All the Ways to Generate Passive Income With DeFi

There may be many hooks for a newcomer to start using decentralized finance or DeFi but it can be difficult to overlook the most attractive one — the fact that it is an open opportunity for anyone in the world with digital assets, a computer and internet to generate passive income. By committing their crypto…

By: Masha Prusso • Loading...

Research & Opinion

There may be many hooks for a newcomer to start using decentralized finance or DeFi but it can be difficult to overlook the most attractive one — the fact that it is an open opportunity for anyone in the world with digital assets, a computer and internet to generate passive income.

By committing their crypto assets into fairly safe decentralized protocols to grow their digital nest eggs in favor of what could potentially be riskier trading activities, crypto owners all over the world are earning annual percentage yields (APY) that are putting bank savings returns to shame.

Over the past three years, especially, the number of different ways that that one is able to perform these income-generation has grown from the basic interest-bearing lending platforms that kicked off the DeFi trend in 2019. Today, modern decentralized protocols and smart contract applications offer the DeFi user things like yield farming, staking, and lending, allowing them to accrue steady growth on their initial outlay.

Far from being a get-rich-quick scheme, DeFi earning does require patience and some careful consideration to avoid malicious protocols. However, because you still maintain control over the funds you do commit to DeFi, it is regarded as a relatively safe way to earn on crypto without the stress and worry that comes with the volatility of cryptocurrency trading.

In this article, we go over four of the most well-known DeFi activities that people are using to earn a passive income, along with practical examples. For the article to be useful, you should already know the basics of how to interact with cryptocurrency networks and are able to use a Web3 digital asset wallet like MetaMAsk with the Ethereum blockchain.

[Read: GETTING STARTED WITH DEFI for a primer]

It may also be helpful if you understand the concept of connecting your wallet to a decentralized exchange (DEX) or automated market maker (AMM) like Uniswap.

Method #1: Lending

Lending is perhaps the most recognized DeFi activity in the space, mainly because many of the early DeFi platforms like MakerDAO specialized in lending protocols. It’s a straightforward concept: you lend your digital assets to a platform by locking your assets into a smart contract. Borrowers may then access these assets as loans and pay back interest to the platform. Smart contracts distribute the interest accrued to lenders in proportion to what they lock in.

They are attractive because of their ease of use — you stake tokens to lock them for lending, and unstake them to take them back — and their high APYs relative to traditional interest bearing accounts with banks. Compound Finance, for instance, offers just above 8.1% APY. The other benefit is the reduced risk of default. Borrowers have to lock up collateral to borrow assets and these are bound by smart contracts that enforce interest repayments from the collateral if borrowers do not pay interest owed.

Method 2: Staking

As the term implies, staking involves the process of locking in digital assets into a smart contract. Many DeFi platforms also use “staking” as a means to open what is essentially a savings account on the blockchain. Like a savings account, your balance will accrue additional income, typically in the form of the same type of tokens or another token on the same blockchain.

Staking in crypto terminology originally derived from networks that ran on Proof-of-Stake algorithms, whereby those securing the network can validate based on how much of the total token supply they hold. The more you own and stake, the more important your vote.

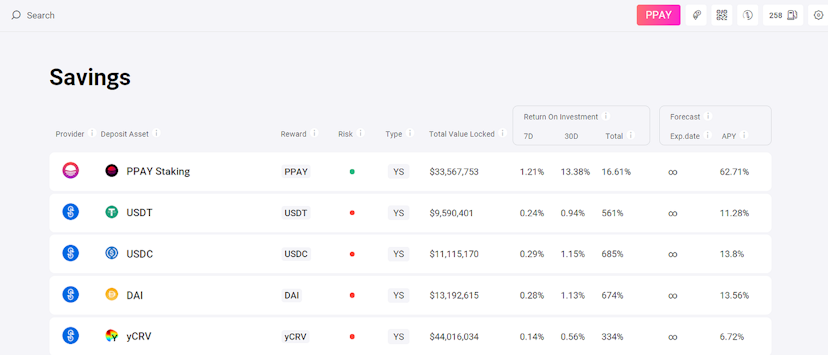

But for many DeFi tokens (mainly on Ethereum, which is not yet a Proof-of-Stake blockchain) , staking is simply a way to encourage users to lock their assets for the long term, with the network revenues shared with stakers as incentive.

Most DEXs with the AMM model offer options to stake their own native tokens — sometimes calling it a Savings option. Uniswap has UNI, Pancakeswap has CAKE, Plasma.Finance has PPAY, to name a few examples. These tokens generally earn a share of the revenue generated by all products and services provided by the platform (like fees from swaps on liquidity pools, for example). This is paid out as additional tokens when savings are unstaked.

Method #3: Become a liquidity provider

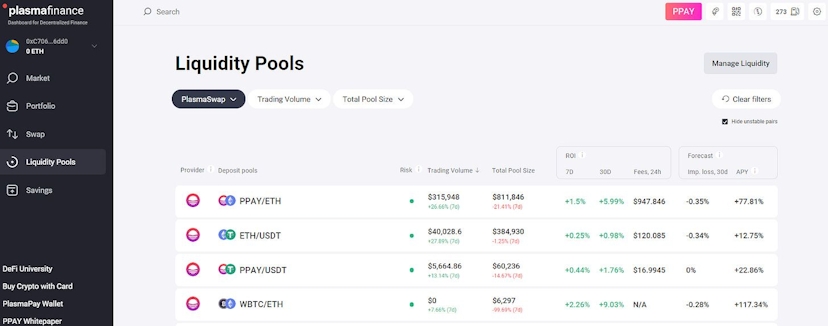

DEXs like Uniswap, Yearn and SushiSwap are popular today because of their automated market maker (AMM) protocols that do away with the need of order books as in traditional exchanges. Instead, they create liquidity pools made up of equal value of token pairs — these now form the very basis for trading markets on decentralized exchanges.

These liquidity pools are public — anyone can provide liquidity to these pools by locking in equal values of particular token pairs. For example, in an ETH/USDT liquidity pool, you can contribute $3000 worth of liquidity by providing $1500 in ETH and $1500 in USDT. When you lock in these assets, you will receive liquidity provider (LP) tokens that represent your share of the total liquidity pool. Redeeming these LP tokens will return to you your stake, plus any revenues generated from swaps, again, in equal value for each pair.

As a liquidity provider (LP), you earn a share of the swap fee or commission (Uniswap charges 0.3% fee on all swaps, for example) proportional to your share of the liquidity pool. The more swaps that take place in that pool, the more LPs earn.

APYs can be even higher for LPs but they do come with additional risk known as impermanent loss (IL), which happens because pooled tokens can fluctuate significantly in price. LPs can mitigate this by selecting pools that are highly liquid or those that are made up of stablecoins and other less volatile assets.

Method #4: Yield farming

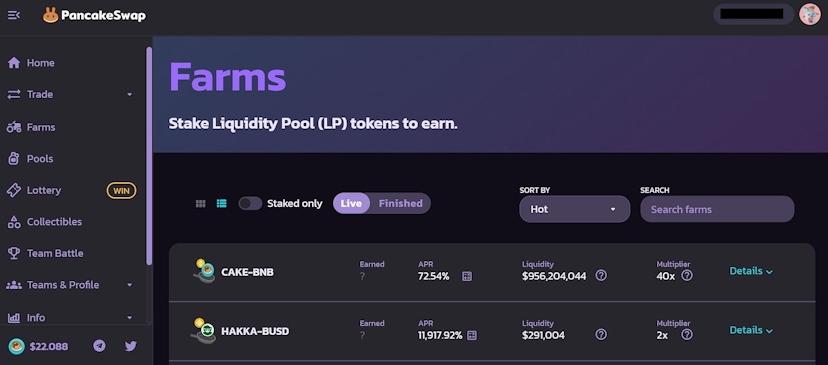

Another favorite methods for DeFi users is called yield farming, which lets people earn additional income on top of providing liquidity.

LPs usually get a specific “LP token” when providing liquidity to pools, which is a token that represents their share in a pool. When redeeming these LP tokens, they will receive back their stake plus any share of fees earned.

Many DeFi platforms also have “farms” now where you can lock these LP tokens, earning even more of the tokens (or other tokens). Think of this as staking, except only available to LP tokens, requiring yield farmers to first become LPs.

Tracking your portfolios

With many different types of opportunities to earn passive income in DeFi, monitoring and tracking your different wallets across different platforms can become somewhat of an administrative challenge.

Which is why many DeFi traders now make use of portfolio trackers or aggregators like Zerion, Zapper and Rotki, which connect to various different protocols and wallets, allowing you to analyze and manage your portfolio from a single dashboard. Other aggregators like 1inch and Plasma.Finance even offer cross-chain integrations and multiple wallet connections, making it possible to access charting views that analyze data from different aggregators in real time simultaneously, helping you identify potential APY returns across pools, and track portfolios on different wallets.

With all these methods, any user can make use of their digital assets to earn passive income. They provide an essential service to the crypto markets by providing much-needed capital and liquidity, and in return, earn incentives — all without intermediaries.

However, just be wary of scams and “rug pullers”, that is, projects who really just want to steal your locked LP tokens to redeem at liquidity pools and drain them. Make sure the farms and platforms you use have a positive reputation and have published smart contracts that are externally audited.

Masha Prusso is a public relations and business development professional working with blockchain and fintech projects. She writes about DeFi, NFT and decentralized networks. Masha is also a partner at Crypto PR Lab and advisor to Plasma.Finance, a DeFi aggregator and DEX for professional traders. French qualified attorney, Masha left her corporate job at UBS Wealth Management in Switzerland to earn an LLM at UC Berkeley in 2017. Living in San Francisco inspired her to become an entrepreneur and start investing in crypto. She also represented Russia in the Winter Olympic Games 2006 as the youngest athlete in snowboarding halfpipe at the age of 16.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.