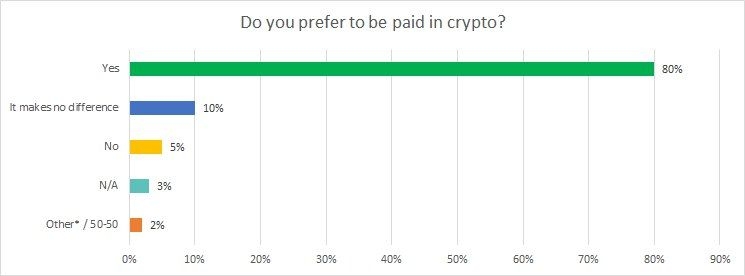

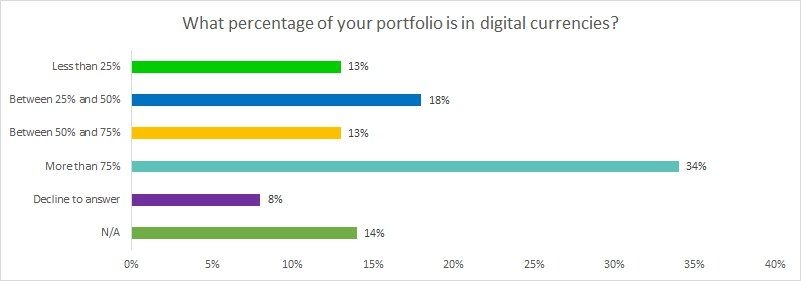

- A resounding 80% of the respondents said they prefer to be paid in crypto, and 34% have more than 75% of their investments in digital assets.

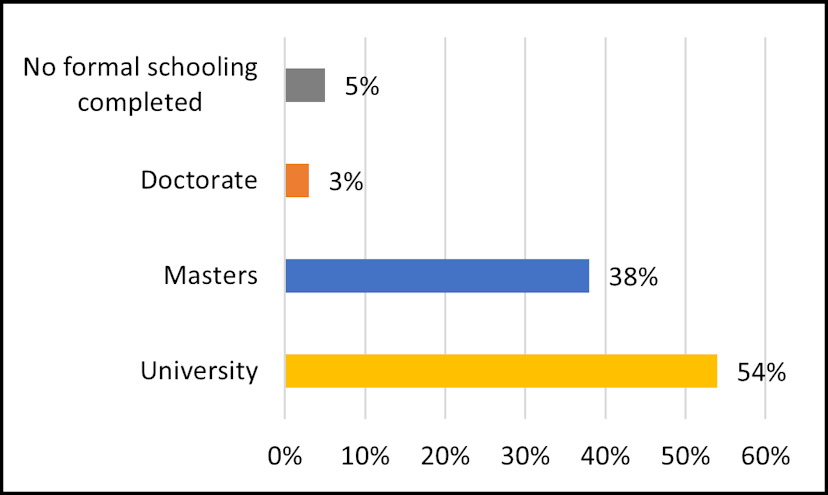

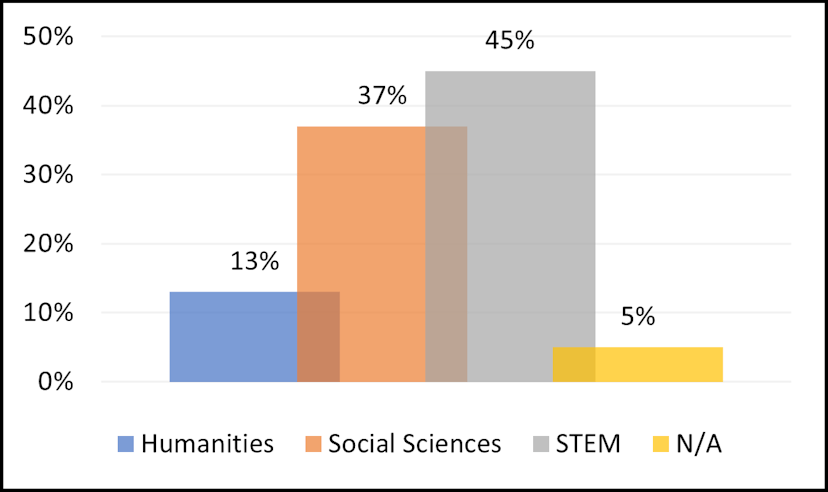

- 95% of the women respondents had some form of higher education and 22% of the women either knew how to code or had comparable technical skills.

- On a scale of 1-10, women gave themselves on average a favorable 7+ when asked if their financial literacy and independence had improved since they had begun using cryptocurrency.

- 32% of the participants are not living in their country of origin.

Pioneers

As pioneers in the cryptocurrency industry, these women are bringing their own chairs to the table, so to speak. They are, generally, committed to changing the status quo and seek financial independence.

In terms of generational demographics, 18% of respondents identified as Gen X and 78% identified as Gen Y (millennials), with younger respondents showing more enthusiasm for DeFi (decentralized finance) as their long-term platforms of choice.

“I look forward to the day that my newsletter is simply about finance, and the word decentralized is no longer needed,” said Camila Russo, founder of a leading crypto publication with over 20,000 subscribers.

“When I started six years ago, most people did not understand why we were doing what we were doing. The notion that the web could be censored or that content creators would have their work taken down seemed impossible,” shared the co-founder of Open Index Protocol.

45% of participants had educational backgrounds in science, technology, engineering, and math (STEM). Only two respondents had not completed secondary education, while a third participant had no formal education at all. This third participant said she did not know “how to read or do numbers,” yet she was comfortable using a Bitcoin wallet for her business in El Salvador.

For all of these participants, their blockchain literacy was propelled by self-directed and self-motivated learning. According to our global survey, 34% of women cryptocurrency users spend 10-40 hours a week on their self-directed education about blockchain technologies, and 20% even admitted to longer hours. These figures may be notably high because many of the participants work in the blockchain industry.

“I did a deep dive, full-on 24/7 crypto. It was crazy! I got a job (and got paid) in crypto so I had to learn very quickly. I had to learn how to use an exchange and everything” said Emily Rose from the UK.

Likewise, a former trader and investment advisor named Juliana, from Brazil, said she was so excited about Bitcoin that she began offering and organizing online courses. This passion altered her travel habits and media diet.

“I also started to travel around the world for conferences,” Juliana said. “By the end of 2017, I stopped reading The Wall Street Journal and Financial Times, and I started to dedicate my time to Coindesk, Cointelegraph, and all the other [crypto] media industries.”

Technology

It should come as no surprise that respondents spend so many hours engaging with crypto media and studying blockchain technology. 36% of research participants said they originally became interested in cryptocurrencies because of the underlying technology.

“Once we put things on the blockchain, we have transparency, and it’s immutable, and it’s the truth” said Merri from the US.

Dionna, who spent 18 years in the US military agreed: “I think the most significant blockchain use case is in the military. The Army lost the medical records of ten years of my career. No tracking system. If I hadn’t made copies of things, there would be no proof that any of that ever happened to me. The problem is that there are many ways that we [the US] could be attacked internally and externally, so that information just can’t be flying around. So, we usually go to old systems and keep them offline, not even connected to the Internet because if a hacker got in, we could be jeopardizing a lot of people. That system isn’t more secure. You lose a lot of information, and then you end up having soldiers wanting to kill themselves because they have to spend ten years telling the same story repeatedly because nobody believes it happened.”

Across the ocean, Doris felt just as strongly about how Nigeria was approaching cryptocurrency regulations. The government recently threatened to ban cryptocurrencies even though 32% of Statista Survey respondents from Nigeria said they used or owned cryptocurrencies in 2020.

“I’m right here in Africa. I see the limitations for women over here. And because technology has changed my life, I believe that technology is freedom for the African woman,” she expressed as she shared her motivations for founding Blockchain Ladies Africa. “When you talk about the blockchain, you talk about cryptocurrencies and about decentralization. That’s what I teach so they can naturally empower themselves.”

Many users struggle to learn about blockchain technology because most free resources are written in English. As such, Nelly in Cameroon is building a decentralized wallet specifically for people in Francophone Africa. Nelly said: “given what I have lived [through], I couldn’t build a centralized exchange.”

Meanwhile, Angela in India told us about how the demonetization crisis in 2016 showed her the unique value offered by cryptocurrencies.

“The one thing that makes me believe in crypto is that it’s not in a few hands. It’s not even in hands – it’s in a million nodes spread all across the earth,” she said. “This is why I believe in it – because there’s not one person that can say ‘you know what, the 500 rupee notes and 1,000 rupee notes are not valid anymore.’”

Investing

Fiat currency concerns and interest in censorship-resistant borderless money are precisely why 80% of the respondents said they prefer to be paid in crypto.

“I would love to get paid in DAI. I work for an international company that [pegs] my salary to the local standard of living,” said Alice from Argentina. “But they do not account for the fact that my money loses half its value within six months. I am not able to save in dollars, so instead, I convert much of my salary to digital currencies.”

Kilifi blog writer and doughnut maker Isovary shared “Sarafu–Credit voucher system gave me a way to handle my debt without having to spend my Kenya shillings because I start off with a basic income and pay for food at the local market or take the moto-taxi Boda Boda.”

After a consulting job, Alice from New York shared that her male colleague chose to be paid in fiat instead. “We were both offered the option to get paid in Bitcoin,” she said. “He is kicking himself right now for not taking their offer.”

Yet another respondent from Venezuela said she recommends her friends keep their wallets private “tell your husband it is an app to track your period.” She said the women listen closer after her recommendation because “saving in cryptocurrency offers women control over money and the value of our work without passing through the hands of the husband and without having to go to the bank to sign.”

In addition to earning, cryptocurrency users love to invest in digital assets. 34% of the surveyed participants have more than 75% of their wealth stored in digital assets. Alice from South Africa said “up to 80% of my savings — I refer to them as investments, not savings. My investments are in crypto because I’m young and I am willing to take risks.”

As for Christine in Russia, who works at a crypto wallet startup, she said navigating government bureaucracy is actually harder than learning to manage her own crypto. She mostly uses it as an investment vehicle, but sometimes learns how to manage it by practicing with small transactions.

“I am stacking sats,” she said, using the catchphrase for accumulating small amounts of bitcoin over a long period of time. “When I travel, I like to buy coffee and other things with it.”

“I was the first person in Australia to buy a house with Bitcoin,” shared leading LocalBitcoins trader Michaela. “Even though crypto is heavily regulated here, banks still turn me away and refuse to work with me.”

“I am not ashamed to share that in 2017, things got very rough for me and I had to look for food in the trash to feed my young son. Today, I get paid in crypto and I change digital wallets the way other women change their purses,” said Viviana from Venezuela.

Our respondents aren’t alone. And they aren’t participating in a niche trend either. A separate Deloitte survey of 1,488 executives across 14 countries in 2020 found 83% of their respondents also believe that cryptocurrencies will increasingly offer alternatives to fiat currencies over the next decade.

“There’s a lot of inefficiency in the legacy systems,” said startup founder Rafaella from Brazil. “They’re breaking because they weren’t built for how globally connected we are now.”

Economic Challenges

Before joining the Web 3.0 movement, nearly 65% of participants grew up in households with limited economic means or experienced traumatic shocks such as job loss, property confiscation or crippling debt.

Isovary from Kenya lost her mom when she was young and recalled struggling to afford sanitary napkins “my father was a good man that loved me very much but we were very poor.” Likewise, Alice from Thailand told us “maybe five or six years ago, where my dad was working but the company wasn’t able to pay him for a year.” For these users, cryptocurrency offers a crucial lifeline.

“In my early twenties, I was pretty much the main breadwinner at home,” shared Grace who pursued an engineering degree while also working to support her parents when they moved to the US.

Over in Ireland, Jillian recounted how her ex-husband’s debt legally became her burden.

“My business was crashing because of the recession,” Jillian said. “My ex claimed bankruptcy and the entire debt became mine. An older lady said to me: I was brought up to pay my debts. It wasn’t until I was driving home that it hit me. Did she think that I wasn’t? Oh my God, this is shocking. I had never even had a library ticket or a traffic violation.”

Over a third of our respondents also reported having experienced a financial crisis in their country, such as repetitive devaluations. These experiences inspired their interest in Bitcoin and other digital assets. In some cases, respondents from Argentina and Venezuela were numb to the exhaustion of managing chaos on a regular basis. They were laser-focused on addressing what was under their direct control since they were used to instability and not relying on the government.

Describing an example of inflation she experienced at an early age, Dennise from Bolivia recalled “growing up, I would regularly visit my mother’s law firm after school. She would often give me money to buy ice cream while I waited for her. One day, when I was 9 or 10 years old, the ice cream man said the price had gone up and I had to return to the office empty-handed.”

Several participants shared comparable experiences. Nelly from Cameroon said she’ll never forget the traumatic events that took place in January 1994.

“It was when the French government decided to debase the CFA franc, which is the money that 14 countries across Francophone Africa shared. We woke up that morning and my parents had pretty much lost their savings because everything was worth half,” Nelly said. “And since African economies are mainly based upon imported goods… it was as if you had divided your savings by four. I think that’s the first kind of time I asked myself, how can you do everything right and still fail?”

In countries where the financial system is considered stable, without inflation issues, the participants’ desire for independence and control was still a primary driver. This is the same sentiment reflected by global communications firm Edelman’s research which found 77 percent of affluent millennials in the US believe that the current financial system is designed to favor the rich at the expense of “ordinary people.”

Empowerment

Even participants who didn’t experience economic challenges still benefited from more direct control over their finances.

“Here, men are deciding how to spend your family money,” said Turkish participant Ece, who started a YouTube channel to broadcast her journey as she learned about cryptocurrencies. “Even when a woman’s wage is way better than her husband’s, the father figure is the one who decides how to spend it. Even in politics, husbands decide for whom they should vote. This is a really very bad situation. But it is changing with my generation.”

A computer scientist from India shared a similar experience.

“Most parents nudge their kids into bureaucratic jobs because that is where they perceive more security even though the work isn’t rewarding,” Angela said. “It was easier for me to separate from the norm because I was in regular contact with outside people, not from India, so I always knew what the culture was worldwide. My journey down the rabbit hole happened fast. After reading a few books on crypto, I signed up for ETH India [her team won] and got my first job in blockchain.”

In Colombia, Ana Maria spoke of systemic classism: “From the moment people meet you, they ask ‘Where do you live? What school did you go to?’ Not out of curiosity, but to find out your socioeconomic status –if you belong to quintile one, two or three. I hated it. Since I was very young, I knew it was important to have financial autonomy.”

“In Mexico, people are always in debt. Banks call to trap you. That was especially clear when the COVID-19 virus started in China. The phone company called me to offer me a ‘free’ phone tied to a two-year contract –to generate income based on debt. It is a way of enslaving people and we don’t even know it. That is why I am launching a savings platform using blockchain.” shared Gabriela who launched a lending circle app called Bloinx.

Cryptocurrency markets are volatile. Bitcoin is still an experiment. But most participants felt it was their right to access and choose such digital assets, knowing the risks. As Paula Gil, of the Norwegian Refugee Council, tweeted: “It is paternalistic to decide on behalf of vulnerable people whether they should participate in the global financial system or not. You and I get to decide. Why shouldn’t they? Focus on consent not on making choices for them.”

Overall, our research participants represent an underserved market interested in fintech services. These women are ideal consumers, often highly engaged regarding user feedback and volunteer contributions.

“For the first time in my life, I can buy myself a whole pizza. I can even dream of buying a car. Something I would never have achieved with the precarious jobs I worked before,” said law student and crypto educator Romina from Argentina.

Her empowerment hints at a massive opportunity. A recent report, Powering Potential, found that closing the gender gap in women’s access to financial products and services could unlock $330 billion in global annual revenue.

More than half of our respondents identified themselves as “active and engaged” with community projects, both local and virtual. 77% of our respondents belong to a DAO, club, or group, and some of them lead or have started knowledge-sharing community groups.

Maggie founded SheFi because she “wanted more women to be comfortable investing and making money. It keeps me learning about projects, using them, demoing them, and discussing them with the group while donating money to nonprofits for women in STEM.

“The members of these groups have been instrumental in moving the ecosystem forward, so I am able to learn a lot from them. We also help each other gain visibility both personally and professionally,” said the US-based respondent Dionna. “Crypto feels like family, like when I was part of the military.”

However, there are still costs associated with self-directed education. Early adopters invest “unpaid time and labor into new modes of organization,” according to Denise Thwaites in her article “A DAO of One’s Own.” The dedication required assumes a certain level of privilege.

Canadian business consultant Magdalena has expertise in both energy and bitcoin mining. But getting work in the crypto industry was far from easy. “I think a lot of women tend to do more volunteering activities because they care and want to participate, but it is also a challenge,” she said. “I don’t expect to get paid six figures right now, but I do expect equity.”

Conclusion

Across the board, the majority of the participants have, at some point, lived through a crisis involving high inflation, devaluation, crippling debt and/or financial isolation. These experiences inspired them to pursue their own financial independence.

According to the International Labor Organization, women in many societies are disproportionately in informal, low-paid, or undervalued jobs. Their vulnerability is compounded by the fact that commercial banks often focus on men and formal businesses. Therefore, we should go beyond encouraging women and minorities to open bank accounts, to support them in deciding how to spend their money and control their finances.

To that end, crowdfinance projects and grants by the Human Rights Foundation, UNICEF and Blockchain for Humanity are all excellent examples of financial inclusion initiatives for cryptocurrency users.

As Melinda Gates wrote, “Targeting women and girls as beneficiaries of development programs is only one part of putting them at the center of development. The other part is recognizing their role as agents of change.”

“I grew up in East San Jose, in the shadows of Silicon Valley. That’s why Celo’s mission made sense to me. For the first time, tech and the world I grew up in came together and I am empowered to change lives,” shared Xochitl.

“I’ve been at this now for seven years, and we’re still at the beginning. There’s a lot of work to be done to change the level of adoption and inclusion” said Connie from BitGive.

Regardless of their employment or income status, these women participants managed to grow their wealth and improve their lives by using cryptocurrency. Blockchain technology helped them manage financial risks and more fully participate in the global economy. In conclusion, we would urge global actors to support education and training efforts related to digital currencies. If they do, it can accelerate women’s rights across borders.

About the Authors

Marina Spindler, project author and lead interviewer. Founder of Spindler Edge, a business strategy and communications consulting firm for blockchain and cryptocurrency companies in the United States and abroad. A SheFi and Gitcoin Kernel fellow, she joined MetaCartel Ventures, Meta Gamma Delta and is a member of the 2021 Congressional Delegation of Women of Color in Blockchain. Bilingual and multicultural, she holds a master degree in public administration from New York University and a bachelor of arts in international affairs. For over a decade, she lived in Washington, DC and led the Carnegie Endowment’s G50 and founded the ML50. You may connect with her on LinkedIn and follow her on Twitter.

Paulina Rodriguez, project manager and data analyst.Former director of international partnerships for PROSPERA, Mexico’s conditional cash transfer program that benefited nearly six million families and has been replicated in 52 countries. A social development expert with more than ten years working in the public sector, she holds a master in public administration from INAP. You may connect with her on LinkedIn and follow her on Twitter.

If you would like to learn more about our in-depth interviews and how they relate to global adoption, consider partnering with Spindler Edge to promote innovation and expand financial inclusion. You may also participate by filling out this survey (open to women who own and use cryptocurrencies) to further our analysis.

Thank You

This report was possible thanks to the dedication of numerous organizations and individuals around the world. We appreciate the World Bank, WEF, and UNICEF for supporting the scope of our research and encouraging us to produce this report. A special thanks goes to our reviewer, Susan Wang of Women in Blockchain Boston, who was instrumental in elevating the quality of our content and contributing immensely to our survey and final report. Our valiant transcribers Ricardo Chacon, Daniela Von Hertwig Meyer and Avril Jacome reviewed over 2,000 hours of interview material and helped us convert them to 200 pages of heroic stories. Early on, Elena Giralt of Blockchain Latinx and Mel Vera of BEN also helped define our overall goals. Thank you to Viviana Sanchez who designed our cover page banner.

We would like to recognize our editor Leigh Cuen for being the first person to believe in our project and open doors to key industry leaders. We are also grateful to Camila Russo and the Meta Gamma Delta members who volunteered to be interviewed and to the Avalanche champions and Celo leaders who participated in our project. Fellow researcher Matt Ahlborg helped us reach out to LocalBitcoins and they kindly helped us connect with their high-frequency traders. Bitcoin Beach put us in touch with local women using Bitcoin in El Salvador and the Grassroots Economics team helped us interview a Sarafu recipient in Kenya. Genevieve Leveille connected us to women in Haiti and Africa and Kernel organizers helped us reach out to the broader Gitcoin community. We are also thankful to the leaders of Blockchain for Humanity, Blockchain Education Network, BitGive, DeFi Alliance and SheFi for further informing our research.

Finally, we are immensely grateful to the 60 women pioneers who agreed to be interviewed and share their journey towards financial independence. Their candid remarks and vivid memories give this report a richness that could have never been achieved through a survey-only approach. The upcoming Spanish version (focused on Latin America) will include regional findings and feature new voices.

Supporters

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.