Ethereum Derivative Hits Market as Concerns Mount Over 'Significant Risk'

Aave and Oasis.app Launch Offering Letting Users Increase Exposure to Staked ETH

By: Samuel Haig • Loading...

DeFi

In a move that may accelerate the growth of staked Ether in a post-Merge market, Oasis.app, a dApp that spun out of MakerDAO, launched a product letting users bolster their exposure to stETH staking yields, the venture announced on Oct. 24.

Oasis.app partnered with DeFi lending giant Aave in the deal.

The product allows Aave users to borrow ETH against stETH — Lido’s liquid staking derivative — and then purchase additional stETH using the borrowed funds in a single transaction.

Concerns

Yet, prominent voices in the Ethereum community have expressed concerns about the increasing dominance of stETH over the liquid staking derivatives (LSD) sector.

During a Sep. 15 stream hosted by the Ethereum Foundation, Superphiz, the co-founder of the EthStaker community, urged DeFi developers to be cautious about innovating derivatives based on liquid staking.

“The goal of staking is not to promote DeFi, the goal of staking is to promote the security and the health of the Ethereum network,” he said. “You’ve got to keep those two goals separate.”

Oasis.app’s offering exposes users to losses in ETH terms should the borrow rates for ETH exceed stETH on Aave. It also hinges on whether stETH will trade at parity to ETH, meaning holders could suffer losses if stETH loses value against ETH.

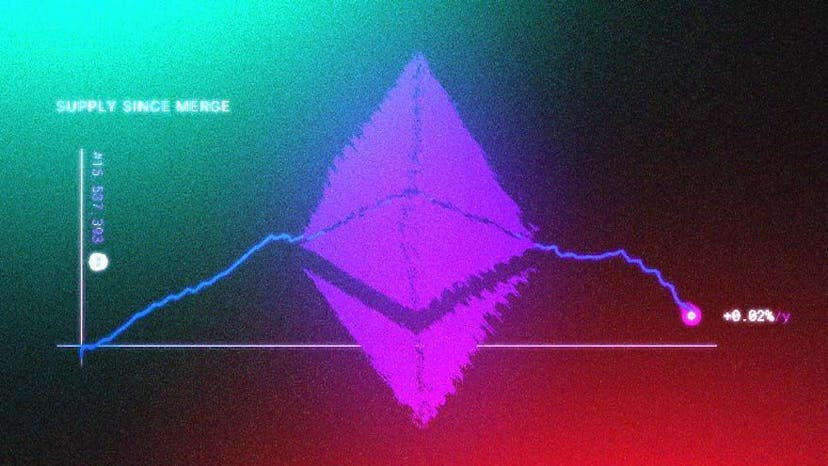

Ether Issuance Goes Negative as Merge Delivers on Deflationary Promise

Shrinking Supply is Attracting Institutional Investors

“Through this expansion, the Aave protocol will enable users to borrow assets against their StEth while retaining their Ethereum staking rewards,” said Stani Kulechov, Aave’s founder and CEO. “There is strong interest in using StEth to earn additional yield without taking on excessive risk.”

Oasis.app CEO, Chris Bradbury, said that the Oasis team was waiting for the completion of The Merge before launching the new product due to concerns about volatility in the price of stETH.

Cautious Approach

“We decided to take a cautious approach and wait for The Merge, due to expected large amounts of volatility with stETH leading up to the event and the risk in the success of the fork,” Bradbury said. “Now that we see the success of Ethereum Proof of Stake we believe now is the perfect time to launch this new strategy on Oasis.”

Bradbury told The Defiant that Oasis.app plans to launch a similar product for rETH, the liquid staking derivative from Rocket Pool, should Aave begin supporting the token.

“We are already expecting [rETH] to be approved on the Maker Protocol in the next two weeks,” Bradbury said. “If it also goes through on Aave, you can expect the same strategy for rETH as stETH.”

A governance proposal calling for Aave to support rETH passed with more than 99% support in June.

‘Liquid staking derivatives (LSD) such as Lido and similar protocols are a stratum for cartelization and induce significant risks to the Ethereum protocol and to the associated pooled capital when exceeding critical consensus thresholds.’

Danny Ryan

Superphiz said the best thing for the protocol is to avoid concentrated liquid staking derivatives because they tend to centralize ETH in a very narrowly controlled environment.

“Right now, there is one provider that is the standard,” Superphiz said. “I really look forward to seeing five or six of these providers, because we need several different versions of this liquidity token to continue decentralization.”

In July, Danny Ryan of the Ethereum Foundation published a report titled The Dangers of LSD warning about the rising peril for Ethereum.

“Liquid staking derivatives (LSD) such as Lido and similar protocols are a stratum for cartelization and induce significant risks to the Ethereum protocol and to the associated pooled capital when exceeding critical consensus thresholds,” Ryan wrote.

But Bradbury argued that concerns regarding the integration of liquid staking derivatives into DeFi may be overstated.

“We don’t think adding this new product will exacerbate the current centralization risks in any meaningful way,” he said. “It’s also important to remember that stETH and Lido is not a single operator, so the centralization risks are spread out more than it initially appears.

Staking Providers

The Oasis.app CEO said the venture would support a diverse set of staking providers, particularly when it helps, or leads to the increase of decentralization in the network.

Lido is currently the largest Ether staker with 30% of all ETH staked on the Beacon Chain, according to Rated Network. The centralized exchanges Coinbase, Kraken, and Binance follow with 12%, 8.5%, and 5.3% respectively. The four entities control 56% of staked Ether combined.

In a recent appearance on The Defiant Podcast. Hasu, a strategic advisor at Lido, played down the centralization risks associated with Lido. He stressed that Lido comprises 29 different node operators rather than a single staker, also arguing that Lido’s dominance prevents centralized exchanges from amassing an even larger share of staked Ether.

“In the Lido whitepaper, it says that the main motivation for Lido is [to] make it so that large exchanges don’t win liquid staking for Ethereum,” Hasu said. “What you would have is much more [staked ETH] custodied by exchanges, you would have a much more concentrated node operator set.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.