SynFutures Launches Orderbook AMM and Points Program Ahead of Token Launch

SponsoredAlready one of the fastest-growing contenders in the onchain derivatives space, SynFutures is seeing massive gains following its recent V3 launch. The trending DeFi project has attracted over 250,000 registrations, reaching $90 million in 24-hour trading v...

By: SynFutures • Loading...

DeFi

Already one of the fastest-growing contenders in the onchain derivatives space, SynFutures is seeing massive gains following its recent V3 launch. The trending DeFi project has attracted over 250,000 registrations, reaching $90 million in 24-hour trading volume just days after deploying on Blast mainnet.

The traction is attributed to the release of an innovative new AMM model, Oyster AMM (oAMM). After confirming its plans to explore a token this year, it launched its points program, Oyster Odyssey (OO). The official announcement shares that users can earn Blast, Blast Gold, and OO points for interacting with SynFutures, which may drive increased speculation and growth.

Pioneering AMM 2.0 with oAMM

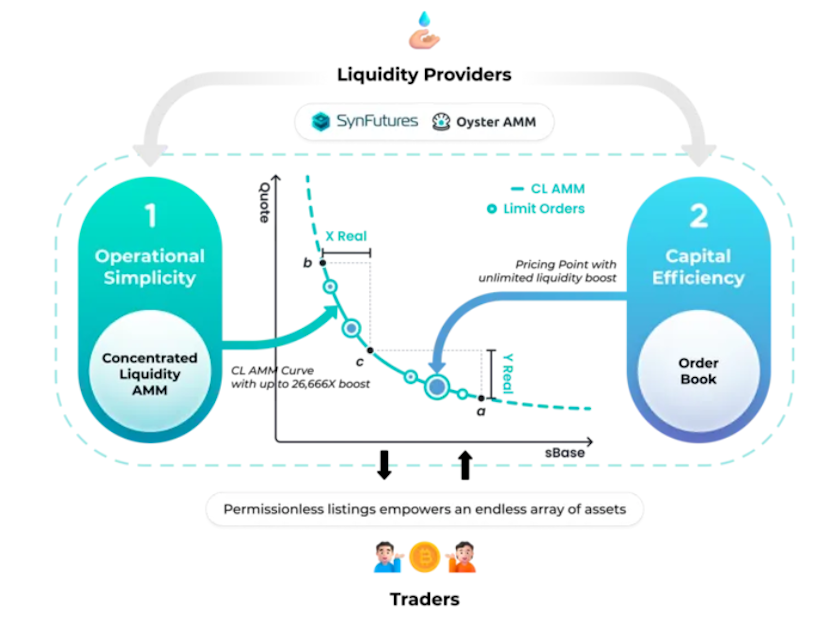

What makes oAMM unique is its innovative design, which combines a concentrated liquidity AMM and an onchain order book. But to truly appreciate the design, it’s essential to understand the benefits and obstacles of order books and AMMs.

Order books are arguably traditional finance's most efficient and established trading mechanisms. It lists the number of shares being bid on or offered at each price point. Because the liquidity of a security or other asset is dependent on the distribution of these bids and offers, third-party individuals or institutions may come in and place their trades to close the gap between the ask and the bid, increasing the liquidity of an asset and thus, increasing the liquidity of the market.

Since the order book model is geared toward professional traders and LPs, AMMs are more common in DeFi. In an AMM model, the market maker acts as an LP and only has to deposit two or multiple different tokens to the liquidity pool. However, this process can be advanced, depending on the AMM.

By combining the benefits of both AMMs and order books, SynFutures has arguably created the most capital-efficient AMM in DeFi derivatives while still appealing to a range of traders and LPs—all while remaining permissionless.

But how does it work? After all, combining AMM and Orderbook on-chain is a complex task.

To ensure that the two types of liquidity complement each other, Oyster uses a structure called ‘Pearl,’ which is a collection of all the concentrated liquidity covering a price point and all open limit orders at the same price. The image and the explanation below provide a step-by-step account of how the model works and how an order gets executed in Oyster AMM. For a more in-depth design breakdown, read the V3 whitepaper.

Diving into the Oyster Odyssey

Along with the release of oAMM in V3, SynFutures launched the Oyster Odyssey (OO), an incentivized points program designed to reward users who provide liquidity and bring new users to the platform. According to the SynFutures blog, “OO isn’t just another program — it’s our way of jump starting the next phase of SynFutures while showcasing our new oAMM, gearing up for the epic stuff ahead. OO is a significant step in our roadmap toward becoming the biggest perps DEX and bringing onchain derivatives to the masses.”

There are four ways to earn points on OO: providing liquidity, inviting friends, opening mystery boxes, and taking spins. For more information, see the official announcement.

Building on Past Successes

Launched in 2021, SynFutures has the backing of several prominent investors, such as Pantera, Polychain Capital, DragonFly, Hashkey, SIG, and Standard Crypto, having raised over $38 million. SynFutures was also the first perp DEX to introduce permissionless listings, allowing anyone to launch futures and perps markets for any asset with a price feed. According to Messari, V1 and V2 saw a cumulative volume of more than $23 billion, with over 100,000 traders and 250 pairs listed—impressive metrics for a pre-token project. Now with V3 live on Blast and quickly becoming the Layer 2’s top dApp, it will be interesting to see the trajectory continue in 2024 and beyond.

Next Up: DeFi’s Biggest Trading Competition

In addition to OO and other rewards incentives, SynFutures is launching a two-part DeFi trading competition with a $500,000 prize pool. Divided into a Masters division and Open, users can compete against their fellow traders to earn the week’s top rankings. A lucky draw winner will also be chosen regularly. Follow SynFutures on X to stay informed about the trading competition details.

Learn more about SynFutures at synfutures.com.

Start trading on SynFutures V3.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.