Binance to Take Over FTX After Insolvency Concerns Spark Market Rout

Binance Agrees to Bail Out Rival After FTT Token Collapses

By: Aleksandar Gilbert • Loading...

Markets

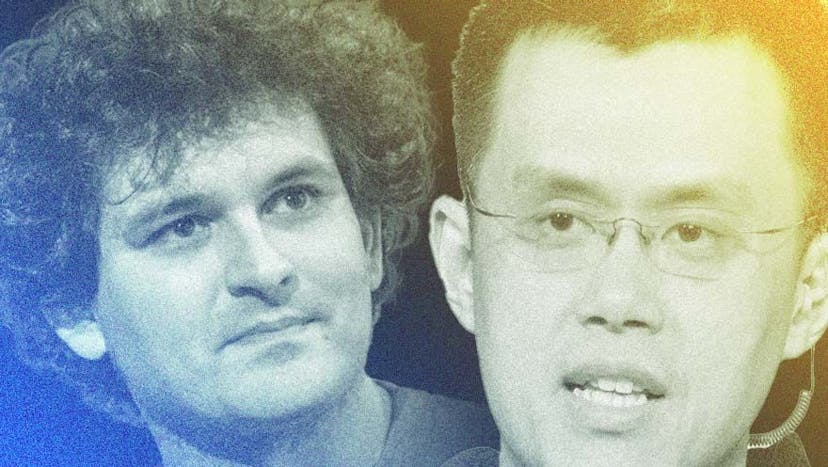

Binance, the world’s largest crypto exchange, plans to execute an emergency takeover of FTX, the crypto derivatives platform that has been hit with a crisis of confidence as its FTT token lost more than a quarter of its value on Monday, Changpeng Zhao, Binance’s CEO, said in a Twitter thread Tuesday.

Fears had mounted that FTX and its sister company, Alameda Research, did not have enough liquidity to cover its trading positions and debt obligations.

Liquidity Crunch

Zhao said FTX had asked for its help on Tuesday. “To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch,” Zhao, better known as CZ, tweeted just after 11 a.m. New York time. “We will be conducting a full DD [due diligence] in the coming days.” An LOI is a Letter of Intent to acquire a company.

No terms for the deal have been disclosed. FTX was valued at $32B following a fundraising round in January, according to TechCrunch.

Zhao had actually put pressure on FTX, which did $13B in trading volume yesterday, over the weekend by announcing Binance would start dumping its FTT position over the next few weeks. Binance had been an equity investor in FTX but sold its stake last year, pocketing $2.1B in BUSD and FTT tokens.

FTT and Binance’s BNB token rallied after the announcement, jumping 26% and 12%, respectively. Ether and Bitcoin rose 7% and 3%, respectively.

In his own announcement, FTX founder Sam Bankman-Fried said things had come “full circle.”

FTX Hit By $1.2B in Withdrawals as Confidence Wavers in Exchange Giant

Binance's Move to Sell FTT Position Triggers 22% Plunge as FTX Scrambles to Shore Up Liquidity

“FTX.com’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance forFTX.com,” he tweeted. “I know that there have been rumors in media of conflict between our two exchanges, however Binance has shown time and again that they are committed to a more decentralized global economy while working to improve industry relations with regulators. We are in the best of hands.”

The deal would not impact FTX’s US business, which is a separate entity, Bankman-Fried added.

Dynamic Situation

Binance has the discretion to pull out of the deal at any time, according to CZ.

“There is a lot to cover and will take some time. This is a highly dynamic situation, and we are assessing the situation in real-time,” he tweeted.

Crypto Twitter exploded with incredulous, and angry, reactions to news of the deal.

“Liquidity crunch. I thought your deposits were backed 1:1,” tweeted Dylan LeClair, a senior analyst at UTXO Management. “Or was your ‘proprietary trading desk’ directionally trading using user funds?”

Ari Paul, the CIO of BlockTower Capital, questioned why an FTX bail out was necessary for liquidity when customer deposits can’t be legally lent out. “I’ll be curious to learn from forthcoming details,” he tweeted. “I’d suggest one question for the industry at this point – if same happens with Binance, who backstops?

Ambassador

The shock deal is a dramatic turnabout for Bankman-Fried, a billionaire who has styled himself as an ambassador for the cryptocurrency industry and tried to be a bridge to the world of traditional finance, as well as Washington D.C.

An MIT-educated physicist, Bankman-Fried got his start in TradFi as a trader of exchange-traded funds. He founded Alameda Research as a quantitative hedge fund in 2017. Two years later he set up FTX in Hong Kong and it quickly became a powerhouse in the crypto derivatives markets.

Last spring, the 30-year-old entrepreneur co-hosted the glitzy Crypto Bahamas Conference with Anthony Scaramucci, the hedge fund impresario. Among the highlights, Bankman-Fried moderated a discussion on global affairs with former U.S. President Bill Clinton and Tony Blair, the former prime minister of the U.K.

Yet FTX’s fortunes unraveled rapidly after CoinDesk published a story on Nov. 2 reporting that Alameda Research, a crypto hedge fund, had 40% of its balance sheet tied up in FTT instead of an independent asset such as Bitcoin or the U.S. dollar. In crypto, just as in the rest of finance, confidence is the lifeblood of major players and soon as skepticism arose about the true strength of Alameda and FTX the token came into question and triggered a classic run on the bank.

On Tuesday, The Defiant reported that FTX’s reserves were under siege as investors withdrew $1.2B worth of Ether and ERC-20 in a 24-hour period, and only $540M of deposits came in.

Bragging Rights

As for Zhao, the deal seals a huge victory and major bragging rights in the clash of crypto titans. Born in China, he moved to Canada at an early age and studied computer science at McGill University. Prior to founding Binance in 2017, he worked for OKCoin, Blockchain.info and Bloomberg Tradebook. He’s currently ranked 75th on Bloomberg’s Billionaire Index with a reported net worth of $18.3B.

The trouble started last week after CoinDesk’s report raised eyebrows among investors.

According to an Alameda document reviewed by CoinDesk, FTT accounted for $5.8B or 40% of Alameda’s $14.6B balance sheet as of June 30. FTT’s circulating supply was valued at $3.3B on that date, according to CoinMarketCap, meaning that more than a third of Alameda’s assets were tied to a position that may be too big to sell without crashing the market.

SBF Replies to 'Constructive Feedback' on His Regulatory Proposals

FTX Honcho Roiled DeFi With Proposed 'Industry Norms'

While FTX and Alameda had commanded a lot of respect in the marketplace there was a nagging vibe that there wasn’t a lot of transparency between their symbiosis. Many major players in TradFi and DeFi have been undone by relying too heavily on one asset to underpin balance sheets and debt obligations, as well as trades in the derivatives market. If Alameda was doing the same thing with a fabricated currency like FTT, that was worrisome.

Fear and Selling

When CZ announced Binance would sell the entirety of its FTT holdings, citing the CoinDesk report, that triggered fear and selling.

Meanwhile, FTT began to plummet in value, dropping from $22 per token midday Monday to about $17 Monday night, where it held steady for several hours. Observers suggested FTX was selling its reserve of SOL tokens in order to raise capital with which it could buy FTT, keeping the latter’s price from dropping further.

“Kinda telling that the moment FTT is flirting with that $22 line the infinite SOL $30 bid drops away. Decisions were made,” Adam Cochran, of Synthetix, tweeted.

Piling on Shorts

LeClaire said FTX’s behavior resembled “an emerging market central bank attempting to defend its currency against speculators right now.”

“Okay, so you can absorb $500 million of spot selling of your own token from CZ, great,” he added. “But can you absorb all of the speculators on Binance piling on short on the suspicion that you’re leveraged?”

Withdrawals

FTT eventually fell to $14.60 Monday morning. Sol fell from $32 per token to about $25 per token.

Early Monday, FTX’s international hot wallet stopped processing customer withdrawals, according to The Block.

Bankman-Fried and Alameda CEO Caroline Ellison had declined to talk comment to CoinDesk in the original article, the publication said. But they scrambled on Twitter to deny what they characterized as rumors there was weakness in Alameda’s model. Ellison insisted the document reviewed by CoinDesk only covered “a subset of our corporate entities.” Bankman-Fried accused “a competitor” of “trying to go after us with false rumors.”

“FTX is fine,” he tweeted. “Assets are fine.”

Systemic

But that did not assuage depositors, who began a run on the exchange. And now FTX, which had bestowed its name on the Miami Heat’s arena and advertised in the mainstream publications such as The New Yorker magazine with the likes if supermodel Gisele Bundchen, will be owned by its archrival.

While investors may breathe a sigh of relief that FTX has been stabilized, some market veterans warn that the risks of catastrophic failure haven’t gone away. Timo Lehes, a co-founder of Swarm, a Germany-based crypto exchange, said risk is now concentrated in Binance.

“The level of consolidation means Binance is now too big to fail,” Lehes said. “Its success is now crucial to the systemic operations of the crypto industry.”

— with reporting assistance from Tarang Khaitan, Owen Fernau, and yyctrader.

Updated on Tuesday with biographical information on Bankman-Fried and Zhao and details about FTX and Alameda’s positions.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.