Celsius Partner Details Inner Workings of 'Ponzi Scheme' in Lawsuit

Asset Manager Claims Celsius Engaged in 'Gross Mismanagement' of Deposits

By: Samuel Haig • Loading...

DeFi

The crisis engulfing Celsius, the embattled centralized crypto lending platform, took a strange turn on July 7 when a former partner that helped manage assets for the firm accused it of running a “Ponzi scheme.”

In a lawsuit filed in New York Supreme Court, KeyFi Inc., a New York-based asset management firm, pulled back the curtain on the inner workings of Celsius, a company that manages $11.8B in assets and rocked the market last month when it blocked customers from withdrawing their crypto deposits.

‘Gross Mismanagement’

KeyFi claims Celsius engaged in the “gross mismanagement of customer deposits” and failed to pay it millions for asset management services.

The suit argues that Celsius used customer deposits to engage in risky trading strategies while falsely claiming to be hedging against potential losses. It also alleges that customer funds were used to manipulate the price of Celsius’ CEL token, which rallied 11,400% between March 2020 and June 2021, according to CoinGecko.

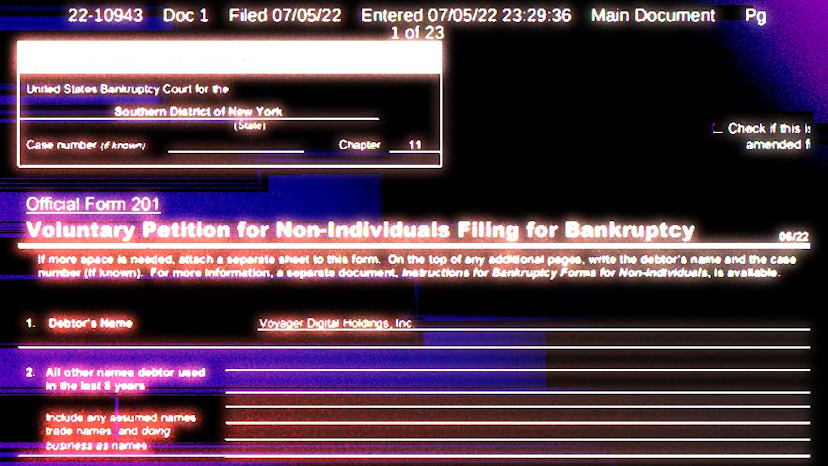

Voyager Delivers Painful Lesson on Perils of Counterparty Risk in Bankruptcy Drama

Voyager Delivers Painful Lesson on Perils of Counterparty Risk in Bankruptcy Drama

Exposure to Three Arrows Sinks Crypto Exchange as Dominoes Fall

“These issues… caused harm not only to the Plaintiff, but the hundreds of thousands of people who use Defendant’s platform, as Defendants are now refusing to honor requests by its customers to withdraw the assets they deposited and entrusted with Defendants,” the lawsuit says.

It goes on to contend that Celsius “was operating a Ponzi scheme.” Celsius did not immediately respond to a request for comment.

Blowing the Whistle

On Thursday night, the Twitter prominent account “0x_b1” outed itself as belonging to Jason Stone, KeyFi’s chief executive and the individual previously managing customer funds on behalf of Celsius. The lawsuit caused a stir on social media and many respondents criticized Stone for not blowing the whistle.

“Don’t you think you should have spoken out earlier. Knowing innocent people’s funds [were] at risk,” tweeted galaxyblu3.

‘These issues… caused harm not only to the Plaintiff, but the hundreds of thousands of people who use Defendant’s platform.’

KeyFi lawsuit

Elliotthereum chimed in that Stone “could’ve informed retail through anon accounts to whistleblow on this matter. Kinda hurts to see you guys knew from 2021 this was no bueno and decided to not seek outreach.”

Stone says he began deploying DeFi and staking strategies for Celsius in mid-2020. According to the lawsuit, Celsius “had no unified, organized, or overarching investment strategy other than lending out the consumer deposits they received” at the time. The two firms entered into an unusually informal arrangement.

Handshake Deal

In the suit, KeyFi says Alex Mashinsky, the founder and CEO of Celsius, invested “tens of thousands of dollars” in KeyFi in 2019 and 2020. KeyFi and Celsius entered into a “handshake deal” in which KeyFi managed “billions of dollars in customer crypto deposits in exchange in return for a share of the profits generated from those crypto deposits,” the complaint states.

KeyFi and Celsius agreed to “deal with each other honestly and squarely and settle up who owed what to whom at some later date,” the complaint says.

Impermanent Loss

Stone said KeyFi proceeded to terminate its relationship with Celsius in March 2021 following a series of discoveries. While Celsius had claimed to be hedging against potential fluctuations in token prices and impermanent loss resulting from liquidity provision, Stone said he became aware that Celsius’s $2B client portfolio “had naked exposure to the market” in February 2021, and that Celsius lacked “basic security controls to protect the billions of dollars in customers’ funds they held.”

Stone said that after these realizations, KeyFi began to terminate its relationship with Celsius, and the subsequent unwinding of positions resulted in Celsius realizing significant “impermanent losses,” which are losses caused by exchange rate volatility in the underlying assets for liquidity provider positions.

He also said that Celsius logged customer deposits as USD-denominated liabilities from 2018 through 2020 despite paying out clients in the underlying tokens they provided. This resulted in “a substantial hole in its accounting.”

KeyFi also claims that a $1B loan provided to Celsius by centralized stablecoin issuer, Tether, was used to cover up that Celsius had become “balance sheet insolvent with less money in its coffers than it owes its depositors.”

‘Good Luck With That’

The suit is bound to enflame passions on social media as Celsius scrambles to save itself. On July 7, Celsius paid back $41M in DAI it had borrowed from MakerDAO. Since July 2, Celsius has paid back a total $190M in DAI to Maker.

Many observers lashed out at Stone. “So you promoted yourself as a professional trader to Celcius and traded Celcius client money into oblivion t[h]rough s***ty trades, and now sue Celsius because they don’t want to pay you for wasting their clients funds… Good luck with that,” said BitMax14.

Others applauded Stone.

Thisiswenzel said “thanks for coming forward. Very interesting read and I’m curious how this will end (in court).”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.