THORChain Processes Record Volume After Introducing ‘Streaming Swaps’

RUNE Is Up 40% This Week With A Lending Platform Expected To Launch Within Days

By: Owen Fernau • Loading...

DeFi

In a bear market, price action like RUNE’s stands out.

The token of the cross-chain liquidity protocol THORChain has surged over 40% this week despite a brutal selloff across broader markets. RUNE hit a four-month high of $1.64 on Aug. 18.

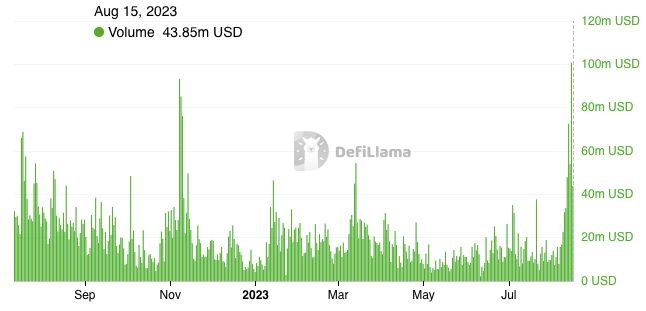

The momentum isn’t limited to the token — THORChain also notched up a record volume day on Aug. 14, when it facilitated over $100M of trades.

Streaming Swaps

Wealthy investors have begun to use the protocol for large swaps, FamiliarCow, the Communications Director for Nine Realms, the THORChain core developers' group, told The Defiant.

The project facilitated its largest ever swap of 3150 ETH for 2,482,348 RUNE, worth roughly $3.65M, on Aug. 15. “We're seeing like these big trades that we haven't really seen before,” FamiliarCow said. He attributes the volume to a new product called streaming swaps which launched on Aug. 1.

Streaming swaps break up cross-chain trades into smaller parts that are executed over up to 24 hours. As the trade progresses, arbitrageurs step in to rebalance the pool so that less value is lost to slippage.

“It's opening up a new market because obviously you can put a lot of size through so the whales are coming to town,” FamiliarCow said.

THORChain’s momentum is notable because of the project’s unique position in DeFi — it’s not quite a bridge, which moves homogenous assets across blockchains — it’s more like an exchange like Coinbase or Binance, which facilitates trades between tokens with the endpoints being each asset’s native blockchain.

Considering that the SEC has sued both Binance and Coinbase as part of a broader crypto crackdown, a decentralized application like THORChain may prove particularly valuable to the crypto ecosystem. This is because it fills a similar role to the exchange but, at least in theory, has a smaller regulatory attack surface by being decentralized.

FamiliarCow didn’t shy away from comparisons to billion-dollar behemoths. “What’s being built here is honestly the replacement of the centralized exchange,” he said.

Past Exploits

To be sure, THORChain has faced its share of bumps in the road.

The project suffered back-to-back hacks resulting in roughly $13M of lost assets in July 2021. And its RUNE token remains over 90% off its all-time high of $20.24, which came in May 2021 when most DeFi tokens peaked.

The project also faced a security scare which became widely known on Aug. 16, when a node operator — THORChain is an independent blockchain — revealed that traders were paying extremely high funding fees to short RUNE right before the launch of a new lending product.

The node operator, who goes by TCB, suspected that the person behind the trades planned to exploit THORChain once the lending product went live.

THORChain uses a cryptographic system called Threshold Signature Scheme (TSS). According to TCB, ethical hackers had revealed a possible vulnerability in the system previously and THORChain had the capability to patch it. However, because it’s an open-source project, patching it would have revealed the security hole in all projects which use it.

“In this particular case the only way to upgrade the network without disclosing the vulnerability to the entire world is to upgrade the TSS with closed source components (a private release),” TCB wrote. “This type of release is philosophically discouraged in decentralized, open-source protocols. However, there's no other good options.”

Collateralized Lending

THORChain is planning to go ahead with its collateralized lending product. Initially supported assets will be ETH and BTC, with plans to enable lending against more assets in the future.

More broadly, THORChain’s plans involve expanding its product offerings by adding order book functionality as well as an option to trade perpetual futures.

It’s also collaborating with major wallets — FamiliarCow said the project “has a foot in the door” with hardware wallet maker Ledger to facilitate swaps between assets. Trust Wallet, which claims to have over 60M users, already uses THORChain under the hood to facilitate swaps.

THORChain wants to “be everywhere and deliver the best product at the lowest layer of the stack with absolutely no third-party dependencies on any other protocol,” he said. “That's the whole game.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.