Aragon ‘Repurposes’ $177M Treasury Into Grants Program

Opportunistic Group Of Investors Blamed For So-Called Governance Attack

By: Samuel Haig • Loading...

DeFi

The Aragon Association has nixed a governance proposal seeking to transfer control of the project’s $177M treasury to its tokenholders, claiming the move will protect Aragon against a governance attack.

On May 9, Aragon announced it is repurposing its DAO and treasury into a grants program for developers building on top of its software.

“This is a response to a coordinated attack by the group known as ‘Risk Free Value Raiders’ who took down Rook DAO,” Aragon tweeted. “Last week, a coordinated 51% attack was launched on the Aragon DAO.”

Aragon’s depiction of events highlights one of the challenges that decentralized governance is yet to overcome. On one hand, smaller teams sitting on sizable treasuries are vulnerable to coercion from malicious actors who accumulate their governance tokens. On the other, projects’ core teams may be unwilling to give up control over governance and treasury assets to their communities, stymying decentralization.

But not everyone in the crypto community is convinced by the Aragon Association’s motives.

“Characterizing this as a gov attack is wrong because they’re proposing to distribute treasury pro rata (not benefiting themselves more than any other token holder),” said MonetSupply, a prominent web3 governance delegate. “If Aragon isn’t willing to operate as a real DAO, what does this say about their products and mission?”

“There is no treasury raid,” said DCF God, an alleged member of the RFV Raiders. “Just a proposal for buybacks as they’ve already done in the past with millions.”

“Where was the vote for this?” asked Snib.eth, an NFT collector.

Token Lags Treasury

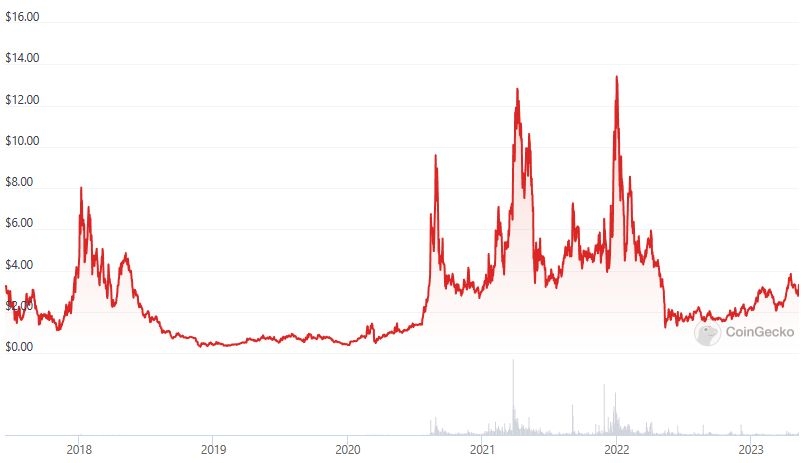

Aragon offers software for launching and managing DAOs on Ethereum. The project launched via an initial coin offering in 2017, securing a $25M treasury at the time. Aragon’s treasury assets have appreciated in value to $177M, but its native ANT token remains priced near its initial offering price.

“The value of ANT did not keep pace with the value of the treasury behind the project. This opened a significant vulnerability, which Aragon both understood and prepared for,” Aragon said, referring to its decision not to move Aragon’s treasury assets on-chain.

The Aragon Association said RFV Raiders are seeking to take advantage of Aragon’s treasury, claiming the group looks to exploit imbalances between the value of projects’ treasuries and governance tokens by buying up their native assets and manipulating governance to plunder reserves.

The association blames the RFV Raiders for attacks targeting Invictus DAO, Fei Protocol, Rome DAO, and Temple DAO. It said the group was responsible for dissolving Rook DAO and “liquidating half of its treasury for financial gain.”

'Suspicious Activity'

Aragon said its moderators identified a “sudden and suspicious uptick in Discord activity” on May 2.

Moderators concluded the activity was coordinated after an investigation and banned “a small group of users” for harassing protocol contributors and other ecosystem members on the forum. The association claimed that members of the Raiders group associated with the Rook DAO attack responded to the bans by rallying against Aragon on Twitter.

Aragon also accused Arca Capital Management, a digital asset-focused investment firm, of leading the charge. “Evidence suggests that Arca’s involvement is aimed at extracting value from Aragon for financial profit,” it said.

Arca Responds

Arca responded with an open letter to Aragon on May 2, claiming one of its researchers was banned alongside other tokenholders for “asking question[s] regarding the treasury transfer from the Aragon Association to the Aragon DAO.”

Arca said a governance proposal advocating for tokenholders to gain control over Aragon’s treasury was passed on June 17, 2022, which included plans for treasury assets to be transferred to the Aragon DAO in November 2022.

“These voted-on agreements have been ignored to date,” Arca said. “Now that ANT is trading at a large discount to the treasury value, we believe that it is necessary to allow tokenholders to find creative solutions to return value to the token while simultaneously allowing Aragon to continue building important DAO public goods. However, this cannot begin until the treasury transfer is further along.”

Governance Attack or Popular Vote?

Aragon said on-chain data revealed that Arca and other members of the group had been stockpiling ANT for several months. It claims that Raiders quickly moved to wrap their tokens following the Discord incident, giving them enough voting power to command a majority vote in governance proposals.

Aragon claims Arca and the RFV Raiders advanced a proposal on its governance forum “seeking delegation to manipulate ANT as a financial instrument for financial profit.”

The Aragon Association is based in Switzerland, where ANT is registered as a utility token in Switzerland. It said ANT specifically serves the utility of facilitating the use of Aragon’s technology.

“The actions undertaken by Arca and the other ‘RFV Raiders’ pose a number of risks to the safe governance of the Aragon DAO,” the association said. “These include: the legal risks to the utility classification of ANT, the violation of Swiss association law, as well as the legal stewardship obligations of the Aragon Association to the treasury.”

Arca said it planned to “work with other tokenholders to propose that Aragon continue the buybacks to return ANT to book value.”

Grants Program

The Aragon Association said its new grants program will fund developers building DAOs, dApps, and plugins on Aragon’s tech stack.

“This initiative ensures the Aragon treasury is allocated towards builders advancing Aragon’s mission to build tools that allow anyone to experiment with governance at the speed of software,” it said.

The association added it will progressively transfer funds to the grants program as needed following an initial 300,000 USDC transfer on May 2.

“Progressive decentralization is an ongoing process, and we are committed to move the treasury into the hands of ANT holders when it’s safe, for the purpose of advancing the project’s mission,” the Aragon Association said. “That said, these events have confirmed our conviction that no project can rush towards the ideals of decentralization at the expense of security.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.