Major CRV Trade on Aave Leaves Money Market With $1.6M in Bad Debt

Trader Had Warned Aave of 'Trading Strategy' Last Month

By: Owen Fernau • Loading...

DeFi

The Curve wars have become the Curve games.

After warning of a trading strategy which could leave Aave with bad debt last month, trader Avraham Eisenberg has put his plan into action. The results have been mixed, but the trader’s actions ultimately left Aave, one of DeFi’s largest protocols with $4.1B in total value locked (TVL), with $1.6M in bad debt.

The fact that Eisenberg could push Aave to suffer a shortfall event has the community scrambling to bulletproof the DeFi protocol. One such proposal on Aave’s governance forums suggests that the protocol make its risk parameters more conservative.

Eisenberg’s attack on Aave comes after a successful $116M exploit of the Mango Markets lending protocol in October, which he dubbed a ‘profitable trading strategy’.

The trader made his initial move on Nov. 13 when he deposited roughly $39M of USDC into the DeFi lender.

A day later, Eisenberg began to borrow CRV, the governance token of Curve Finance, a leading decentralized exchange (DEX), using his USDC as collateral.

Eisenberg then swapped the borrowed CRV repeatedly for more USDC and looped his already large position through four separate transactions on Nov. 22, according to Etherscan.

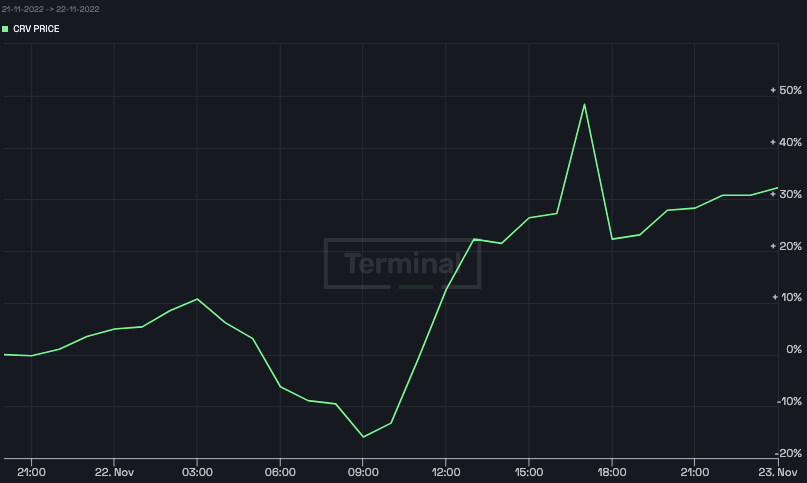

The price of CRV initially dropped as the trader sold the tokens en masse. An oddly-timed release of Curve’s stablecoin coincided with a reversal in CRV’s price — after the drop, CRV is up 35% in the past 24 hours, according to The Defiant Terminal.

Bad Debt

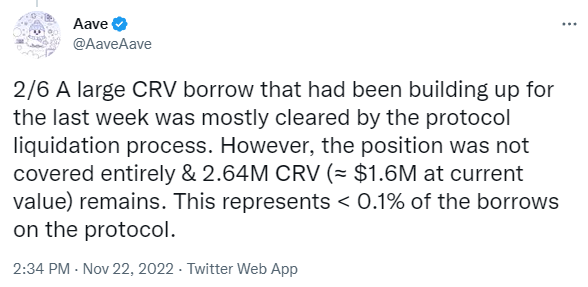

This raised the value of the borrowed CRV relative to the collateralized USDC, which led to the position getting liquidated but also saddled Aave with $1.6M of bad debt.

“The Aave ecosystem was built with a number of mechanisms that the Aave community can deploy to cover events like this,” the protocol’s Twitter account posted, citing the Safety Module, which is an incentivized pool of locked AAVE tokens to be used to cover shortfalls, as one of the main tools which the community has to deal with bad debt.

As has been the theme throughout recent market turbulence, the crypto action which happens on-chain using open-source protocols is transparent and easy to follow.

The ambiguity of Eisenberg’s intentions stems from his potential actions on centralized exchanges. The trader may have taken an offsetting long position in CRV on centralized exchanges, anticipating an increase in the token’s price.

The increase came partially because, in order to liquidate a position, a liquidator must pay back the borrowed token, CRV in this case. And of course, in order to do this, a would-be liquidator would need to buy CRV, driving up the price.

Eisenberg may also have been shorting the AAVE token while attempting to stick the Aave protocol with bad debt, a theory proposed by well-known crypto investor Jason Choi. If this was the strategy, it hasn’t been successful so far — AAVE is up 2% in the past 24 hours, according to The Defiant Terminal.

Illiquid Assets

People are wondering in Aave’s Discord whether it’s possible that an attacker may try a similar trade again. As a token like CRV isn’t that liquid, a trader can take a significant portion of the asset off the market by borrowing against some other form of collateral as Eisenberg did. This makes the asset required to liquidate a position more scarce, and that scarcity means that purchases will drive up prices much faster.

“There is a risk here which is what the attack targeted, but it’s not a risk specific to DeFi protocols,” Zachary Lerangis, COO at crypto research firm, Arkham Intelligence, told The Defiant. “The risk comes from loans in volatile assets with low liquidity. This kind of liquidation risk exists for any lender, not just on DeFi, and Aave showed robustness in not incurring significant damage in this case.”

Gauntlet Proposal

In response, Gauntlet Network, which bills itself as “the financial modeling and simulation platform for blockchain,” and works with Aave, has produced a governance forum post proposing that the protocol freeze 17 markets for tokens like YFI, the token for the yield aggregator Yearn Finance, as well as stablecoins like Synthetix’s sUSD.

The post cites an abundance of caution and a volatile market as motivating factors.

Others like Teddy Woodward, co-founder of the fixed rate protocol, Notional, are noting what he sees as a problem with the design of Aave V2, the version of the protocol Eisenberg used to carry out his trade.

“On Aave, your collateral ratio only depends on the asset you post as collateral, not the asset you borrow,” Woodward tweeted. “Because[Eisenberg] posted USDC, Aave thinks his position is ‘safe’ even though he borrowed a volatile asset.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.