What is a DAO? Mapping Out the Ecosystem

This article offers a 10,000ft view on the ‘Decentralized {Autonomous} Organization’, or DAO tooling and project landscape. It’s intended to be complementary to introductory posts like Linda Xie’s ‘A beginner’s guide to DAOs’. The goal is to help contributors and participants better acclimate themselves with the distinct project categories and relevant infrastructure leading the growing…

By: Kevin Nielsen • Loading...

Explainers

This article offers a 10,000ft view on the ‘Decentralized {Autonomous} Organization’, or DAO tooling and project landscape. It’s intended to be complementary to introductory posts like Linda Xie’s ‘A beginner’s guide to DAOs’. The goal is to help contributors and participants better acclimate themselves with the distinct project categories and relevant infrastructure leading the growing movement around capital, talent, and community coordination on Ethereum.

What is a DAO?

A decentralized autonomous organization (DAO) is an entity that enables a distributed group of actors to organize or achieve a certain goal or meet a mandate, broad or specific, by coordinating through a shared set of rules enforced on a blockchain. These rules are coded into smart contracts (mostly) with the help of ‘governance frameworks’ which we’ll discuss below.

“Instead of a hierarchical structure managed by a set of humans interacting in person and controlling property via the legal system, a decentralized organization involves a set of humans interacting with each other according to a protocol specified in code, and enforced on the blockchain.” – VB

Many of these organizations don’t necessarily function or rely on automated processes, and instead, rely mostly on the subjective coordination of a set of very human actors. The level of autonomy is dependent on the type of project and the governance framework it uses, given that stakeholder personas and decision types vary broadly in contrast to the traditional, more defined corporate governance processes. You might find that I use the terms DAO and DO interchangeably throughout this post. Here’s a handy tool from the Ethereum Foundation covering some of the basic concepts around DAOs.

DAOs will slowly (or not so slowly) take the center stage of cryptocurrency network development and product entrepreneurship as every token project begins to implement various strategies to move toward a self-propelled, community-built, owned, and operated system. – @OKDunc

Why are DAOs Important?

As activity and value shift into the digital realm, distributed community and stakeholder coordination becomes ever more important. DAOs or DOs offer a mechanism to bridge the gap between market and firm dynamics by reducing external information, bargaining, and enforcement transaction costs, and by enabling any actor, anywhere in the world, to engage in certain activities aligned with a common and communal mission. These activities can be as simple as pooling capital or building a website, but that capital and talent coordination can now occur almost instantaneously, at scale, and anywhere in the world.

The most immediate example of these entities gaining traction is crypto protocols distributing ownership and decision-making power via novel token distribution mechanisms, to ‘progressively decentralize’ their protocols. In exchange for user engagement and contributions, platforms rewarded users with a direct ownership stake that aligns their success with that of the platform. These experiments have shifted the burden of governance, and sometimes management, to a community, instead of a central actor. The trend, fueled by the expansion of the DeFi industry last summer, is a move towards a “new ownership economy, wherein networks are built, operated, and owned by their users.” – The Ownership Economy

Protocols are a single category in this new paradigm and are likely to be the ones with the most opportunity to automate decision-making, given the objective nature of protocol parameter adjustments. However, crafty communities have figured out that these flexible frameworks and enforceable rules enable anyone to coordinate and work towards any common goal.

This has brought about a slew of new types of DOs: from small membership organizations that curate NFT art to investor entities that pool capital and seed early-stage projects, members can provide specialized and sometimes niche services while still leveraging economies of scale, global talent, and pooled capital. All this, while still operating in a completely distributed and digital manner, and without reliance on a central coordinating actor (traditionally the firm), thus dramatically accelerating the provision and scale of services.

All of this, of course, doesn’t come without risk. “It’s also important to consider that these entities are simply tools, and don’t solve human problems. Tokens can insert market mentalities into a group, which crowds out all non-financial motivations. Every community could evolve into a profit-maximizing network; all ‘community’ values are eroded; economic self-interest spreads ever further.” – @dazucks tweet. Stakeholders need to consider that establishing a culture and ideology around these entities is important, as it will spur social incentives and non-financial contributions, and will allow these entities to become extremely powerful social and human coordination tools.

The Current State of DAOs

We’re in the early innings of this revolutionizing game. Ideas regarding DAOs and governance mechanisms have been around for a while now, yet we’re experiencing a proliferation of these organizations, sparked by the major DeFi protocols that pushed for user engagement.

We should expect to see a fractalization of large ecosystems into smaller niche, specialized DAOs or DOs that can provide valuable and portable services across the crypto industry and beyond. DAOs have already begun to spin up with different use cases. Smaller entity profiles, like curator or guild DAOs, have managed to craftily coordinate around existing community tools and channels like Discord, and have opted for simpler, more noble frameworks like Moloch or Snapshot.

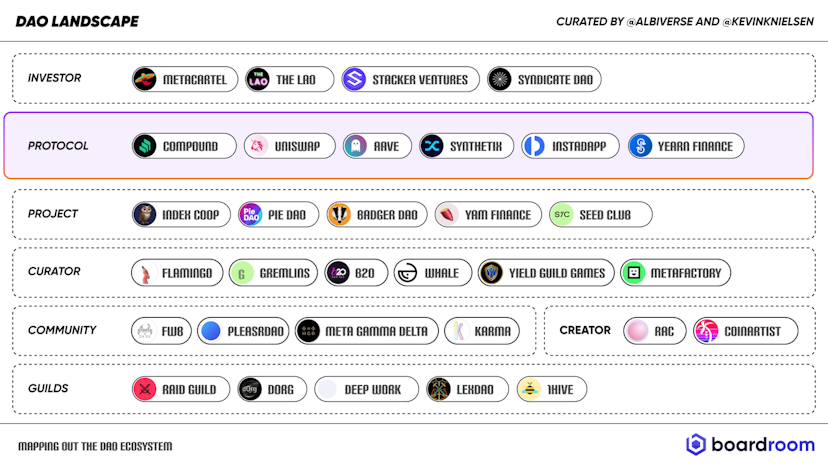

It bears to highlight that we’ve recently seen the emergence of intra-DAO relationships, most notably smaller communities interacting and offering services to large blue-chip DeFi treasuries and communities. To understand these higher-level relationships that span across multiple governance frameworks and ecosystems, transparency and standardization of information, as well as how we communicate about these entities will become increasingly important. To that end, let’s start with some broad DAO type categorizations and examples:

Protocol

Protocols distribute a governance token enabling their past and present users to vote on network decisions. These tend to be protocol parameter adjustments or smart contract upgrades. Given the complex and technical nature of these decisions, some protocols see a handful of knowledgeable delegates emerge as thought and execution leaders in governance.

Project

These organizations draw the closest comparison to traditional firm structures. The organization builds itself to develop and ship products and services, sometimes aided by token economic models and incentives. Revenues flow back into a treasury governed by the tokenholders. These projects sometimes hold governance tokens from other protocols and can emerge as powerful meta-governance decision-makers in external governance processes.

Investor

Stakeholders pool capital into these organizations and receive a (sometimes proportional) voting share to decide on what the DO should invest in. Owners pool their knowledge and expertise to build a portfolio of investments aligned with their mandate or investment objectives. We’ll likely see the emergence of activist investor DOs that can rapidly coordinate to move markets and push agendas. Read about the 2016 DAO.

Creator

A creator fractionalizes an NFT that represents a valued asset they created and distributes the ownership to a number of fans and supporters. This finances the asset’s production. The new owners can co-create, promote, market, and distribute the creation to give collective ownership, identity, and experience. Mirror and RAC have some interesting experiments here.

Curator

A similar structure to the investor DAO but with a more specialized focus on asset and NFT art curation at the moment. In the future, members could contribute expertise, brand, and capital to curate anything, including people and projects, and share in the upside and appreciation of a curated portfolio, or even fees generated from curation services.

Community

Tokenized communities can organize around a shared interest or person, and use a DOs token to gate a certain social space, like a Discord server or a Telegram group. Members can benefit from the closed network and perks, as well as push initiatives and projects together.

Guilds

These entities focus on talent coordination to provide a high-quality, contracted service to a buyer. Freelancers and individual contributors benefit from the organization’s distribution and marketing channels and their ability to connect top talent with top projects, allowing contributors to work broadly across the ecosystem. Contributions can come in the form of code, products, partnerships, educational initiatives, contracts, or content. Check out this post that dives into more detail. As an example, Boardroom was able to bootstrap our early development effort with the help of dOrg.

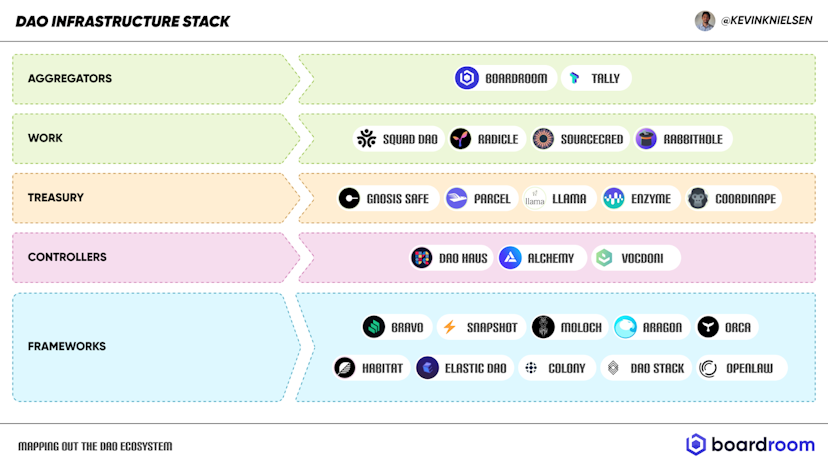

DAO Infrastructure Stack

To enable these organizations to flourish, a vibrant ecosystem of tooling has developed to support their growth. These tools build novel governance and management mechanisms and lower frictions to interact with governance processes. Given the open nature of most frameworks, there is a myriad of iterations that projects have forked and tweaked to fit the needs of their communities. Nevertheless, here are some of the most common tools used by DAOs today:

Frameworks

Governance frameworks are smart contracts that enable rules of a decentralized governance process to be enforced on the blockchain. This code specifies the parameters by which power is distributed, the process is executed, and votes are cast. Check out Compound’s Governor Bravo contract as an example.

Controllers

Some of the above frameworks have a controller that allows users to directly interact with the governance contracts through a user interface. They tend to be built by the same team building the framework. Controllers can also offer data and APIs helping developers pull and index information and can provide more comprehensive features helping integrators spin up their DO.

Treasury

Treasury and capital allocation is a common decision that DO members have to make. Funds can be secured in a smart contract ‘multi-sig’ wallet requiring a minimum number of people to approve a transaction before it can occur (M-of-N), or they can be stored in other types of smart contracts (these treasuries are growing pretty significantly). There are a number of teams building the contracts and the tooling for signers, as well as members, to seamlessly interact with locked capital or portfolio assets allocated and managed by governance.

Work

Talent and contributions are core to the value created by DOs internally and externally. Folks are building tools to measure labour and output from contributors and members, given that in a multidisciplinary environment, the delivery of product, knowledge, and services will end up taking many forms and could become quite subjective. There are also complex identity and contributor reputation and trust issues that still need to be addressed.

Aggregators

Aggregators can act as the glue that bridges the gap between these different tools and frameworks. Their efforts will likely center around abstracting away the nuance and complexity of infrastructure and middleware in an effort to lower user experience frictions in interacting with DOs. These providers are also well positioned to index and serve global statistics and data as well as study the more ‘meta’ relationships emerging from cross-DAO interactions.

—

It’s unlikely that these project categorizations will accurately stand the test of time, and that tooling will dramatically shift in the coming years. Nonetheless, at Boardroom, we’re fascinated by and excited for the dramatic growth and experimentation being undertaken by global contributors and stakeholders. General, albeit slightly inaccurate categorization, can help better communicate use cases to newer folks unfamiliar with these novel entity structures.

You can follow our ‘Tweets’ channel on Discord to keep tabs on the discussion. A big thank you to @OKDunc, @albiverse, @Julia_R0senberg, and @JohnSterlacci for their fantastic ideas and feedback on this article.

Kevin is the founder of Boardroom, a platform improving distributed governance across stakeholder owned crypto networks and DAOs. He grew up in Spain and attended Cornell University, before working at Oracle, Blockfolio, and TQ Tezos. He’s an avid music enthusiast and is fascinated by economic and human coordination problems.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.