Crypto Rallies As US Debt Ceiling Talks Continue

Beacon Chain Withdrawal Queue Briefly Clears, Ether Jumps 3%

By: Samuel Haig • Loading...

Markets

Crypto markets have started the week in the green, with Ether up nearly 3% at $1,860.

Render (RNDR) is up 13% today and 60% in the past two weeks amid speculation that Apple’s rumored VR headset will leverage its decentralized graphics processing network. Kava, a Layer 1 blockchain that uses a co-chain architecture to offer compatibility with the Ethereum and Cosmos ecosystems, rallied 8%.

Only five of the top 100 digital assets have posted losses of greater than 1% over the past 24 hours, according to CoinGecko.

ETH last changed hands for $1,860 after tagging $1,875 earlier on Tuesday, according to The Defiant Terminal.

Notably, crypto is showing signs of resilience despite major stock markets like the S&P 500 and Nasdaq losing over 1% today. The US dollar remains firm as debt ceiling negotiations continue.

Staking Boom

Ethereum is riding momentum from its Shapella upgrade six weeks ago, which activated staked Ether withdrawals for the first time. Following an initial spate of withdrawal requests, the queue for withdrawals briefly hit 0, according to Wen Merge.

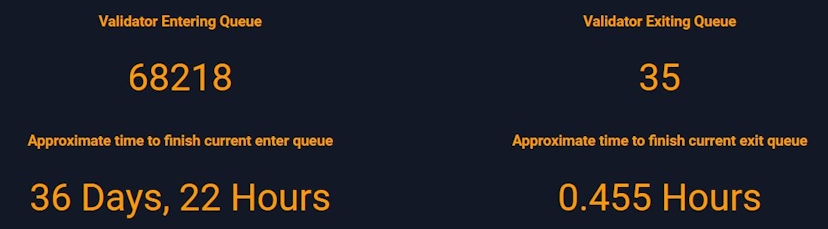

Meanwhile, the queue for onboarding validators has swelled to more than 68,000, meaning that one would need to wait for over a month before joining the network.

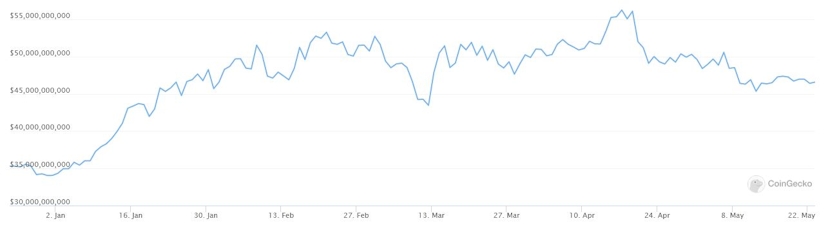

According to Nansen, ETH locked up for staking is up by more than 8% since Shapella went live, at close to 21M. The data indicate that newly onboarded stakers and existing validators re-staking previously accumulated rewards have already offset the ETH withdrawn from the Beacon Chain. Ether has rallied 55% this year.

Memecoins

Ethereum’s burn rate remains high as memecoin traders continue to drive elevated rates of on-chain activity. Nearly 60% of all Ether destroyed since the Merge was burned over the past 30 days, according to Ultra Sound Money.

Pizza Scams

The memecoin flavor of the week appears to be pizza, with opportunistic scammers whipping up multiple rug-pulls on Bitcoin Pizza Day. On May 22, 2010, Laszlo Hanyecz, a programmer and early Bitcoin adopter, paid 10,000 BTC (worth over $270M today) for two pepperoni pizzas to demonstrate Bitcoin’s potential as a means of payment.

In 24 hours, four of 14 pizza-related meme tokens were confirmed to be rug pulls, according to Dextools. A further five are believed to be honeypots, which are tokens which can be purchased but not sold. The scams are estimated to have raked in over $200,000.

DeFi

The combined market capitalization of DeFi assets is down on the month but up 37% year-to-date, currently sitting at $46.6B after starting May at $50B.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.