DeFi Rates are Sliding Closer to TradFi Yields

DeFi’s borrowing and lending rates are trending downwards, opening questions of what will happen to open finance if yields converge with those of traditional finance. Borrowing rates for USDC have declined to 2.5% and 3.1% on Compound and Aave, from over 15% three months ago, according to LoanScan. Lending rates have suffered similar compression, with…

By: Owen Fernau • Loading...

DeFi

DeFi’s borrowing and lending rates are trending downwards, opening questions of what will happen to open finance if yields converge with those of traditional finance.

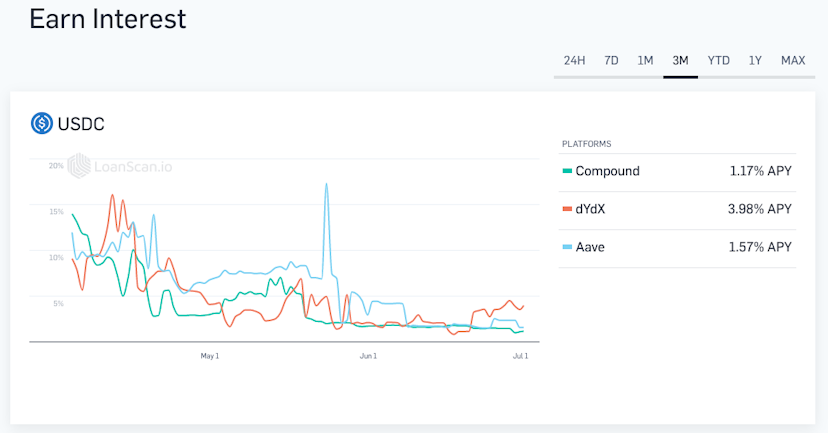

Borrowing rates for USDC have declined to 2.5% and 3.1% on Compound and Aave, from over 15% three months ago, according to LoanScan. Lending rates have suffered similar compression, with yields on the stablecoin dropping to 1.2% and 1.6% on the respective lending protocols in that period.

USDC Lending Rates. Image source: LoanScan

Borrow rates are the cost of capital. Just like in traditional finance, users borrow capital at certain rates. The flip side of this is the supply, or the rates users get for lending out their crypto. Borrow and lend rates move in tandem, with lending rates usually below borrow rates.

Lower rates mean it’s cheaper to borrow crypto, which is good for borrowers, but not as good for lenders, who, earlier this year, were regularly able to deposit their crypto in exchange for higher yields, sometimes in the double-digits. Now those rates barely reach over 1%.

MakerDAO, the second-largest lender, according to a Dune Analytics dashboard, cut borrow rates on its DAI stablecoin to 3.5% from 5.5%, according to LoanScan.

Unlike Aave and Compound Finance, which control borrow rates algorithmically, Maker depends on governance votes to dictate rates. Maker governance also has a proposal live to further lower rates across all vaults. Vaults are where users park collateral in order to generate DAI. Users must pay the interest rates, called Stability Fees in Maker’s system, in order to borrow. Voting is restricted to holders of Maker’s MKR tokens and will close tomorrow.

MakerDAO’s lower rates has users like PaperImperium concerned that the rate changes will make the protocol “unprofitable on an operating basis,” as they wrote on MakerDAO’s forum.

DAI Lending Rates. Image source: LoanScan

Why Down?

Rates are dropping partially because more stablecoins are entering the DeFi ecosystem, said State.eth, a pseudonymous crypto user who works on “governance stuff” at Aave. This pushes rates down because, as stablecoin supply in lending protocols goes up, the price of borrowing them goes down.

Econ 101 says that increased supply leads to lower prices. The “price” in this context is simply the borrow rate, the cost of capital. So higher stablecoin supply brings down the price here too, with the price being the borrow rate.

Also, “the basis trade on CEXs [centralized exchanges] is now 0% so that money went into DeFi,” according to State.eth. What that means is that people no longer want leverage via centralized exchanges, so users have brought their assets into DeFi to realize yield. Effectively this is a subreason to the first — stablecoin supply is increasing.

And thirdly, borrow rates are decreasing “because some of the tokens rewarded in liquidity mining have gone down,” State.eth said. Projects like Compound offer their own native COMP token to reward users who both borrow and lend. As the value of the rewards token drops, so do the yields.

TradFi Compression

The 10-year Treasury note, the most widely tracked government debt instrument in finance, sits at a borrowing rate of 1.48% at the time of writing, only about two percentage points lower than DeFi.

Scott Lewis, co-founder of DeFi Pulse, has a positive spin on the convergence of DeFi yields with traditional finance. Lewis called this trend “the coupling” on Twitter, saying that many more organizations will want to borrow in open finance if rates are comparable to TradFi, which will attract more liquidity to the ecosystem. It’s “how decentralized finance eats traditional finance,” he wrote.

The flip side of course, is lenders are getting lower yields.

Window Closing

As for the future direction of borrowing and lending rates, State.eth said, “it depends on if we go back full swing into a bull market or not.” A bull market would increase demand for loans as assets’ price gains outweigh interest rate payments, in turn driving rates back up again.

However, with the speed at which money appears to be entering the space, the increased stablecoin supply may make it so DeFi never quite sees the consistent 10% plus yields of the last year. As the investor going by the handle UncommonYield said of the converging DeFi and CeFi rates, the “opportunity window is closing.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.