THORchain Volumes Surge On Success Of ‘Streaming Swaps’

Cross chain network’s RUNE token has quadrupled in the past month as TVL doubled.

By: yyctrader • Loading...

DeFi

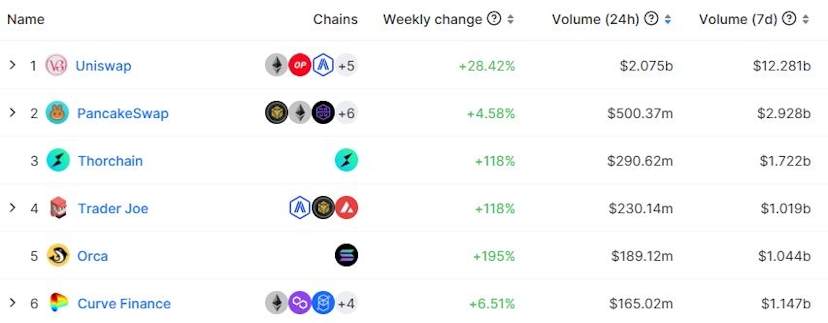

THORchain, a decentralized network that enables swaps of native assets across blockchains, has processed over $1.7B of trades in the past week, making it the third most active DEX and putting it ahead of DeFi mainstay Curve.

“THORChain's streaming swaps can offer the best price execution of any CEX or DEX in the market today. This innovation has propelled the DEX to become the third-largest DEX in the world by volume,” core developer Chad Barraford told The Defiant.

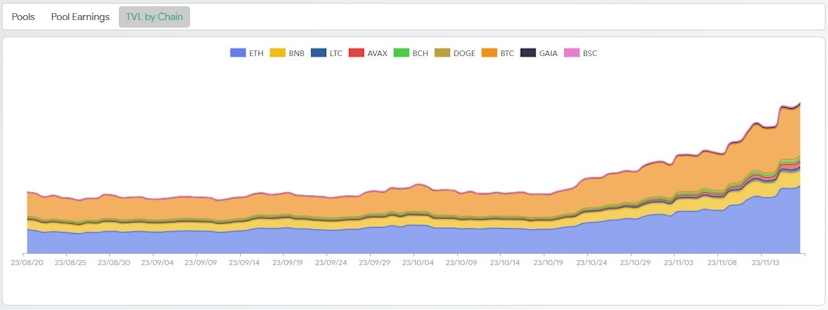

The project’s RUNE token has surged nearly 300% in the past month to a market capitalization of $1.8B, driven by the increased trading activity and liquidity added to the network - the total value locked (TVL) on THORchain has more than doubled in the same period.

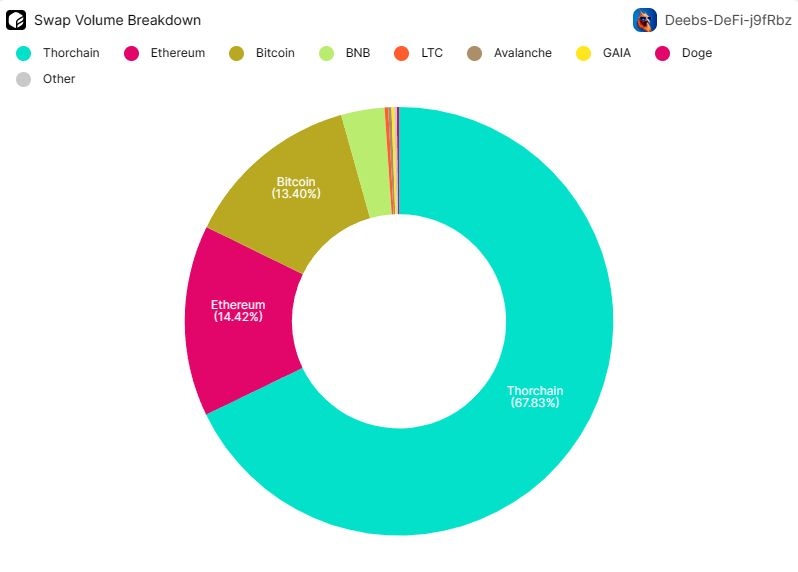

The RUNE token benefits from rising activity since all assets on the platform are paired with it, meaning liquidity providers must purchase RUNE to pair with their Bitcoin or Ether, for example. In addition, traders need RUNE to pay transaction fees.

“Any interaction that users have with the network directly drives value into the $RUNE asset,” said Barraford.

Streaming Swaps

The project’s recent wave of success can be attributed to streaming swaps, a feature introduced over the summer.

Streaming swaps break up cross-chain trades into smaller parts that are executed over up to 24 hours. As the trade progresses, arbitrageurs step in to rebalance the pool so that less value is lost to slippage.

“Price execution for trades is better than *any* centralized exchange since the addition of streaming swaps. THORChain is *the* place to go to swap, earn, or borrow against your native, unwrapped Layer 1 Bitcoin,” FamiliarCow, another team member, told The Defiant.

Bitcoin and ETH swaps account for the majority of non-RUNE transactions, according to a dashboard from Deebs DeFi.

Wallet Integrations

Crypto wallet providers Trust Wallet and Ledger are leveraging Thorchain to offer native cross-chain swaps to their users, particularly between Bitcoin and Ethereum.

“And we have a major partnership coming in the near future. It seems that every wallet wants the ability to swap from BTC <> ETH trustlessly,” Barraford said.

“Major providers like Trust and Ledger are tapping THORChain to power swaps for users, rather than centralized swap services. Devs never stopped innovating and won't until we've reduced the centralized exchanges to stablecoin issuers and DeFi wrappers,” added FamiliarCow.

THORChain also launched a lending feature in August, which offers interest-free loans against BTC and ETH with no liquidations or fixed expiry dates.

“So far, it's been going very well. If 100% of the loans were closed today, the network would mint back half the RUNE that was burnt to open the loans, which is net burning ~1M RUNE,” said Barraford.

He added that the loan feature is experimental for now, launched with a low cap of 1% of the RUNE supply.

Recovering From Past Exploits

THORChain launched in 2021 and was immediately embraced by the DeFi community, which was eager to finally have a way to swap native assets without the need for wrappers like WBTC.

However, its first Chaosnet iteration was hit by a series of multimillion-dollar exploits, shaking the community’s faith in the project.

With the successful rollout of streaming swaps, the project has managed to revive itself after launching its upgraded mainnet in June 2022.

“The THORChain community has been through a lot, and yet we've stayed focused, continued to ship and innovate. This comeback is a long time coming, and something I expect to be just the beginning,” said Barraford.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.