Bitcoin and Ethereum Hash Rates Hit All-Time Highs Despite Bear Market

Cryptocurrency miners continue to pump computing power into the Ethereum and Bitcoin networks despite their tokens’ recent price drop.

By: Aleksandar Gilbert • Loading...

DeFi

Cryptocurrency miners continue to pump computing power into the Ethereum and Bitcoin networks despite their tokens’ recent price drop.

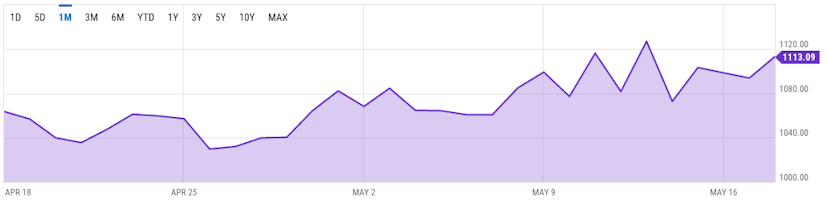

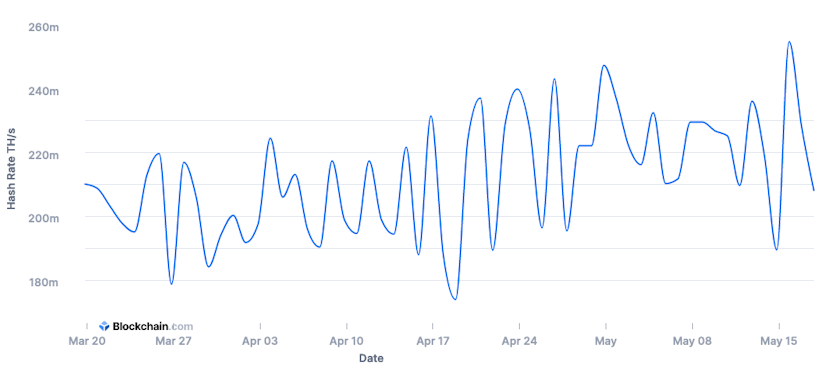

The hash rate for Ethereum hit an all-time high on May 13, when it topped out at more than 1,126 terahashes per second, according to ycharts.com. Bitcoin’s hash rate peaked two days later at over 254 million terahashes per second, per blockchain.com.

Ethereum Hash Rate. Source: ycharts.com

Bitcoin Hash Rate. Source: blockchain.com

Mining Remains Profitable

As of Thursday morning, Ether and Bitcoin have both fallen almost 60% from their all-time highs of $4,878 and $69,044 respectively.

Nevertheless, the miners that validate transactions on the Ethereum and Bitcoin networks continue to find profit in the work, said Will Foxley, content director at Compass Mining.

“Hashrate is just going after potential revenue from mining, and as long as there is a gap between the cost (of mining) and potential revenue and profit,” he said, “you’re going to see hash rate continue to climb.”

The hash rate is the computational power used to validate blockchains; the higher the hash rate, the more secure the network since more validators are securing the network. This makes a so-called 51% attack much harder to execute as a malicious actor would need to control a majority of the hashing power.

As data from the past week shows, the blockchains’ hash rate is “divorced from the market.” – until a point.

“That point is where the cost to mine bitcoin, or the cost to mine Ethereum, is near equivalent to the spot price,” Foxley said. “For Bitcoin, you can still mine a Bitcoin for a few thousand dollars cheaper than it costs to purchase it at spot – depending on your machine.”

The same goes for Ethereum. In fact, mining Ethereum – i.e. dedicating computing power to validate transactions and secure the network – has been more profitable than bitcoin for much of the past year due to the former’s meteoric bull run. While the token is down substantially from its all-time high, it’s up more than 1,400% since the beginning of 2020.

The Merge

Despite Ether’s rise over the past two years, it is “a little” surprising that miners continue to contribute computing power to its network, Foxley acknowledged. After all, when the system switches later this year from the current proof-of-work consensus mechanism – which requires ever-greater computing power – to the proof-of-stake mechanism, which does not, all those video cards purchased to mine Ether must be repurposed.

But there’s a reason for Ethereum miners’ dedication.

“Ether miners don’t really care if they have net loss on their GPU, because that Ether as an asset can also create yield and pay off your miner in a different way,” he said. “If I was an Ethereum miner, think of all the places I could have earned yield for my Ether over the last two years. I could have farmed it a million different places and got a return on that … there are more places to put your capital to work.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.