NFTs Are Securities? All Eyes Turn to Top Shot Case

Judge Says It's 'Plausible' NBA Top Shot Moments NFTs May Have to Be Registered With Regulators

By: Samuel Haig • Loading...

NFTs & Web3

Now it might be NFTs.

Even as U.S. regulators’ define virtually all digital assets as securities or investment contracts, a civil case may further establish that NFTs also meet the definition.

On Wednesday, U.S. District Judge Victor Marrero ruled a lawsuit against Dapper Labs may move forward and rejected the company’s request to dismiss the action after concluding it is “plausible” that its tokenized collectibles may prove to be securities.

Accusations

The plaintiffs are a group of collectors of NBA Top Shot Moments, videos of professional basketball stars making famous plays. The videos are made unique by effectively watermarking them with NFT technology. The plaintiffs have accused Dapper Labs, NBA Top Shot’s creator, of earning hundreds of millions of dollars by selling unregistered securities.

They claim Dapper also abused its position by propping up the market for Moments and restricting users from withdrawing their money from the platform.

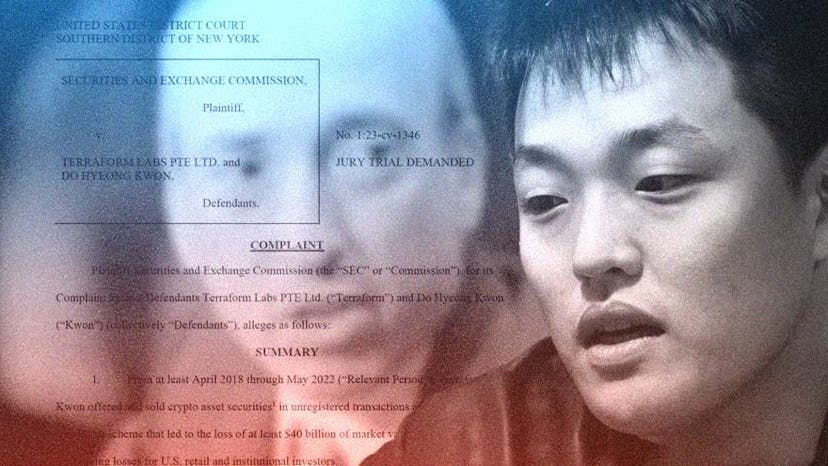

SEC Defines 'Interrelated' Terra Tokens as Securities

Feds Charge Do Kwon and Terra With Fraud in Case With Deep Implications For Crypto

While Top Shot opened its doors to the public in October 2020, it did not start allowing users to withdraw funds from the platform until May 2021. The plaintiffs say that Dapper Labs frequently flaunted high-priced Moment sales at users while they were unable to remove their funds from the platform in a bid to entice further trading activity.

Commenting that he is being asked to assess whether Moments are akin to basketball cards or commodities, or crypto tokens, Judge Marrero said, “It is a close call.” The judge noted that the plaintiffs argue Dapper Labs as an investment contract, which would require them to be registered with the U.S. Securities and Exchange Commission.

Investors will closely watch this case as the SEC continues to press cryptocurrency issuers to register their tokens. This month, the regulator defined staking-as-a-service as a registrable security in a settlement with Kraken, the No. 3 cryptocurrency exchange. The SEC also broadened its definition of cryptocurrencies as securities in a lawsuit filed against Do Kwon and Terraform Labs last week for alleged fraud.

Dapper’s lawyers refuted the suggestion Top Shot NFTs are securities.

“Basketball cards are not securities,” they said. “Pokémon cards are not securities. Baseball cards are not securities. Common sense says so. The law says so. And, courts say so.”

Deemed Collectibles

Top Shot NFTs feature multimedia highlights depicting key moments in basketball history. Dapper issues new moments each season, with the NFTs graded as either common, rare, or legendary in scarcity.

Dapper Labs’ Flow blockchain hosts the Top Shot NFTs. The collectibles are also traded on a marketplace owned by Dapper Labs.

Darren Heitner, a lawyer and a Dapper Labs equity holder, cautioned against reading too much into Judge Marrero’s decision to allow the case to proceed.

“The Moments sold on the platform should be deemed to be collectibles, which are typically not categorized as securities,” he told The Defiant.

Heitner said the case could be determined by whether the plaintiffs can demonstrate that Dapper has “a vested interest in the buying and selling of the collectibles” and whether it “retain[s] any control over the items that are transacted on its platform.”

All that Moments purchasers own is, essentially, the line of code recorded on the Flow Blockchain. It follows that, if hypothetically, Dapper Labs went out of business and shut down the Flow Blockchain, the value of all Moments would drop to zero…

Judge Victor Marrero

The suit highlighted that Top Shot NFTs could not be traded on other blockchains. Marrero noted that Dapper has a financial interest in Top Shot exclusively operating on the Flow blockchain due to the on-chain fees and activity driven by the project.

“All that Moments purchasers own is, essentially, the line of code recorded on the Flow Blockchain,” Marrero said. “It follows that, if hypothetically, Dapper Labs went out of business and shut down the Flow Blockchain, the value of all Moments would drop to zero…”

Legal Relationship

The judge went on to say that this arrangement may create the “sufficient legal relationship between investor and promoter” to establish an investment contract, and thus a security, under Howey.”

The Howey test is a legal precedent establishing that tradable financial products that provide investors with a reasonable expectation of profit must be registered as securities or investment contracts.

Feds Shift Into DeFi With Prosecution of $340M Alleged Ponzi Scheme

U.S. Accuses Four Russians of Running Fraud Through Smart Contracts

Dapper’s lawyers argue that securities must be linked to capital fundraising efforts, and cannot be “formed products” like the Top Shot Moments the company sold.

“This was not a capital investment drive, not an appeal to passive investors, but the sale of cards to collectors,” they said.

Restructuring

Marrero also said that the case should not be seen as establishing a precedent for NFT litigation broadly. “Not all NFTs offered or sold by any company will constitute a security, and each scheme must be assessed on a case-by-case basis,” he said.

On Feb. 23, Dapper Labs announced it let go of 20% of its staff. “We are restructuring the Dapper Labs organization to improve our focus and efficiency, strengthening our position in the market and better serving our communities,” it said.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.