CZ Zings Genesis-Gemini Fracas With Vow to Protect Customer Assets

CZ Addressed Concerns about Binance and the Market

By: Edward Robinson • Loading...

CeFi

Changpeng Zhao, the founder and CEO of Binance, said Wednesday that he would never let his exchange expose itself to the stress now engulfing two other major crypto players — Gemini and Genesis.

“We do not move control of customer assets to third parties,” Zhao, who is known as CZ, said in a fireside chat at the CfC St. Moritz crypto conference in the swank Swiss ski resort town. “We didn’t stake in Genesis — that we didn’t touch. We are never going to give another party control over our assets, otherwise we will be liable for them.”

Critical Piece

Even so, questions are swirling around Binance, the No. 1 global crypto exchange with $11B in daily trading volume, as the market copes with the fallout from the FTX meltdown in November, and now the news that conglomerate DCG is under investigation by U.S. prosecutors. DCG controls Genesis, a lending platform that froze customer withdrawals two months ago.

In December, crypto data firm Nansen reported Binance sustained $3B worth of withdrawals in a one-week period. On Tuesday, Forbes reported that customers withdrew a net $360M from the exchange. The company’s flagship BNB token is up 13% in the last seven days compared to a 10% uptick in Ether, according to CoinGecko.

In a far ranging interview, Zhao sought to address many of those concerns. He said Binance was profitable and committed to employing best practices to run a critical piece of the $857B cryptocurrency market’s infrastructure.

‘We didn’t stake in Genesis — that we didn’t touch. We are never going to give another party control over our assets, otherwise we will be liable for them.’

CZ

“It is very important for exchanges to hold one-to-one reserves because the market is too volatile, and proof of reserves is very important,,” Zhao said.

For many of the investors gathered for this annual conference, trust and proof of reserves has become a top priority as the industry struggles to rebound from the worst year since Bitcoin hit the market 14 years ago.

CZ talks Binance with Nicolo Stohr, the CEO of CfC St Moritz. Credit: Andrea Furger

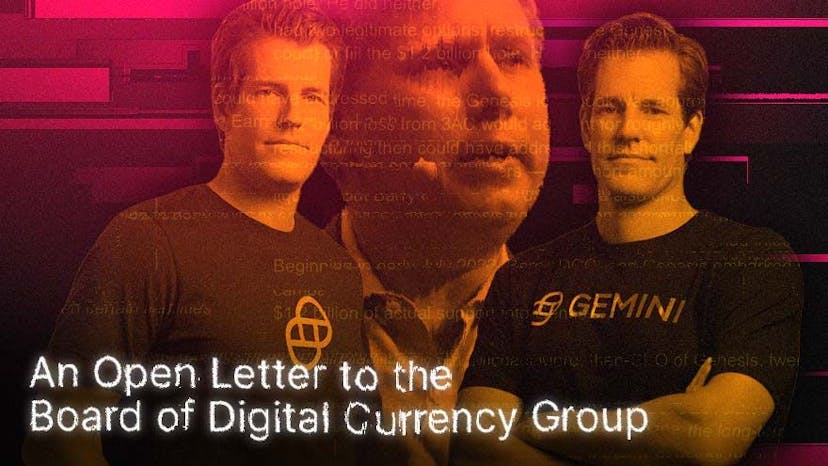

Concern that DCG may be the next domino to fall is a hot topic, especially after Cameron Winklevoss, the CEO of crypto trading firm Gemini, publicly accused Barry Silbert, his counterpart at DCG, of accounting fraud on Tuesday. Winklevoss said Gemini is poised to sue DCG for not returning $900M in customer funds used as part of its Earn yield business.

No Central Bank

Zhao downplayed the series of failures that have whipsawed crypto since the fall of the Terra ecosystem last May. Unlike traditional finance, where central banks stand ready to rescue troubled lenders with taxpayer-funded bailouts, crypto operates in a far more Darwinian way. And Zhao said that’s how it should be.

“In crypto, there is no central bank to bail you out,” he told an audience of 300 rapt attendees. “Why prolong a failing organization? There is pain in the short term but good ones last, and not so good ones don’t. That’s a good thing. ”

Winklevoss and Silbert Trade Blows as Fraud Accusations Fly

DCG Boss Rejects Gemini CEO's Accusations of Accounting Fraud

One of Binance’s own pain points stems from increasing regulatory scrutiny. With U.S. law enforcement and regulatory agencies stepping up a crackdown on the industry, Zhao was careful to strike a conciliatory note toward greater oversight. Binance has drawn criticism for not domiciling in one locale like a traditional exchange and submitting to conventional licensing procedures.

Awkward Period

While Zhao vowed to preserve Binance’s unconventional model, he appears to be recognizing the regulatory reality now unfolding. “I am a decentralization advocate,” he said. “I want people to have the power to control their wealth and financial tools. At the same time we are in a transition phase of this industry, we have to integrate with banks, and we have to get licenses.”

Sea Change

The pressure is bound to ratchet up in the year to come. The U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission are just two of the agencies bearing down on crypto firms to register their offerings, conform to disclosure rules, and perform customer identity checks. That’s a sea change for outfits like Binance that have long sought to have no fixed headquarters.

“CZ seems sensitive to the changes in the regulatory wind and the sentiment in the retail public in terms of compliance, best practices, and proof of reserves, which has to include liabilities,” said Donna Redel, adjunct professor of blockchain digital assets at Fordham Law School in New York. “If they are the largest exchange, shouldn’t they try and set best example to get global consumer confidence?

Updated on 11 Jan with comments by Donna Redel.

Updated on 11 Jan with BNB price data.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.