Betting Market for Arbitrum Airdrop Surges Before Announcement

A key indicator shows traders started aggressively betting Arbitrum’s ARB token would be airdropped hours before the token distribution was announced. On March 15, a day before the airdrop went public, traders on prediction market Polymarket started placing more bets that the airdrop would happen before March 31. “Yes” shares spiked as high as $0.72…

By: Owen Fernau • Loading...

DeFi

A key indicator shows traders started aggressively betting Arbitrum’s ARB token would be airdropped hours before the token distribution was announced.

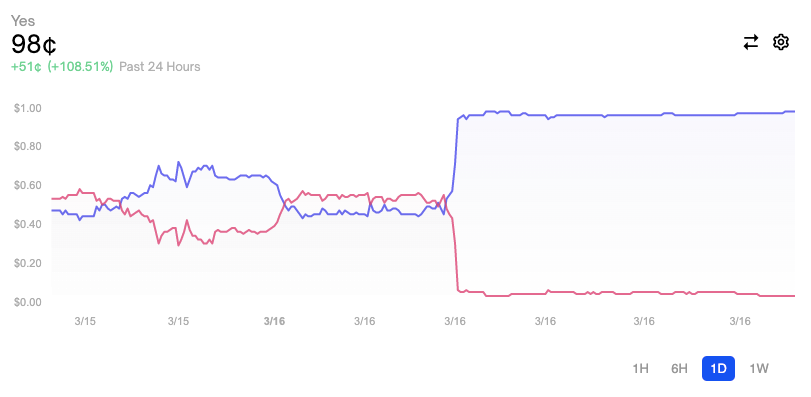

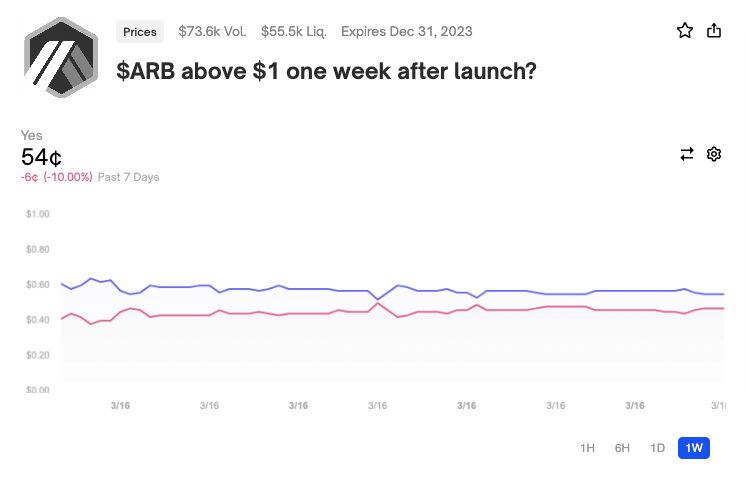

On March 15, a day before the airdrop went public, traders on prediction market Polymarket started placing more bets that the airdrop would happen before March 31. “Yes” shares spiked as high as $0.72 after sitting as low as $0.17 cents four days previously.

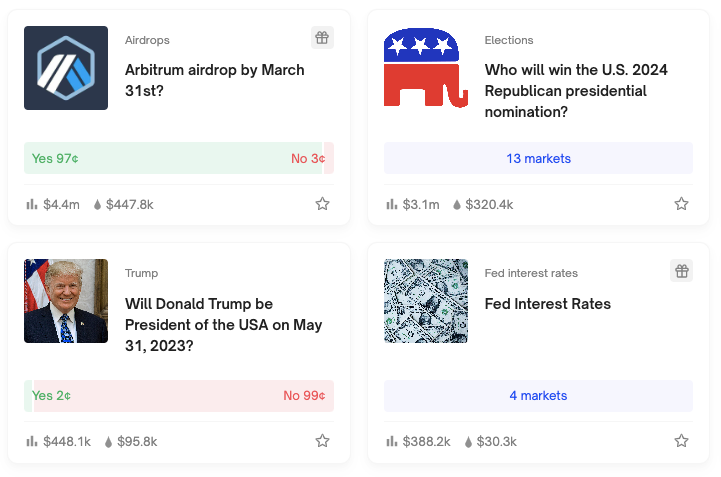

At $4.3M, the Arbitrum airdrop bet is easily the open market with the highest total volume in Polymarket history, according to Polymarket Whales, a data site dedicated to the prediction market. The second-most active market is on whether Donald Trump will win the 2024 Republican nomination, at about half the volume.

The bets are sparking speculation that there may have been traders who knew of the airdrop announcement before the general public and were able to profit from that information.

With projects building in open source software, transactions happening in public blockchains, and distributed communities grouped under the “DAO” label making key decisions, crypto is more transparent but also lends itself to information asymmetry. Those who are involved in governance decisions or have the technical skills to understand on-chain movements, can leverage that knowledge to make trades before announcements are made.

Polymarket Whales shows four traders profited by $69,000 or more by betting on the timing of the ARB airdrop.

Potential Insider Trading

0xGeeGee, an anonymous trader, agreed some people were likely trading with non-public knowledge.

“It is what it is, obviously insider knowledge leaked,” they told The Defiant. The trader added that people had repeatedly bet on the rumor in previous months and had turned out to be wrong. “This is the game we’re playing anyway,” 0xGeeGee said.

The trader said they took a 60% loss, from holding “no” shares when the announcement was made, sending the shares from $0.45 to $0.03 as of Mar. 16.

0xGeeGee is correct to say that “yes” shares for the Arbitrum airdrop market have rallied before — on Mar. 6, the “yes” odds tripled before coasting back down below $0.20.

Twitter and Discord users following the project are also crying foul.

Polymarket allows users to bet on the outcome of a variety of future events like an election’s results, future interest rates, and developments in crypto.

Looking forward, another market on the ARB token is already gaining steam. This one may be a bit harder to game, as it involves ARB’s future price.

Still, 0xGeeGee thinks that if one is looking for a fair market, crypto may not be a person’s best choice. “It’s not a fair game, but crypto or trading is not a fair game ever,” they said.

[ CORRECTED on 3/21 @ 5pm to remove reference that said Amber Heard’s trial betting market was the biggest in Polymarket’s history]

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.