Goerli and Cooling Inflation Drive Ether to Two-Month High

Completion of Final Merge Test Helps Drive ETH Rally

By: Samuel Haig • Loading...

Markets

Crypto markets have reversed earlier losses and are rallying after consumer prices fell to 8.5 % in July from 91% in June, according to data from the U.S. Bureau of Labor Statistics released Wednesday

Economists polled by Reuters had predicted a reading of 8.7% — a reduction from last month’s 9.1%, but a far cry from the Fed’s target of just 2%.

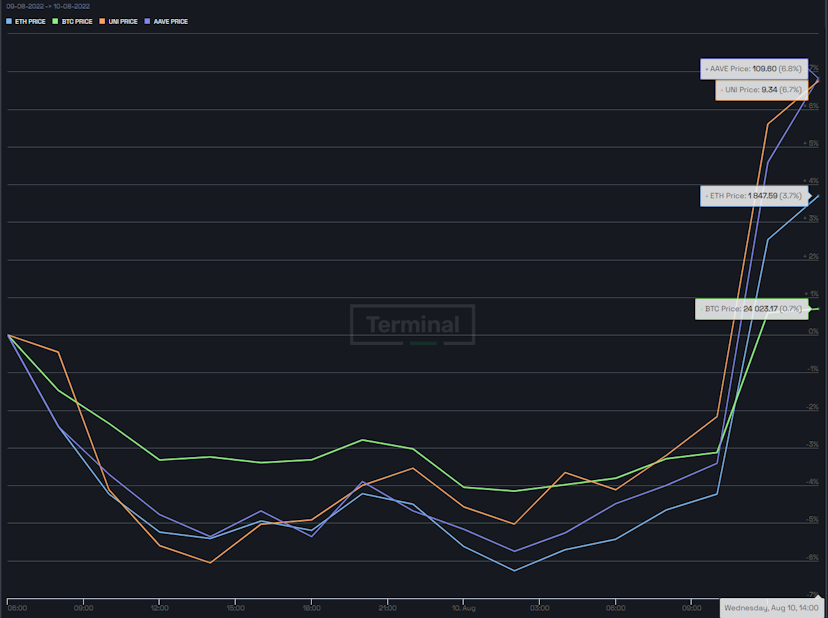

Ether surged 11.7% over 24 hours in early morning trading U.K. time, to $1,884, trouncing Bitcoin’s 6.4% uptick. Ether’s surge appears to also be driven by the completion of the Goerli testnet merge, the last major hurdle before The Merge takes place next month and shifts Ethereum network to a Proof-of-Stake consensus mechanism.

Source: The Defiant Terminal

DeFi stalwarts UNI and AAVE are up more than 13% in the past 24 hours.

The ETH/BTC ratio stands at 0.0769, a three-month high, as investors continue to favour the second-largest cryptocurrency by market capitalization ahead of the Merge, Ethereum’s transition to an eco-friendly proof-of-stake consensus mechanism.

Wall Street Traders Love The Merge… For Now

Some Investors are Betting Ethereum May Double When it Shifts to PoS

Fed Hikes

The issue of increasing inflation has dominated financial news in recent months, with the Federal Reserve hiking interest rates and the Biden administration introducing new taxes as part of the Inflation Reduction Act in a bid to curb inflation.

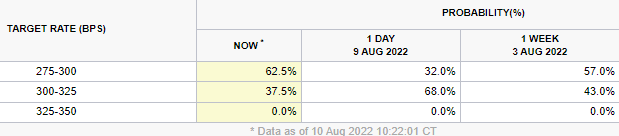

After the U.S. central bank indicated at its July meeting that it would consider further interest rate hikes based on economic data, cooling inflation numbers could mean a smaller increase in September. Indeed, the market is already pricing in a 0.5% hike rather than 0.75% after the data was released.

Source: CME FedWatch

Bear Market

Increasing interest rates and deteriorating macroeconomic conditions have been cited as a major contributing factor to the brutal Q2 2022 crypto downtrend. Reduced risk appetite among investors is believed to have contributed to Ethereum shedding more than 70% of its value to briefly trade below $1,000, according to The Defiant Terminal.

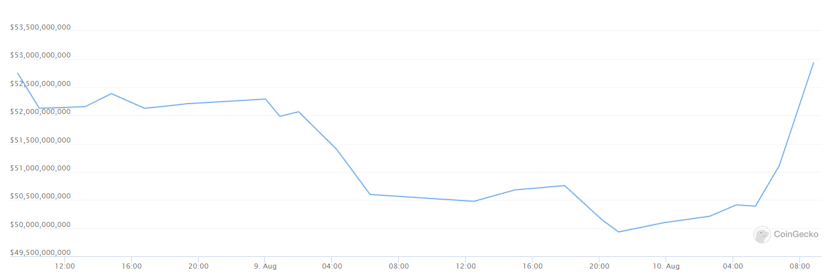

The combined capitalization of DeFi assets is up nearly 5% to $53.2B. Some of the day’s top gainers include decentralized options exhange Dopex — which is up 48%, and liquid staking protocol Lido — which rose 18.4%.

Combined DeFi capitalization over 24 hours. Source: CoinGecko.

Updated on Aug. 11 to report ETH performance and news on Goerli testnet merge.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.