Traders Move ETH out of Centralized Exchanges and into DeFi

Ether balances on exchanges drop to lowest level since August 2018 while ETH locked in DeFi continues to rise.

By: Samuel Haig • Loading...

Markets

Traders are pulling their Ether from centralized exchanges and locking them into DeFi smart contracts, suggesting that traders believe that markets may still climb higher.

Data from Glassnode shows that the number of ETH stored on exchanges is at its lowest level since August 2018, with 20.6M Ether, or 17.1% of Ethereum’s supply, locked on centralized trading venues.

However, Ether’s supply was lower in 2018, and the 20.6M Ether held on centralized exchanges accounted for 20% of the coin’s circulation. On a percentage basis, Ethereum’s centralized exchange balance is at its lowest level since July 2016 — when ETH traded for just $10.

Number of Ether held on centralized exchanges (blue), ETH price (black). Source: Glassnode.

Bullish Sentiment

Significant reductions in exchange balances suggest that investors are willing to hold on to their crypto for the long-term, and are placing them into cold storage for safe-keeping or in DeFi smart contracts to earn yields.

Last July, on-chain analyst Willy Woo said that when “supply shocks” on centralized exchanges coincided with stable prices, the market is about to rise. When exchange balances plummeted during both May 2020 and July 2021, the price of Ether sharply rose shortly after.

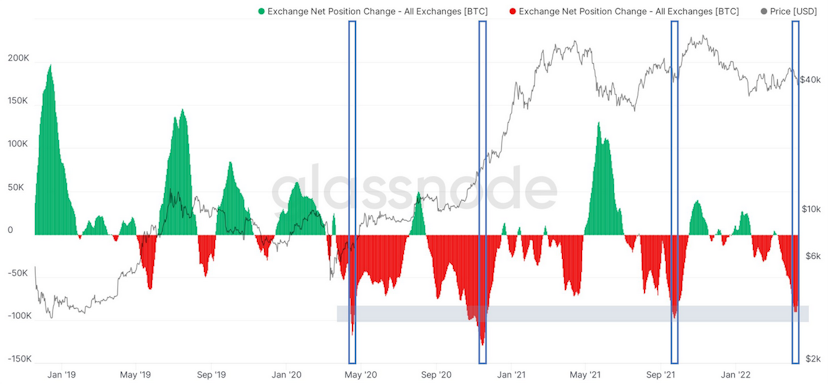

Ethereum isn’t the only coin that traders are taking off of centralized exchanges. On April 13, crypto analyst Will Clement published a chart showing that traders withdrew Bitcoin from centralized platforms at a startling clip over the past few weeks.

“On only 3 other occasions have we ever seen Bitcoin withdrawn from exchanges at this rate,” he tweeted. That was in May and December of 2020. Both occurrences preceded periods of price rises.

Historic fluctuations in the balance of BTC on centralized exchanges. Source: Glassnode.

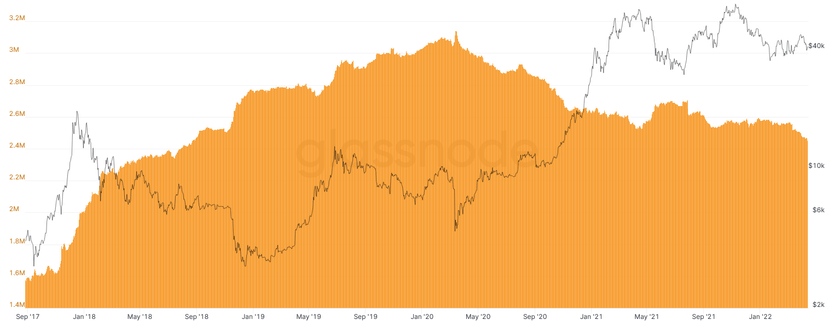

Glassnode data also shows that the balance of BTC on centralized exchanges is at its lowest level since 2018.

However, the centralized exchange balances both for Ethereum and Bitcoin have steadily declined since mid-2020, with only Bitcoin balances seeing a brief up-tick in mid-2021 before the price crashed in November.

Bitcoin centralized exchange balances. Source: Glassnode

While ETH balances on centralized exchanges plummet, the number of Ether staked in DeFi protocols is rising.

The sum of ETH deposited in smart contracts is approaching an all-time high, with 27.5% of supply, or 33.1M Ether, locked in DeFi protocols. The record of 28.1% was posted in late October 2021, just weeks before the recent record-breaking bull market came to an end. Between November 2021 and January 2022, the price of ETH fell 56% from nearly $4,900 to $2,150.

The share of Ethereum’s supply locked in smart contracts last broke into new all-time highs amid the ‘DeFi summer’ of 2020, which was accompanied by significant price gains for ETH.

Share of Ether supply locked in smart contracts (blue), ETH price (black). Source: Glassnode.

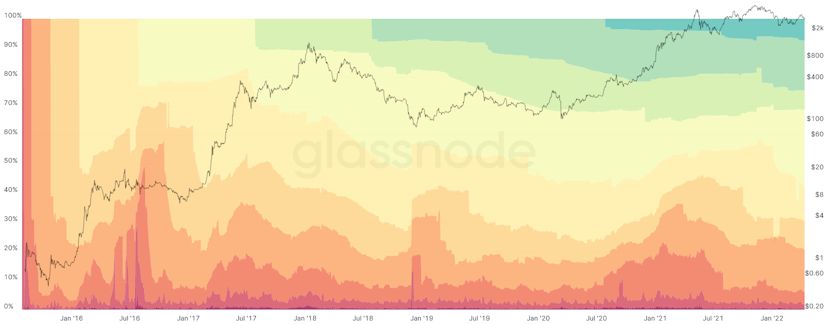

According to Glassnode’s ‘HodlWaves’ chart, which measures when coins were last moved on-chain, more than half of the Ethereum supply has not moved in more than 12 months.

While about 30% of ETH’s supply has moved between wallets in the last six months, the HodlWaves data suggests that most ETH investors are holding onto their coins for the long term.

Ethereum HodlWaves. Source: CoinGecko.

Approximately 9.1% of Ethereum’s supply is also locked up for staking on the Eth2 Beacon Chain, according to Staking Rewards. A record number of validators are also waiting to come online.

Things looked a lot different in the last time traders withdrew ETH from exchanges en masse – back then, traders were celebrating the DeFi summer of 2020. Now, DeFi traders are more wary and grizzled, and the protocols look vastly different. The open question: where will ETH holders park their assets this time around?

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.