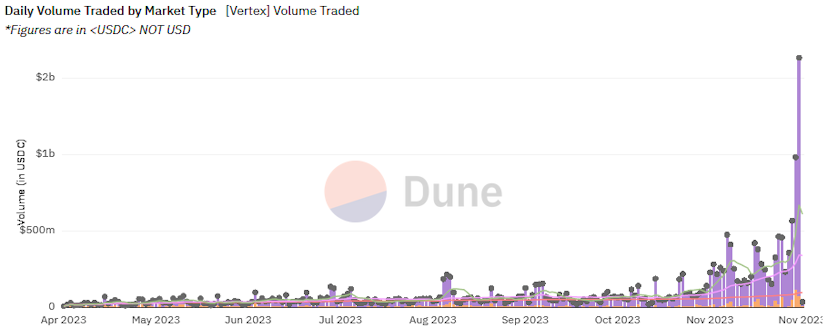

Vertex Activity Surges With $1.5B In Daily Volume

Vertex beats out dYdX to rank as leading perpetuals DEX by trade volume

By: Samuel Haig • Loading...

DeFi

Vertex, the Arbitrum-based derivatives decentralized exchange, is now standing atop the DEX rankings by daily trade for perpetuals.

Data from Dune Analytics shows Vertex hosted more than $1.5B worth of trades over the past 24 hours. ETH contracts accounted for 48% of volume, followed by BTC with 46.4%, and USDT/USDC with 3%. The platform hosted 677 unique addresses over the past day, suggesting an average daily volume of $2M per user.

Vertex also ranks seventh among DEXes for spot trading with more than $71M worth of trades over the past day, according to DeFi Llama. The platform posted an all-time high of $112M on Nov. 26 to come in third.

“Vertex Protocol have been growing sharply,” tweeted Adrian Zdunczyk, a popular web3 influencer. “The numbers don't lie: $43M Total Value Locked, ~9000 unique traders, and $10B volume traded over the past 30 days.”

Vertex’s total value locked is also up 300% since the start of November.

Rewards campaign

Vertex’s impressive growth has been attributed to its ongoing incentives campaign. Vertex traders are currently earning rewards in the form of the platform’s native VRTX token and ARB, the native token of Arbitrum.

Last month, Arbitrum allocated up to 3M to Vertex incentives as part of its first community grants round. Vertex launched its incentives campaign on Nov. 8 and will cease offering rewards after Jan. 31.

Vertex also offers fee-free market-maker trading at present, while market-taker trades garner rebates in the form of VRX and ARB. VRTX stakers earn between 30% and 50% of protocol revenue, with the project currently generating six figures in daily revenue.

The incentives have sustained Vertex’s growth despite decentralized exchange activity retracing across the board after soaring to its highest level since March, with activity on DEXes falling 17% for the week. Vertex is the only top 10 DEX by volume to post an uptick in activity for the past week, seven of which posted a drop in activity of between 18% and 47%.

Incentivized wash-trading?

However, some researchers believe Vertex’s incentives campaign incentivizes wash-trading on the platform, questioning whether activity will remain high once rewards dry up.

Batsyy, an ambassador for Woo Network, flagged that open interest is extremely low compared to volume, speculating that the surging activity on Vertex was likely driven by wash-trading from large users seeking to farm its incentives.

“Must be insane tech if you can get $1.5B volume a day with $15M open interest,” Tanoeth, a GMX proponent, sarcastically tweeted.

However, the trading activity described is not uncommon when incentives are available to users, with whales and other traders often seeking to maximize their reward allocations wherever and however they may be available.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.