The Bitcoiner’s Guide to DeFi

Decentralized finance, or DeFi, is exploding in popularity. Concentrated in the Ethereum ecosystem, it offers the types of services hitherto dominated by the legacy financial system such as lending, borrowing, and savings. But like the ICO craze of a few years ago, the growing mania around it has raised eyebrows from those with a deep…

By: Carolyn Reckhow • Loading...

Research & Opinion

Decentralized finance, or DeFi, is exploding in popularity. Concentrated in the Ethereum ecosystem, it offers the types of services hitherto dominated by the legacy financial system such as lending, borrowing, and savings. But like the ICO craze of a few years ago, the growing mania around it has raised eyebrows from those with a deep knowledge of distributed ledgers and strong opinions on monetary policy. Savvy, early Bitcoin investors may be skeptical of another Ethereum craze, while those in traditional finance are likely to adopt a “wait and see” approach to determine DeFi’s staying power.

DeFi is moving toward a parallel, decentralized financial system

Bitcoin was created in response to the global financial crisis of 2008, when it became blindingly clear that the financial systems propping up the world’s economies were self-serving, dangerously unstable, and inefficient. Failures on the part of centralized authorities led to the loss of trillions of dollars in value; in real terms, this meant the loss of ordinary people’s jobs, homes, and savings. Bitcoin, premised on policies of sound money, included a fixed currency supply and an overarching and immutable commitment to fairness and transparency. It was designed to fill the void left by the fecklessness of the global financial elite.

More than a decade on, BTC is still one of the only digital currencies that has demonstrated real value and utility. But we all know this is not the end of the story; for the vision of a decentralized financial system to become reality, many more apps, protocols, and digital assets will and must proliferate. And in the current snapshot of the decentralized economy, Ethereum is the only viable protocol where this is being realized. The apps being built on Ethereum today are increasingly robust and sophisticated.

The biggest phenomenon in crypto right now — certainly in terms of growth — is the universe of DeFi apps currently sprouting on Ethereum. Over the past year the DeFi sector has grown by over 1,000% — surging past $10 billion locked. And it’s getting noticed: Bloomberg, Forbes, and Entrepreneur Magazine are among the mainstream outlets that have recently covered the fast-growing phenomenon.

As Bitcoiners, you may say, “Why should I care?” There are a couple reasons. Most simply, it’s always good to understand what’s going on across the space, even if we don’t take a positive view of everything. And beyond that, there is value in DeFi. It can be an important piece of the puzzle we must assemble to achieve our shared vision of a decentralized economy. More than that, there are more and more ways for Bitcoin holders to make money in DeFi.

With that in mind, here’s what Bitcoin investors should know about decentralized finance.

DeFi 101

DeFi refers to any app or product that offers a financial service on a blockchain. In practice, virtually all DeFi apps run on Ethereum. They offer services such as borrowing, lending, savings, derivatives, and insurance — all functions that exist in the legacy economy, but that are opaque, inefficient, and controlled by powerful gatekeepers such as banks.

Decentralized finance offers greater access and transparency by removing these powerful gatekeepers. The technology also brings benefits such as immutability and censorship resistance — while often simultaneously placing greater weight on the responsibility of each individual investor. Ultimately, DeFi promises to both radically expand access to services such as lending and borrowing, and to offer ordinary people much better returns than the lower-than-inflation interest rates paid by banks or the negative interest now offered on much sovereign debt.

The question, of course, is whether DeFi will live up to this promise. Bitcoiners are used to looking askance at Ethereum — after all, it has been promising world-changing apps and products for years, and in the eyes of many, this has been nothing but talk. Worse, there is ample evidence that the ICO frenzy of a couple years ago actually served to distract from the progress of blockchain technology generally. The pump-and-dumpers, the opportunists, the shills, and the simply naive who resided in the Ethereum community cast a pall over the entire space in the eyes of mainstream enterprise, media, and finance — one we are still recovering from.

So why is DeFi different?

The good, the bad, and the ugly of DeFi

The growth in DeFi apps is different from previous bubbles, such as the ICO craze, because it offers real products with real use cases. Platforms such as Maker and Compound let people earn by putting their crypto to work in various ways: they can deposit their crypto and earn interest, they can take out loans, or they can trade derivatives based on this activity. These are essential functions of any financial system, and blockchain versions of them must develop organically, with the same decentralized and immutable native functions of the underlying technology for blockchain to reach its potential.

The innovative power of blockchain technology also means that DeFi platforms already offer people financial opportunities that are not possible in the legacy financial system. For example, Aave offers flash loans that allow people to borrow with no collateral or credit. There is no parallel to this in traditional finance — it is a DeFi innovation.

Of course, not everything in DeFi is as promising as this. As in any bull market, there is plenty of chaff along with the wheat, and plenty of opportunists are looking to make a quick windfall by capitalizing on the current enthusiasm. Projects like $tard make this comically, or painfully, clear, as does the cornucopia of food-themed platforms such as SushiSwap, BurgerSwap, and YAM Finance. Any potential investor has a duty to perform appropriate due diligence before participating in any DeFi platform. But an emphasis on individual choice and personal responsibility is actually perfectly in line with Bitcoin’s governing ethos.

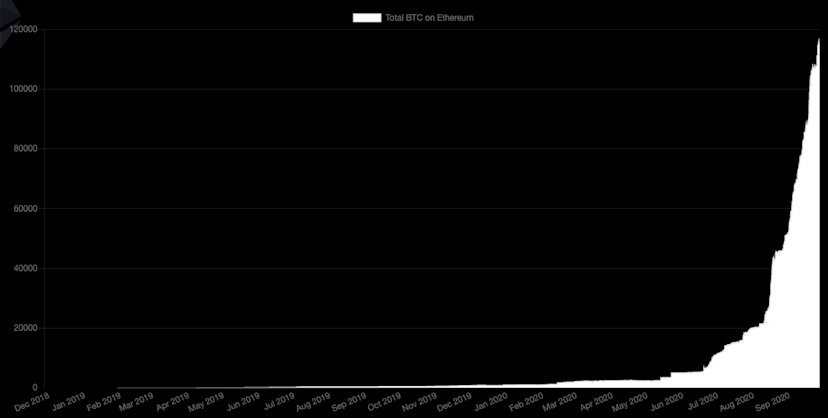

Froth aside, DeFi presents a real opportunity both to grow the decentralized economy and to make returns on digital assets. Honest Bitcoiners will recognize that plenty of DeFi apps are built on solid principles of sovereign money. Moreover, while most DeFi apps are built on Ethereum, activity isn’t confined to just a single chain. Projects like tBTC and WBTC, or even the Bitcoin sidechain RSK, can allow people to invest and earn across chains — and with roughly two thirds of all crypto wealth currently denominated in Bitcoin, this will be important to the overall growth of the decentralized economy. Bitcoin is still king, and cross-chain innovations will open up opportunities for Bitcoiners who like the idea of earning yield on native blockchain systems but prefer to exit back into sound hard BTC.

DeFi has the chance to do something important. Bitcoin should play a big part

There is plenty of good and bad to go around the rapidly expanding DeFi space, but fundamentally, many of the projects emerging from the sector are part of an important step forward for decentralized financial systems. The share of value that is denominated in Bitcoin, at roughly $200 billion, dwarfs the size of the DeFi market ($10 billion) as well as Ethereum’s market cap (currently $43 billion). For this economy to be successful, Bitcoin must therefore play an important role. And Bitcoiners who do their research ought to recognize the same sound and sovereign money principles which brought them into the space in the first place. BTC-ETH bridges offer just the kind of cross-chain functionality that can help achieve this outcome. And there might be money to be made, too.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.