Yield Guild Games Token Halves In A Day After 500% Rally

VCs Appear To Be Selling YGG Ahead of Major Unlock On August 27

By: Tarang Khaitan • Loading...

NFTs & Web3

Yield Guild Games’ YGG token tumbled 55% in a matter of hours on August 7.

Major investors seem to be booking profits after YGG rallied an eye-watering 540% in the past 30 days. The token surged from $0.14 on July 9 to almost $0.75 on Aug 7.

In the past week, nearly 12.6M YGG tokens have been sent from Wintermute, a market maker that specializes in digital assets, to various crypto exchanges, presumably to be sold.

Venture capital firms DWF Labs and BITKRAFT Ventures deposited 3.65M YGG and 1.57M YGG, respectively, to Binance in the past two days, according to the on-chain analytics account Lookonchain.

Looming Token Unlock

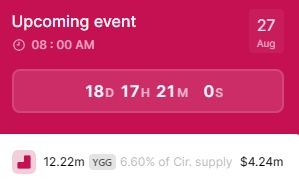

The price of the YGG token could be pressured further as 12.22M YGG tokens are due to be unlocked on Aug 27 – amounting to 6.6% of the current circulating supply.

Yield Guild Games is a DAO focused on creating gaming guilds as subDAOs around Play-to-Earn (P2E) games. It also provides scholarships, through which players can rent the NFTs needed to play P2E games, and share the revenue generated with the NFT owners.

YGG is a governance token that carries voting rights and can be used to pay for services on the network. They can also be staked to earn additional rewards.

The most widely recognized game to have integrated with Yield Guild Games is Axie Infinity, which inspired YGG’s scholarship program.

Waning Interest

Players' interest in P2E games has been dwindling as the broader NFT market continues to reel from the ongoing market downturn.

Axie Infinity has witnessed a decline in monthly new accounts being created in the first five months of 2023, according to a Dune query.

Making matters worse for these P2E projects is the fact that the United States Securities and Exchange Commission (SEC) alleges that some of these popular projects constitute securities offerings, further dampening sentiment.

Axie Infinity, The Sandbox, and Decentraland are some popular metaverse tokens that the SEC has called securities.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.